Thoughts on the Market: July Edition

Written by Jamie Murray, CFA

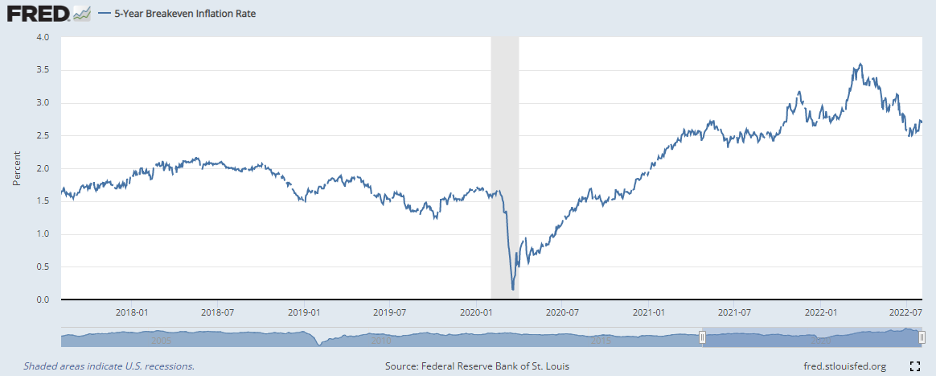

We wrote last month that after the worst start to a year in half a century, positive data points on the equity markets were transpiring. You can re-read the argument by clicking here. At the time, contributors to supply side shortage reversals included falling energy and commodity prices, easing of the semiconductor shortage, lower shipping costs and falling bond yields. One month later, markets have further improved on all fronts.

Labour markets, the last remaining bastion of inflation pressure, remain tight as evidenced by the massive July payroll gains but are anecdotally improving as per recent commentary from Uber on its enhanced ability to onboard drivers to its platform.

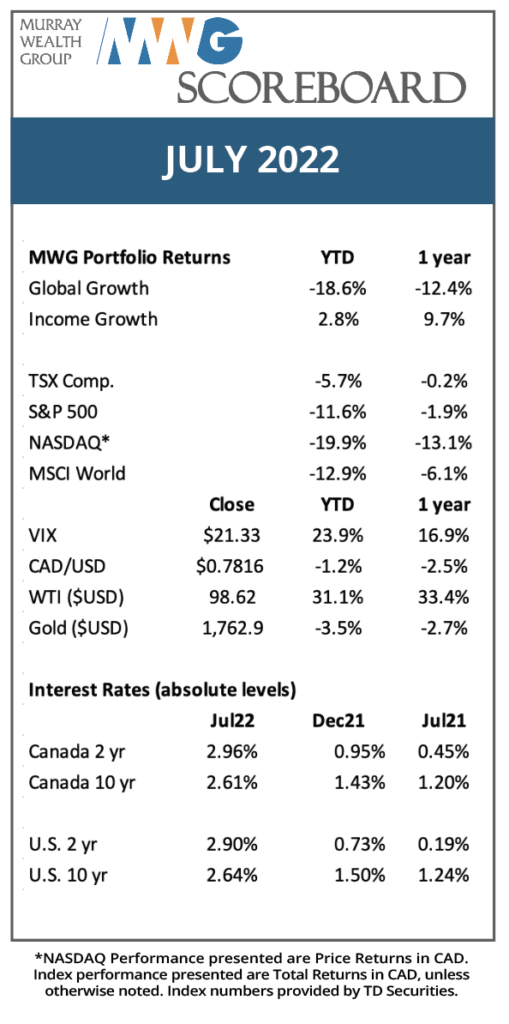

The primary reason for improvement in many of these metrics, however, is a slowdown in exposed markets. Housing activity (both development and transactional) has slowed. Retailers continue to deal with excess inventory. Tech companies are slowing their pace of hiring or laying off staff. Surely, that should pressure earnings in the short term. Not quite. Earnings estimates for the S&P 500 are actually higher than they were at the start of the year. Part of that is due to strength in energy suppliers’ profitability (oil, gas, power). North America (particularly the U.S.) is less exposed to rising energy prices than they were in 2008, given the growth in production over the past decade (Figure 1). While the tech hubs of San Francisco and Seattle may be seeing relative weakness this year, commodity hubs like Houston and Denver are experiencing relative strength for the first time since 2014.

Fig.1 U.S. Oil and Gas Production effectively doubled over the past decade

Pricing is another lever that can maintain earnings growth. Despite experiencing a host of rising costs, Starbucks reported U.S. sales growth of 9%, mainly due to higher spend per transaction. Naturally, when consumers are paying more, those extra dollars are flowing somewhere, usually into corporate bank accounts. Equities, after all, are priced in nominal dollars (not real terms) and provide a degree of purchasing power protection that T-bills and cash cannot.

