Converge Technology Solutions

We initiated a 1% position in Converge Technology Solutions (CTS.TO) in the Global Equity Growth Portfolio in June. Converge is executing a roll-up acquisition strategy, buying independent IT Service Providers (ITSPs) across North America. ITSPs help end users implement and manage technology solutions such as software, hardware, and servers from the original vendors (e.g., Microsoft or IBM), as well as ongoing managed services like analytics and cybersecurity.

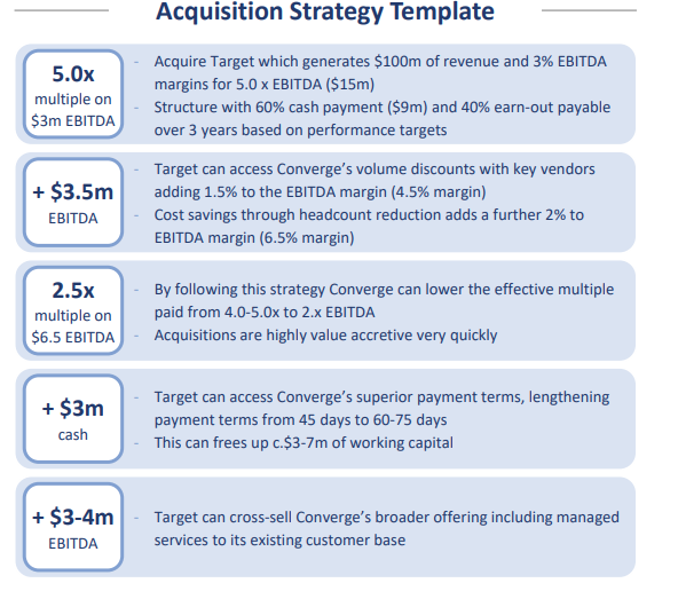

The IT services market is both large and complex, with customer needs shifting at the pace of technological change. Converge aims to build a scaled, global business that can improve capital efficiency over smaller independents by taking advantage of cross-selling, volume discounts, working capital optimization and back-office rationalization. To date, Converge has acquired 22 ITSPs following the same playbook. Although each ITSP has a unique service offering, and thus margin profile, the below infographic (Figure 1) demonstrates the Converge process.

In the example provided, a $15M acquisition starts with a $9M upfront cash payment and the remaining 40% deferred over three years with performance bonuses. Volume discounts and back-office integration can add $3.5M, more than $3M of cash can be freed up from working capital and $3M+ can be achieved through revenue synergies. Add it all up, Converge can acquire the company for net $12M (adjusting for working capital) and raise EBITDA from $3M to $9-10M.

Figure 1. Converge Acquisition Process Results in Highly Accretive Acquisitions.

It almost seems too good to be true, and in some ways it is. If this strategy is so profitable, will other companies not initiate the same acquisition model? Our confidence in Converge stems from the success of the model to date, which requires a high degree of execution on both the sales and integration fronts, and the flywheel effect this can have on future acquisitions. We believe ITSPs are witnessing the value creation and will choose to partner with Converge, giving the company an edge in consolidation.

The company is approaching its 2021 year-end targeted revenue run-rate of $2B. Longer term, Converge believes it can grow (to be clear, through acquisition) to a $5B sales run-rate in 2024. This can be accomplished by expanding its addressable market. To that point, Converge is looking at a European beachhead acquisition (likely in Germany or the United Kingdom), which we expect before the end of 2021. We believe Converge is still in the early innings of building a new global IT services powerhouse.

This Focus Stock is written by our Head of Research, Jamie Murray.

The purpose of this is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.