Thoughts on the Market: June Edition

Nature is Healing.

Written by Jamie Murray, CFA

The rain to the wind said,

‘You push and I’ll pelt.’

They so smote the garden bed

That the flowers actually knelt,

And lay lodged–though not dead.

I know how the flowers felt.

-Robert Frost

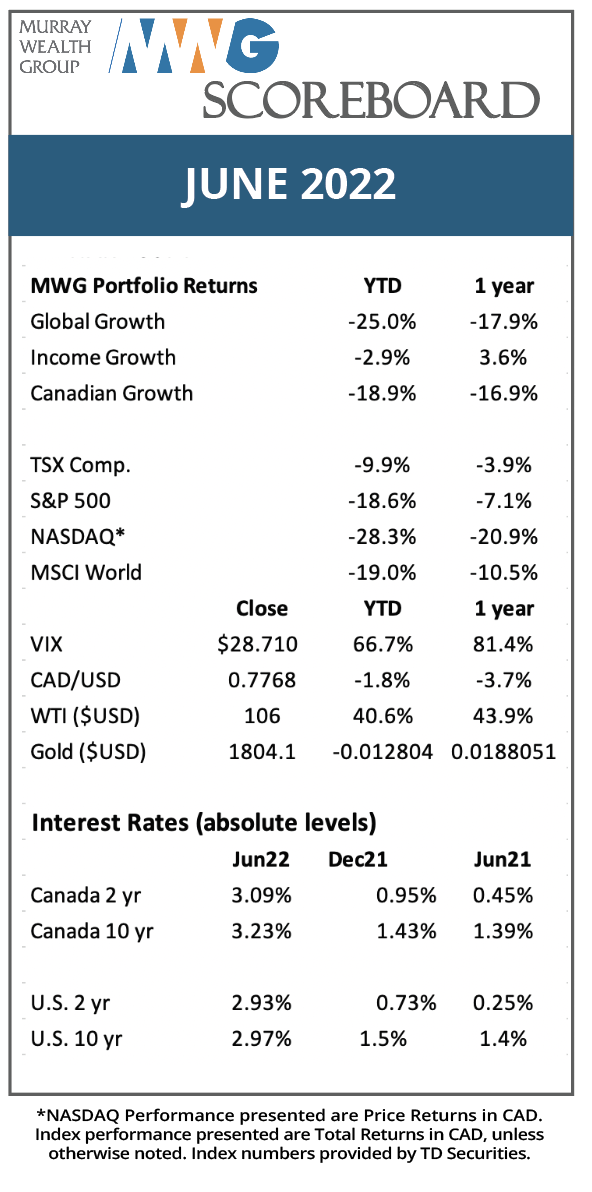

North American equity markets endured their worst first half in the past 50 years, with indices down 20-30% as economies confront a proverbial storm of economic events. We present our updated views of the investing landscape and harness the wisdom of poet Robert Frost to help us frame our thoughts.

As the title suggests, we see many constructive data points that indicate markets will return to balance and provide a more constructive investment climate. While it’s normal to feel like a lodged garden when markets experience heavy drawdowns, companies with strong financial roots typically spring to life at the first sign of sunlight and represent the best opportunity for new investment. As shown in Figure 1, the time periods ahead of recessions produce most of the negative investment returns, with equities bottoming during the recession. On average, returns are overwhelming positive in the periods following a recession. Investors that hibernate when the investment climate cools miss out on the strong returns achieved when the sun shines once again.

Figure 1. Investment performance before, during and after a recession.

So dawn goes down to day. Nothing gold can stay.