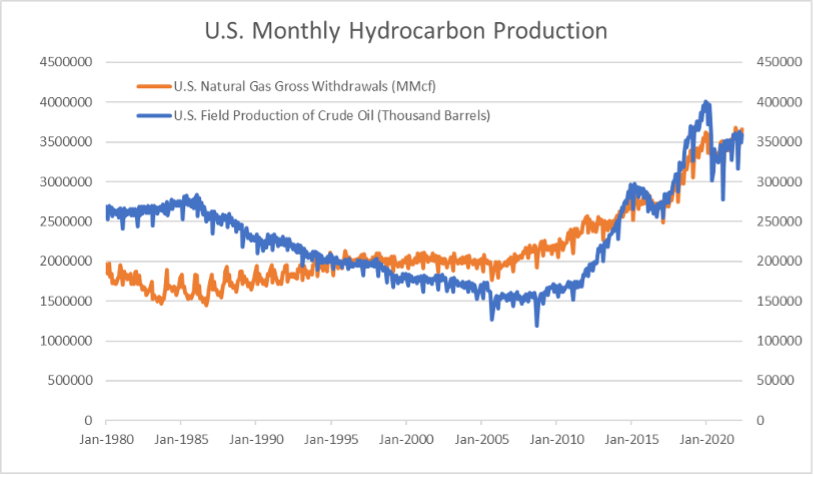

Finally, the Federal Reserve wants the economy to slow. It wants to see people work a little harder and longer, spend a little less on purely consumptive activities and bring inflation back down to 2%. Of course, it aims to accomplish this without a recession. So far it appears to be on its way to successfully achieving its aim. Consumer spending is holding up, and while employment remains high, a number of inflationary forces are improving (gasoline demand, for example, is down 9% year over year according to the EIA – Figure 2).

Figure 2: U.S. Gasoline Demand year-over-year

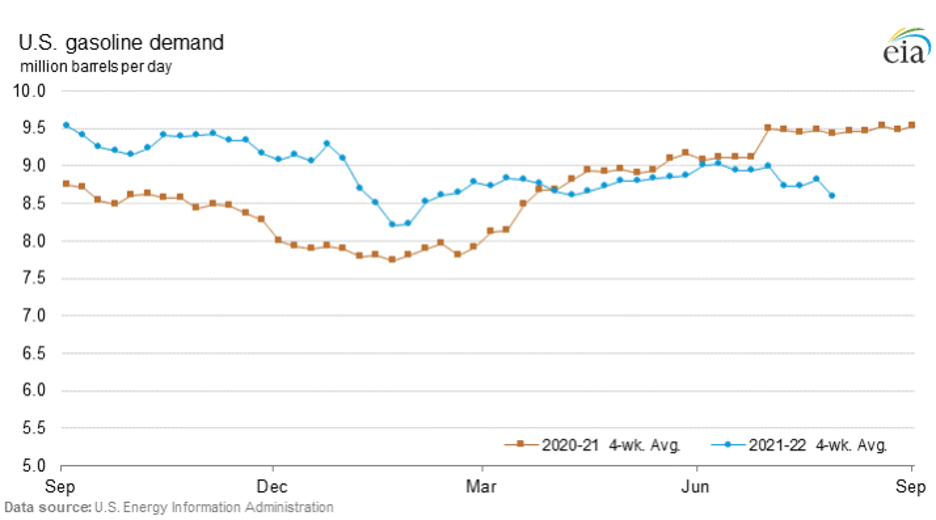

The hope is that supply can catch up with demand across most verticals and then continue increasing in lock step, leaving the COVID economy behind. This is best captured by looking at inflation breakeven which is the implied inflation expectation determined by Treasury Bonds and Treasury-Inflation Protected Securities (TIPS). The 5-year measure indicates inflation expectations of 2.75%, down from a high of 3.5% in April 2022 (Figure 3).

Fig. 3: Breakeven Inflation Rate is the rate implied by inflation-linked securities and treasury bonds

In our Global Equity Growth Fund, we remain positioned in long-term growth stocks with strong balance sheets that can weather an economic slowdown, take market share, and emerge stronger in a recovery. Our Income Growth portfolio features high yielding companies that should be able to increase their yields over the long term. We remain confident in the ability of both funds to deliver strong returns.

