Linamar Corp (LNR-TSX)

Written by Bruce Murray, CFA

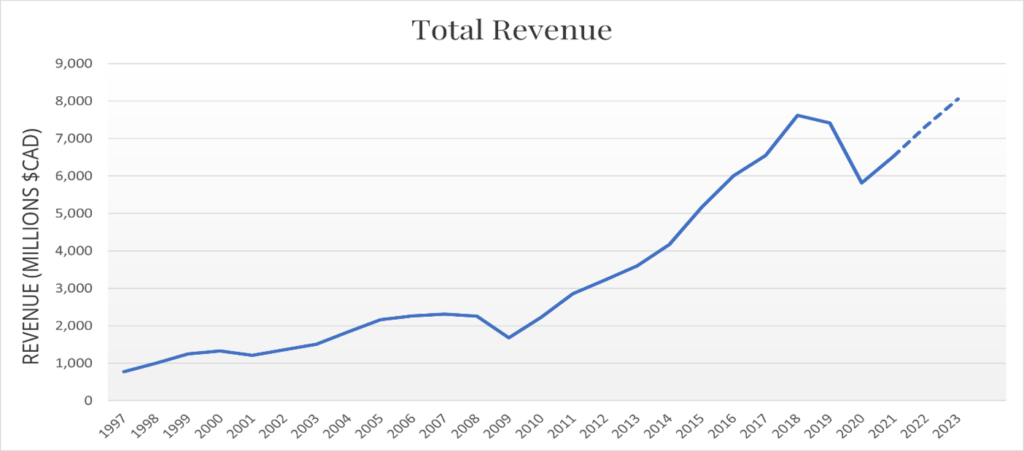

We are reviewing Linamar this month as we believe it represents a very timely investment opportunity. I have personally followed this company since it came public in 1986, when I was an analyst at what is now BMO Capital Markets. The company which generated about $40 million in annual revenue at the time, has grown by almost 200x over the last 36 years. Next year’s revenue is expected to pass the $8 billion mark.

Linamar’s core competency is the machining and development of complex and precision componentry for industrial products. The automotive industry is the largest volume buyer of these types of parts and represents Linamar’s biggest customer base. Over the years, however, the company has broadened its product base. It opportunistically entered the industrial access equipment market through the initial acquisition of another Guelph-based company, Skyjack, whose scissor lifts (pictured below) can be found at numerous commercial and industrial sites. In the last few years, Linamar also expanded its agricultural service business with the acquisition of Winnipeg-based MacDon Industries and Ontario-based Salford group, which manufacture harvesting and nutrient application equipment, respectively.

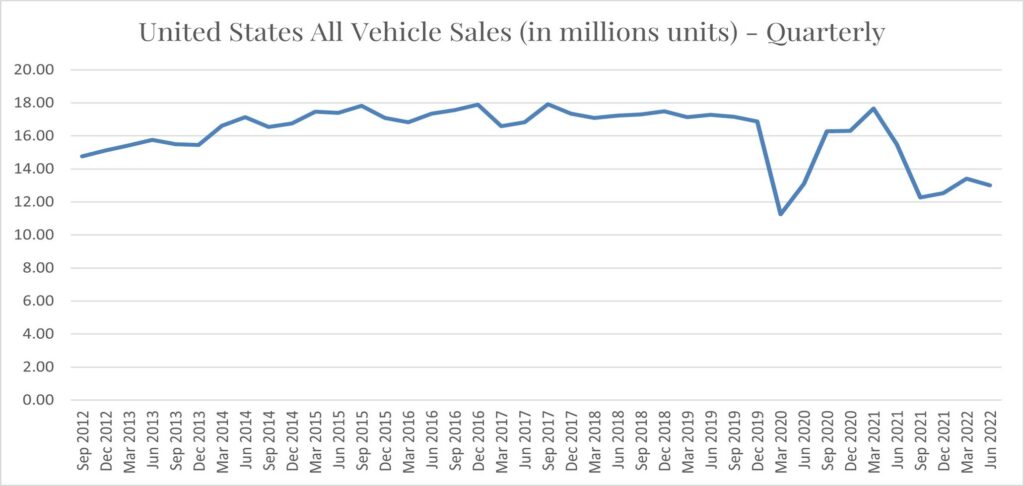

2021 and 2022 have been disappointing years for the company, beginning with pandemic-related shutdowns that slashed industrial output and led to massive production shortfalls as well as supply chain issues. The auto industry was particularly hard hit as many automakers failed to secure their microchips early in the pandemic and supply was diverted to computers and communication equipment as the work from home boom intensified with the onset of Covid. More recently, the Ukraine war has also led to dislocation among Linamar’s European customers.

