Konnichiwa!

Our October market report is being written in a small café in Kyoto, Japan, as Bruce and Jamie tour different parts of Asia following a family wedding. Never fear, our commitment to investing (and jet lag) have kept us closely following the rise in equity markets to all-time highs.

We will touch on some thoughts from our Asian travels in our November monthly research.

The Grind Continues.

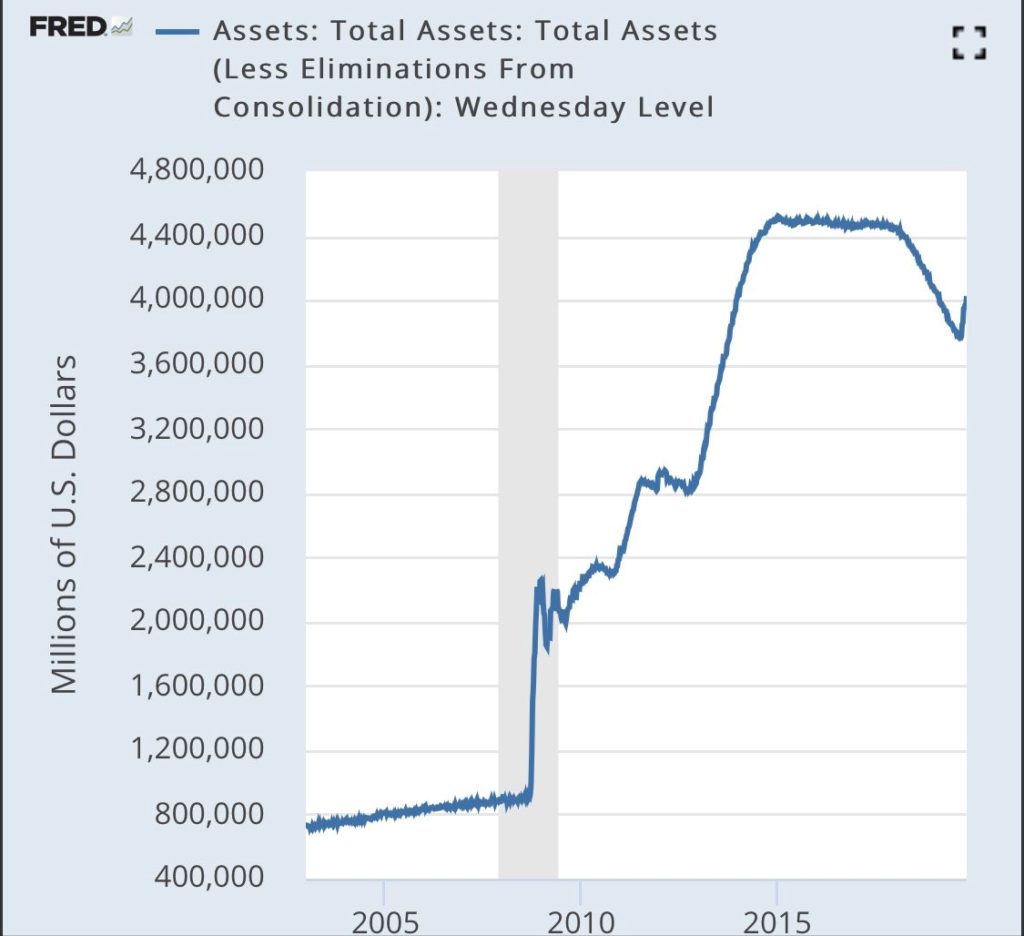

Although it has felt like a difficult 12 months of investing in equity markets, the S&P 500 closed at an all-time high for the 16th time in the past year. October also provided 2019’s third rate cut as the Federal Reserve continued on with a significant easing cycle through lower rates and a rebooting of its balance sheet expansion (as evidenced in Figure 1). Historically, balance sheet expansion has coincided with rising equity markets (note that the 2017 rally was fuelled by large U.S. tax cuts). Although the Fed’s operations are technically not quantitative easing, it has the same effect by providing liquidity to the banking system.

Figure 1: The Fed has restarted its balance sheet expansion through the purchase of T-Bills.

In addition, a reversal in either of the growing amount of cash sitting on the sidelines or defensive positioning/low investor confidence could add to the upside in the market. If the global economy is able to manage a soft landing with a corresponding rebound (potentially due to improving trade terms or additional financial liquidity), we would expect upwards revisions to 2020 earnings estimates, leading to a new leg higher.

U.S. Equities.

U.S. equity markets convincingly rallied to new highs in October despite an earnings season that was mixed, at best. The S&P 500 and the NASDAQ composite rose 2.0% and 3.7% to close at 3,037 and 8,292, respectively. Year-to-date the returns have been impressive (S&P 500 has returned 21.1%, NASDAQ has returned 25.0%). As indicated by the strong NASDAQ return, technology shares were a standout in the month.

Canadian Equities.

The TSX Composite fell 1.1% in the month, with weakness in the energy sector preventing the index from reaching new highs. Strong performance in financials, forestry and consumer discretionary sectors helped avert losses in the oil patch. The Canadian dollar was relatively unchanged at US$0.761.

GLOBAL EQUITY GROWTH FUND

The MWG Global Growth Fund rose 1.64% in the month and has now returned 17.8% year to date. We did not make any active changes to the portfolio during the month.

Several companies, including Facebook, Amazon, Google and Microsoft, reported during the month. Facebook beat Q3 expectations in terms of both revenue and expense control. Monthly user metrics continue to grow and advertising ARPU (Average Rev Per User) is strong. One of our favourite metrics, free cash flow generation, hit $5.8 billion in the quarter. Amazon also beat Q3 expectations but lowered guidance slightly for the remainder of the year as they invest behind ‘One Day Delivery’. Microsoft results were strong in all segments. We continue to see multiyear growth in Office 365 and Azure along with margin improvements.

The top three performers within the Fund were United Health (+15.8%), Aritzia (+12.5%) and Stelco (+12.4%). The bottom three were Alliance Data (-21%), Constellation Brands (-9.5%) and Spin Master (-9.1%).

INCOME GROWTH FUND

The MWG Income Growth Fund declined 0.43 % in the month and has now returned 20.3% year to date. The Fund is currently yielding 6.5%. We did not make any active changes to the portfolio over the month. Most of the holdings will report quarterly results in November.

The top three performers in the Fund were Evertz Technologies (+9.2%), Medical Facilities (+5.9%), and True North Commercial (+5.7%). The bottom three were Cardinal Energy (-19%), IBM (-7%) and Corus Entertainment (-4.7%).