Thoughts on the Market: July Edition

Searching for value post-pandemic.

With news of the Delta variant dominating headlines, it is worth examining whether a strong economic recovery should remain our baseline assumption, and if we should continue to stay fully invested despite elevated market multiples.

Currently, the U.S. benchmark S&P 500 Index is trading at 21.5x 2022 EPS, which reflects expectations of a strong recovery that extends to the hard-hit travel and leisure sectors. Notably, this is above the 12-18x historical range for the S&P 500 on a forward P/E basis. Before sounding the alarm bells, low interest rates and stronger cash conversion (a higher proportion of accounting earnings are translating into cash flow) should warrant P/E ratios that are elevated relative to historical ranges.

As well, the construction of indices is everchanging. To illustrate, let us quickly break down the S&P 500 Index. Over the last five years, higher multiple technology shares have outperformed the broader market, resulting in the Information Technology sector’s share of the Index rising from ~20% in 2015 to ~27% currently (we argue there has never been as impressive a slate of companies as the FAANG contingent). To the contrary, the Energy sector, which had an 8.4% weighting in 2015, is currently one of the smallest sectors at 2.5%. Some of these changes are due to corporate additions and deletions to the Index but the broader trends are indicative of sector performance.

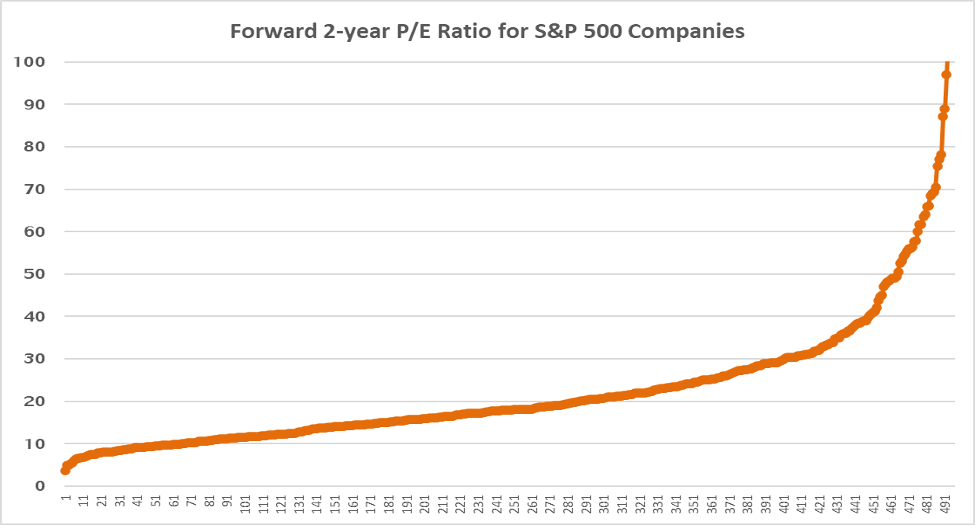

Figure 1 provides a chart of the P/E ratios of every company in the S&P 500 (save for 7 companies without available data), ordered from lowest to highest P/E. The earnings denominator (‘E’) is the 2-year forward earnings estimate for the year ending Jun 30, 2023, meaning it materially captures the economic recovery from the impact of COVID-19. Despite a weighted average multiple of 21.5x, the median P/E is just 17.9x. As well, there are 314 companies (63%) that have P/E multiples below the 21.5x weighted average.

Figure 1: Forward P/E Ratio of S&P 500 companies

Source: MWG, Refinitiv Eikon

As always, there are companies that we view as expensive, though often for good reason. We own shares in companies like Nike (P/E = 32x) and Intuitive Surgical (P/E = 54x), although we have been reducing our exposure as valuations for these (and other) durable growth companies have climbed to ranges that are less attractive. Alternatively, we have recently raised our weighting in companies like Netflix (P/E = 33x) and Amazon (P/E = 39x) as these companies are just entering a sustained period of profitability after years of heavy investment and we see long runways for earnings to grow at greater than 20% annually. We also continue to build positions in companies like Dollar Tree (P/E = 16x) where we forecast double-digit earnings growth and an attractive valuation.

To conclude, the search for value is a never-ending quest, and we believe there are still attractive opportunities to be found at both ends of the valuation curve.