The following graph illustrates that new car sales have been depressed by lack of inventory.

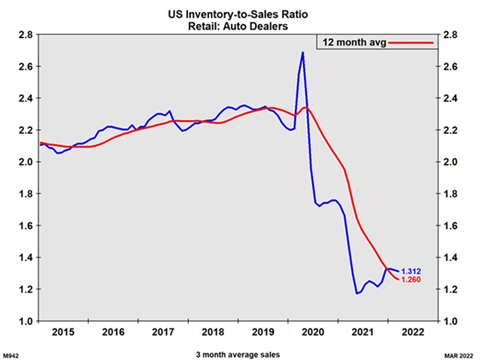

Several years of strong production will be required to rebuild inventory, which has fallen dramatically as depicted in the inventory to sales chart below.

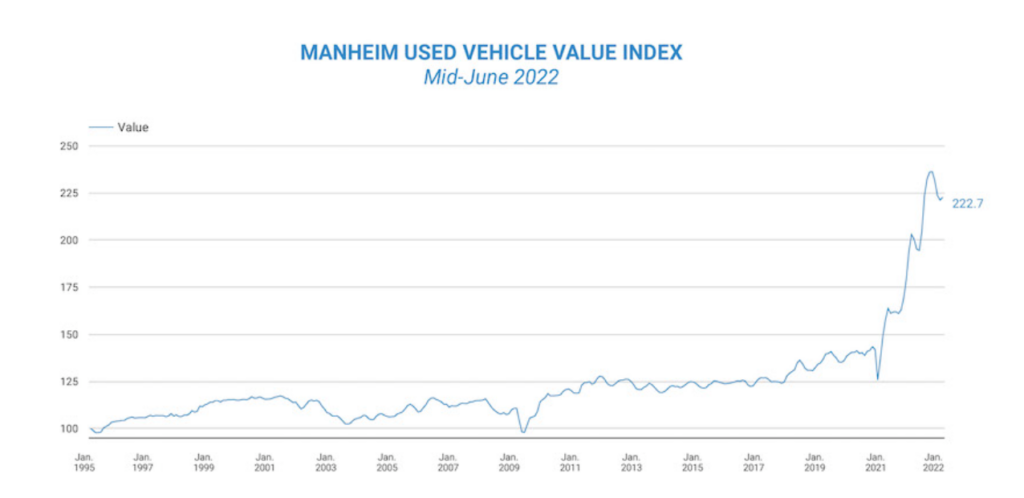

The graph below reflects the increase in used car prices that has taken place due to the poor availability of new models, ensuring strong pricing until new car inventory rebuilds.

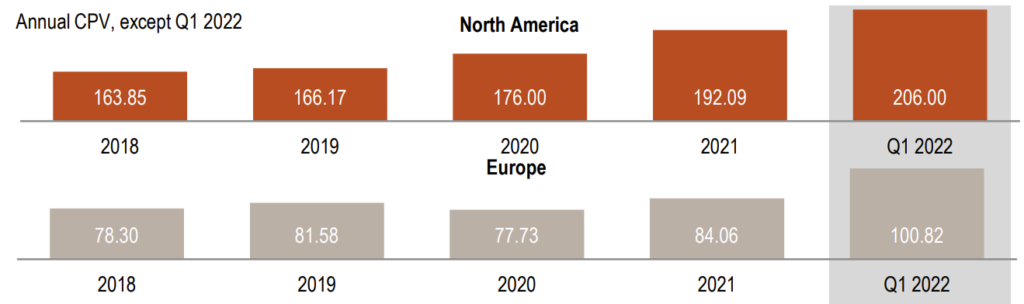

Over the last two years, though, Linamar has also become net debt free as cash flow normally dedicated to expansion was used to offset debt. Moreover, it has been able to increase its future sales growth through substantial business wins that will allow its content per vehicle to continue to grow in future years. In mobility, auto-related content per manufactured vehicle in 2021 rose to new highs as shown below:

The company and other automotive sources indicate that the chip shortage will ease substantially in the 2nd half of 2022, which will allow Linamar’s volumes to pick up. For example, on a recent tour of a Linamar plant that provides complex assemblies that go into 9 & 10 speed transmissions for both General Motors and Ford pickup trucks and associated higher-end vehicles such as Cadillac, it was indicated that they expect the annual run rate to increase significantly in the second half of 2022 compared with the first half of the year. We believe these higher unit volumes will translate into increasing profit margins and profitability and, hence, a higher stock price later this year.