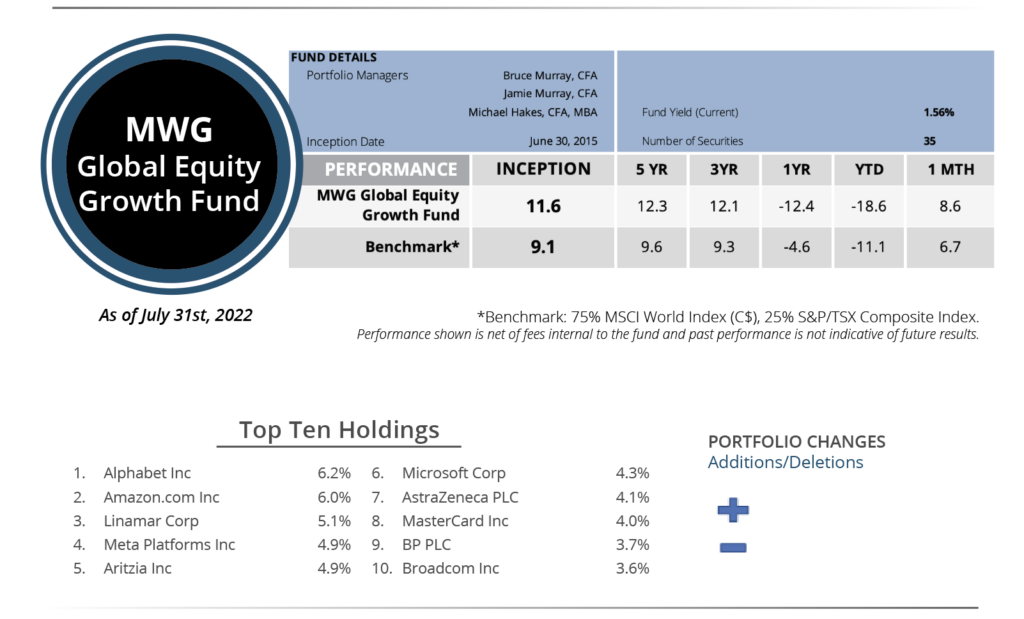

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund rose 8.6% in July, outpacing the benchmark return of 6.7%. Year-to-date the fund remains down 18.6%. The top performers in the month were Netflix (+28%), Amazon (+26%) and Adyen (23%) while Comcast (-4%), Raytheon (-4%) and Eli Lilly (-2%) were the bottom performers.

We made no changes to the portfolio companies in July 2022.

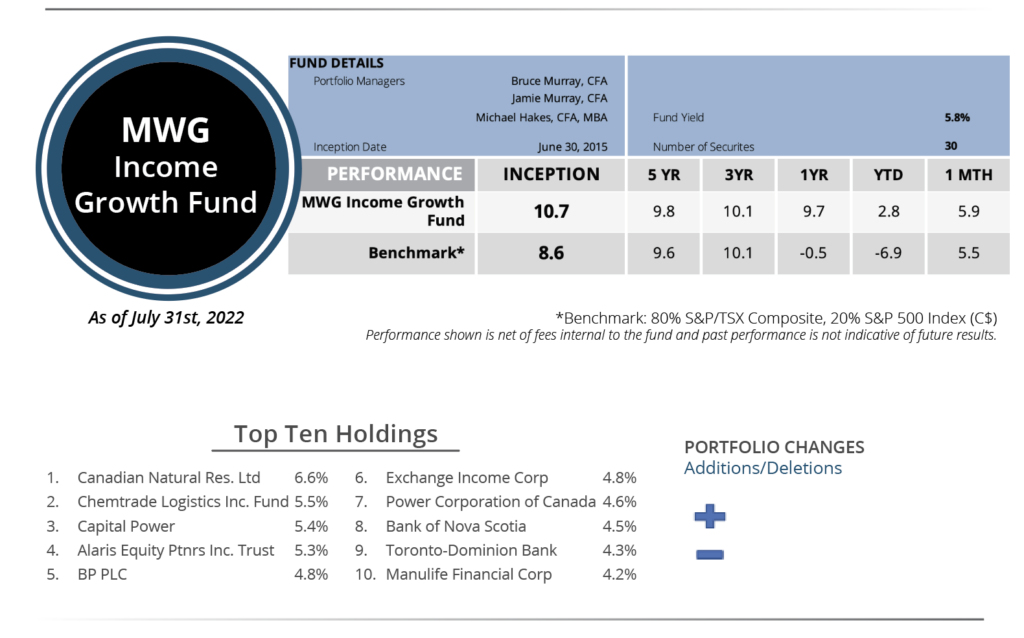

INCOME GROWTH FUND

The MWG Income Growth Fund rose 5.9% in July, outpacing the benchmark return of 5.5%. Year-to-date the fund has returned 2.8%. The top performers in the month were Evertz Technology (+13%), Blackstone (+23%) and Exchange Income (12%) while IBM (-8%), Quarterhill (-4%) and Chorus (-3%) were the bottom performers.

We made no changes to the portfolio companies in July 2022.