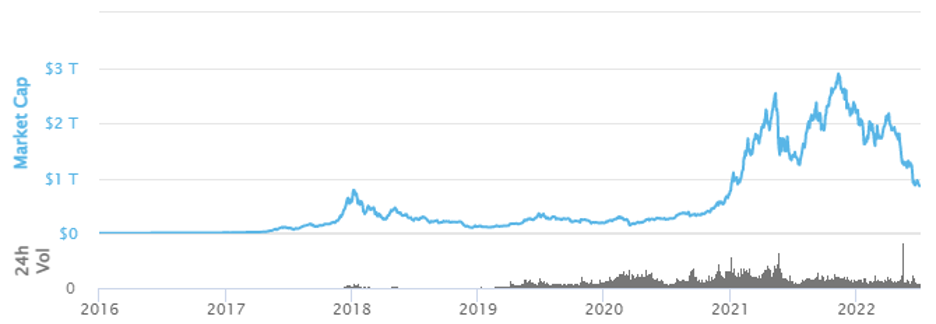

Cryptocurrency advocates often parroted the digital gold analogy as a key rationale for having exposure to the asset class. There is potential for blockchain technology longer term to lower costs, but these types of case studies lie outside of the traditional crypto ecosystem. To that point, there are increasing signals that a great deal of crypto-related investment is simply leveraged speculation on the growth of the crypto ecosystem, and thus, recent losses should lead to reduced interest in the sector. Many applications rely on web-based APIs as opposed to blockchain technology and exist simply to provide a ‘raison d’etre‘ for products such as NFTs.

Figure 2 shows the cumulative value of all cryptocurrencies. Since November 2021, their gross value has fallen about 70% or ~ US$2 Trillion. Currently, the top five crypto products account for nearly 75% of industry value (Bitcoin itself is about half) but there are over 350 products with a total value over $50 million each. As the industry reckons with increasing amounts of fraud, theft and bankruptcies stemming from leverage and entity co-dependencies, it likely will take a long wash-out of all the bad actors before the industry takes another step forward. Ultimately, we would view this as a healthy development.

Let chaos storm! Let cloud shapes swarm! I wait for form.

As we monitor economic data, we believe we are closer to reaching a new equilibrium than recent equity market volatility suggests. Consider the following data points (click hyperlink for full story).

- While we remain concerned with European energy security in the short term given the ongoing Russia/Ukraine conflict, we note that energy prices in North America have fallen 20% in the past month. Energy has been a primary driver of inflation (including higher costs for producers). Prices for other commodities, including copper, lumber, and wheat, have also fallen notably from spring highs.

- China’s re-opening should further improve the supply of manufactured goods and demand from Chinese consumers.

- The semiconductor shortage is quickly moving towards a semiconductor glut.

- Auto production should start to increase through summer, with access to chips and the easing of vehicle pricing.

- Bond yields have declined 50 bps since mid-June and should provide some relief for housing as the basis for setting fixed rate mortgages.

- Shipping costs, both ocean and trucking, are correcting quickly from record high levels providing more relief to supply chains.

Some supply-constrained sectors like air travel and hospitality that will experience a similar supply response in due time, but for now will continue to add to inflationary pressures. However, an examination of the main drivers of market disruption over the past nine months reveals a much healthier backdrop for growth stocks if the data above holds true.