Linamar is pushing forward with its customers as “greener” products are brought to market. The company has engineered drive train systems for electric vehicles including BEVs (battery electric vehicles), and through a strategic partnership agreement with Ballard Power Systems, has a range of products to also support FCEV (fuel cell electric vehicles). In its Q1 2022 report, LNR announced the strongest Q1 new business wins in its history, 75% of which were for electric vehicles.

Linamar’s electrification product group (eLin) exhibit at the Advanced Clean Transportation 2022 Expo was the hit of the show, displaying a full body and drive train for an electric medium truck on a RAM platform.

LNR’s access equipment business has also done very well over the years, expanding product lines and entering new markets. The company recently announced that it will be opening a scissor lift plant in China.

MacDon Industries, which was acquired in early 2018, makes unique harvesting headers for combines and sells self-propelled windrowers (swathers). MacDon complements a small European harvester operation LNR acquired in Hungary in the early 1990s. The recent Salford acquisition expands Linamar into soil preparation products. Salford is a global leader in the manufacturing of tillage, seeding and precision nutrient application equipment. With the scale of LNR’s agricultural equipment businesses now becoming meaningful, it should contribute nicely over the next several years. It will also no doubt benefit from the rise in agricultural prices that has been a fallout of the war in Ukraine.

Outlook

In summary, the outlook for all of LNR’s businesses is improving. In the short term, the big opportunity lies in a recovery in global auto production rates, which have been depressed by both Covid shutdowns and the well-known semiconductor supply issues that have depressed manufacturing rates by as much as 50% among the auto OEMs. LNR believes it will see a material pickup in production levels in the second half of 2022 as some of its major customers (e.g., GM & Ford) get access to more semiconductors. This should lead to a substantial pick up in profitability. It will also be launching $700 to $800 million of new business in 2023, which will add 8.5-10% to estimated sales.

The company expects its industrial businesses (Agriculture and Access) to grow their revenues by double digits in both 2022 and 2023 and experience decent margin improvements in the latter year.

Conclusion

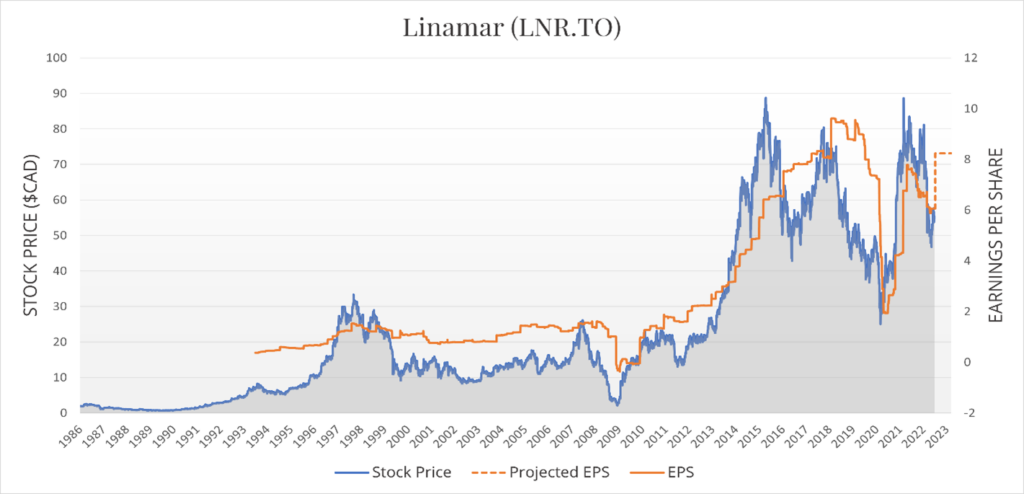

LNR’s stock has fallen from a high of $90 per share to the mid $50s, where it trades today.

Linamar is undervalued. This is a well-managed company, selling at less than 10x earnings, with no net debt and an anticipated expansion in sales and margins over the next 18 months as the global industrial sector enjoys a massive recovery of lost volumes. Longer-term, market share gains resulting from LNR’s superb engineering ability will continue to drive the company forward.

Management recognizes the stock is undervalued and has repurchased over 1.5 million shares in 2022 at attractive recent prices.

A year from now, I foresee LNR trading at a multiple of 10-12x earnings of $9-10 per share, which implies a $90-120 stock price.

This Focus Stock is written by our CEO, CIO and Portfolio Manager, Bruce Murray, CFA.

The purpose of this is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.