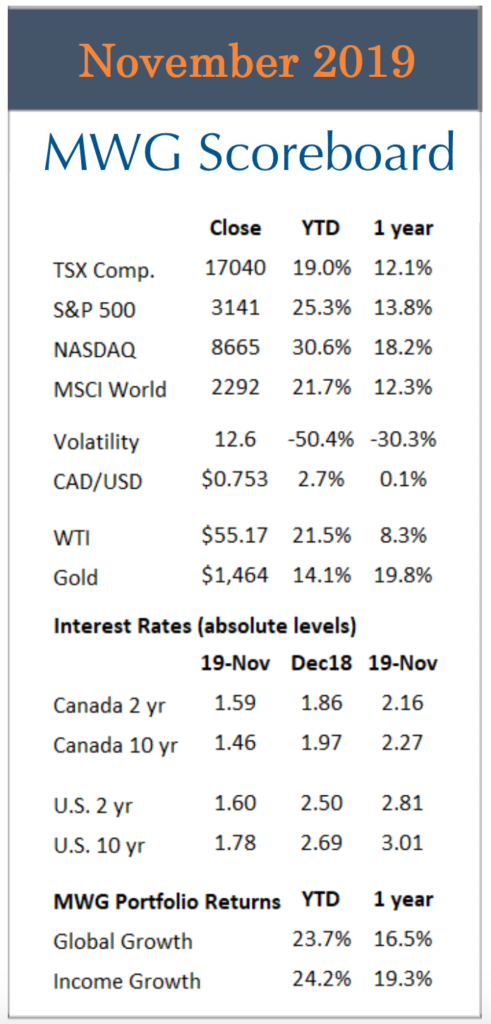

With December now in full swing, we want to wish all our readers a wonderful Christmas season and a Healthy, Prosperous and Happy New Year!

November 2019 – a Month for Investors to Cherish.

So far, 2019 is turning out to be a great year for investors, far better than what many anticipated during the near panic selling experienced in last year’s 4th quarter.

November was very generous, with major North American indices registering gains of 3.4 – 3.9%. The markets often rally into the new year.

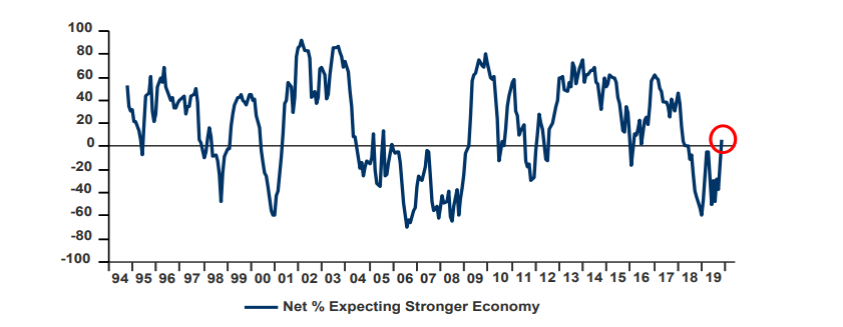

This year, commentators have focused on FOMO (Fear of Missing Out) as institutional investors, who had raised cash or reduced their exposure to volatility in anticipation of weaker markets, panicked to reduce cash levels in fear of losing their bonuses or jobs (both of which are tied to performance).

Figure 1: Stronger Economic Expectations Causing Investors to Buy, Buy, Buy!

Despite the substantial gains registered to date, we remain positive on the outlook for stocks. Earnings are currently expected to grow 6% in 2020 and a further 10% in 2021 (although this number will likely come down as we move forward).

We also believe our portfolio, which is weighted towards non-cyclical and higher earnings growth companies, will fare relatively well in an economy driven by the productive use of data and automation across almost all industries.Given the returns available on competing investments (fixed income in particular), we believe growth of this magnitude will be sufficient to encourage pension funds to increase their equity exposure. This should help drive the market higher, with gains at least in line with earnings growth.

GLOBAL EQUITY GROWTH FUND

The MWG Global Growth Fund rose 5.1% in the month and has now returned 23.73% year to date. In November we sold some Royal Caribbean Cruises (RCL) after the stock rallied post Q3 results. Shareholders were relieved that storms did not have as big an impact as expected and booking remained solid through 2020. Also during the month, we added to Alliance Data (ADS). ADS has underperformed but we believe it is undervalued as Credit Card Services will continue to benefit from portfolio growth in a stable environment and cash will be used to pay down debt after the sale of its Epsilon Division which provided marketing services to corporate loyalty programs.

The three top performers in the fund over the month were United Health (+11.7%), Royal Caribbean Cruises (+11.2%) and Netflix (+10.4%).

The bottom three performers were Home Depot (-5.2%), Constellation Brands (-1.0%) and Bank of Nova Scotia (-0.8%).

INCOME GROWTH FUND

The MWG Income Growth Fund rose 3.2% last month and has now returned 24.17% year to date. During the month bought Inter Pipeline Ltd. (IPL) and sold Automotive Properties REIT (APR.UN) and Kohl’s (KSS). We sold Kohl’s after it reached our target price. Kohl’s had performed very well as it run up on strong results from Walmart. We felt it was priced to perfection. We added to IBM and Tapestry (TPR) with the proceeds. We switched Automotive properties REIT for Inter Pipeline as the dividend is more attractive Providing a yield of 7.8% versus 6.6%. Medical Facilities (DR) reported a very weak quarter as they saw the competitive environment in South Dakota worsen Due to the opening of a new regional hospital. They cut the dividend by half. We will be assessing the business and management.

The three top performers in the fund over the month were Kohl’s (+14.3%), Exchange Income Fund (+14.1%) and Corus Entertainment (+13.6%)

The three bottom performers in the fund were Medical Facilities (-39.7%), High Arctic Energy (-10.3%) and Intertape Polymer (-5.1%).