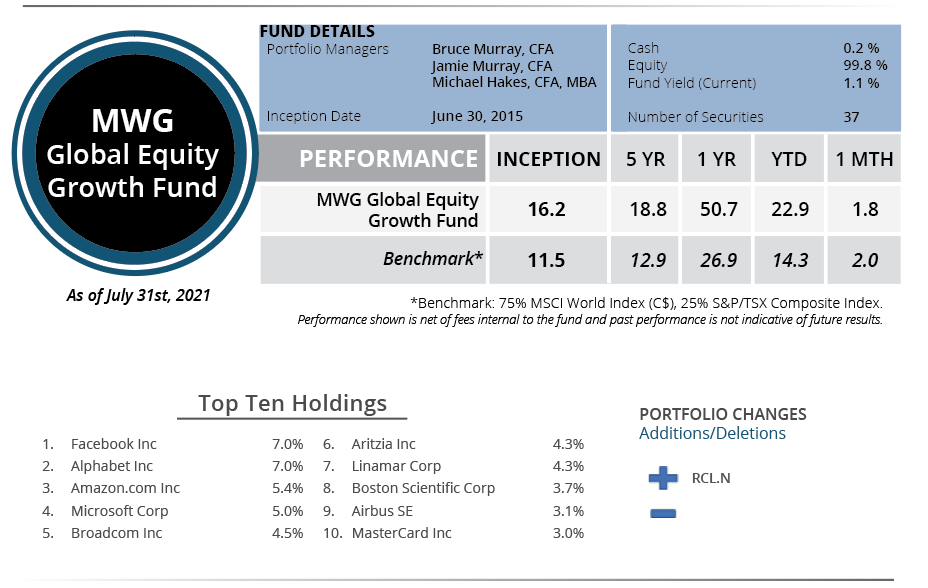

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund returned 1.8% in July and has now returned 22.9% year-to-date. The top three performers in the portfolio were Stelco (+13%), Adyen (+11%) and Aon (+10%), while Uber (-12%), Alliance Data (-10%) and Zalando (-7%) were the bottom performers.

During the month, we repurchased a position in Royal Caribbean (RCL) following a 30% drop from peak price levels in June on concerns surrounding the Delta variant and its impact on returning to service. Recall we had sold our remaining position in the US$94 range in June 2021, booking a tidy profit. Between 2015 and 2019, RCL’s valuation ranged from 10-15x on a P/E basis. With US$10 EPS expected in 2024, we believe the shares could be valued between US$100 and $150 versus our repurchase price of US$74.

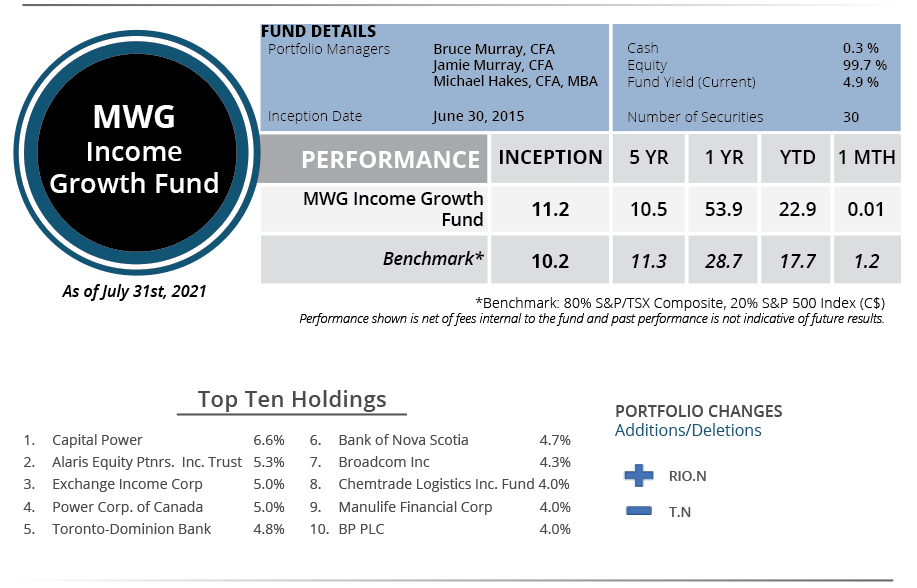

INCOME GROWTH FUND

The MWG Income Growth Fund was flat in July, leaving its year-to-date return also at 22.9%. The top three performers in the portfolio were Medical Facilities (+18%), BSR REIT (+7%) and Alaris (+5%), while Doman Building Materials (-17%), Corus (-9%) and Canadian Natural Resources (-8%) were the bottom performers.

During the month, we purchased a position in Rio Tinto (RIO), one of the world’s major mining and metal companies with a 5.5% dividend yield. We believe metal prices should remain elevated following a decade of depressed investment in new mines and exploration. RIO is one of Australia’s largest iron ore producers, with some 330 million tonnes, and has a 10.4 million tonne share of the Iron Ore Company of Canada’s production through its 57.8% ownership. RIO also owns the world class Kennecott Copper Mine in Utah, has a 34% share of the Oyu Tolgoi Mine in Mongolia and owns 5.5% of the world’s largest copper mine, Escondida, in Chile. The company has a very strong asset base consisting of relatively low cost production facilities in politically low risk countries, largely the U.S., Australia and Canada.

We exited our AT&T investment after the company failed to improve its capital allocation metrics. We expected activist investor Elliott Management to coax more efficiencies out of AT&T’s unique asset base. However, we do not believe the proposed changes will generate sufficient returns to warrant continued investment.