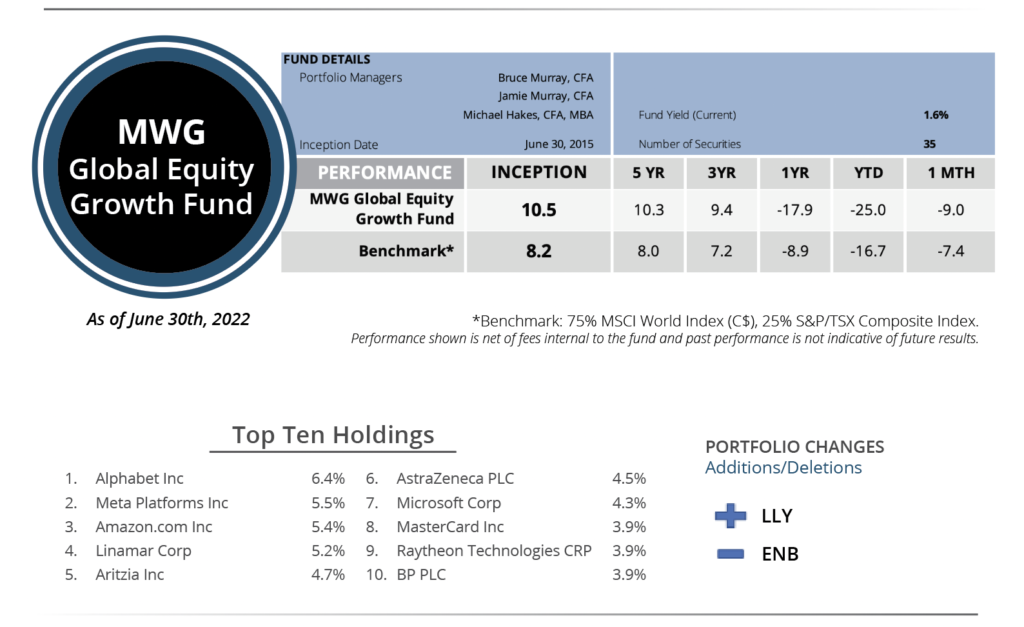

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund fell 9% in June, more than the decline of its benchmark (down 7.4%), as the Fund’s weighting towards communications, technology, industrial and consumer discretionary stocks was disproportionately impacted by rising interest rates and recession fears. Year-to-date, the Fund has fallen 25.0%.

We started a position in drugmaker Ely Lilly in June. Ely Lilly has a diverse pipeline with five new products expected to launch in the next two years that should contribute to topline growth of 40% over that timeframe. Its Tirzepatide product for diabetes and anti-obesity has potential to be one of the biggest selling drugs of all time given that 40% of the U.S. population (and growing rapidly) is living with obesity and competition from only Novo Nordisk’s Wegovy. Tirzepatide will extend LLY’s GLP-1 injectable shelf life following the expiry of its Trulicity patent in 2027. Lilly also has new products aimed at treating eczema, cancer, ulcerative colitis and Alzheimer’s (a market with large potential and poor treatment options).

We sold our position in Enbridge to take advantage of the market weakness in higher leverage names where we see better long-term returns.

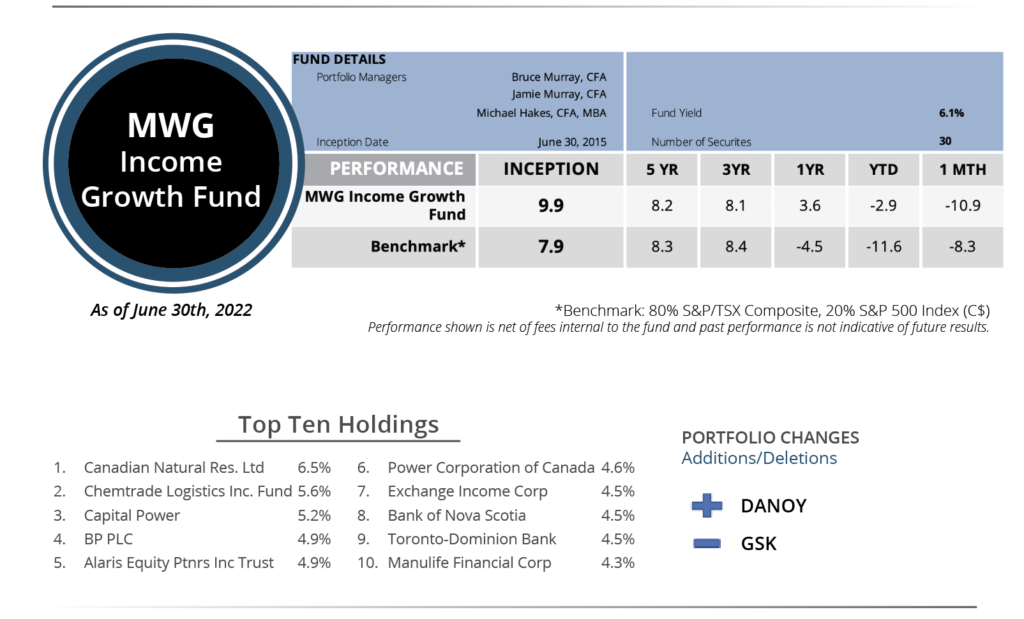

INCOME GROWTH FUND

The MWG Income Growth Fund fell 10.9% in June, more than the decline in its benchmark of (down 8.3%). The Income Fund has now fallen 2.9% year-to-date.

During the month, we added a position in Danone, the French dairy and consumer product producer. The company has brought in a new management team and should benefit from a renewed focus on higher growth products and pricing improvements to manage current inflationary pressures. The new plan should drive earnings growth of 8% on top of a 4% dividend yield.

To fund the purchase of Danone, we sold our shares in GSK ahead of its consumer spin-off, which could generate a taxable event for Canadian investors.