IBM reported its financial results last night. While earnings were inline, revenue misses in its legacy businesses sent the shares down 6% in trading. Nevertheless, we believe IBM is poised to move higher as the company returns to revenue growth in 2020-2021. Its newly acquired business, Red Hat, posted accelerating revenue growth in its first quarter under IBM and should get much bigger as IBM cross sells its products through its massive sales channel. As well, improving employee reviews of the company highlight a culture changing for the better. With low expectations and low valuation, IBM is an attractive tech holding in a volatile market.

IBM: Signs of a turnaround afoot

IBM is a controversial stock as the company has a history of strategic missteps, culture problems and operates in certain legacy business lines which are clearly in decline. The shares are trading just 15% higher than 10 years ago while the NASDAQ 100 Index has returned approximately 400%. However, we feel like the tide is turning with a growing market opportunity as cloud computing enters its next phase and a culture that is slowly improving. With investors looking elsewhere in the technology space, there is potential for IBM shares to outperform.

Cloud Phase 2

IBM acquired Red Hat in July 2019 to expedite and improve its cloud services positioning. “The cloud” can be an ambiguous term. Often, consumers view cloud as the offsite storage for files or photos. Within business, its viewed as outsourcing your datacenters needs largely to Amazon AWS or Microsoft Azure. Both of these are examples of usage, but the benefit of cloud computing extends past outsourced storage. Put simply a cloud operating environment is one where computer server usage can be optimized and shared amongst different users with the ability to scale quickly server usage when necessary.

In Cloud Phase 1, driven by 1) smartphones and 2) a focus on servicing costumers over the internet, companies began building apps to complete almost any task (need something? there’s an app for that). Microsoft and Amazon were big beneficiaries of Cloud Phase 1 as they built out their AWS and Azure services which were perfect for development and scalability of the buildout of the “app” world (aka the Public Cloud). IT is estimated that approximately <20% of workloads are handled by public cloud.

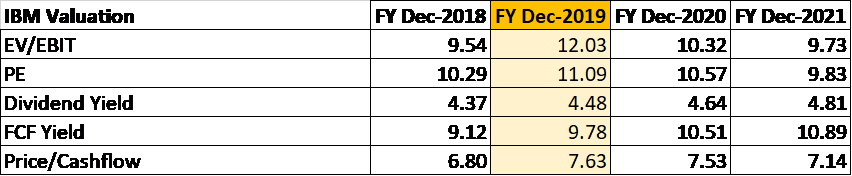

Cloud Phase 2 will be more complicated as companies look to optimize their existing and mission critical systems, and according to IBM – it is a US1.2 trillion dollar opportunity that the technology sector will be chasing. Companies will likely begin employing a hybrid cloud and multicloud environment which will require significant development and expertise for managing workloads across different cloud environments. Enter Red Hat. Red Hat is a leading provider of cloud operating systems and middleware serving. IBM believes it can capture a larger share of wallet and cross sell Red Hat’s products across its global footprint. It is unknown how successful this strategy will be, but if IBM can prove out its product portfolio, we believe there is upside to both financials and its valuation multiples. IBM still handles a large amount of banking work globally – for example, 97% of the largest banks are clients and 90% of credit card transactions are processed on IBM mainframes. There is a high level of trust, regulatory knowledge and data that IBM can leverage to ensure it captures its share of work.

Figure 1: Hybrid Cloud (Phase 2) Market Opportunity

Culture Shift Underway

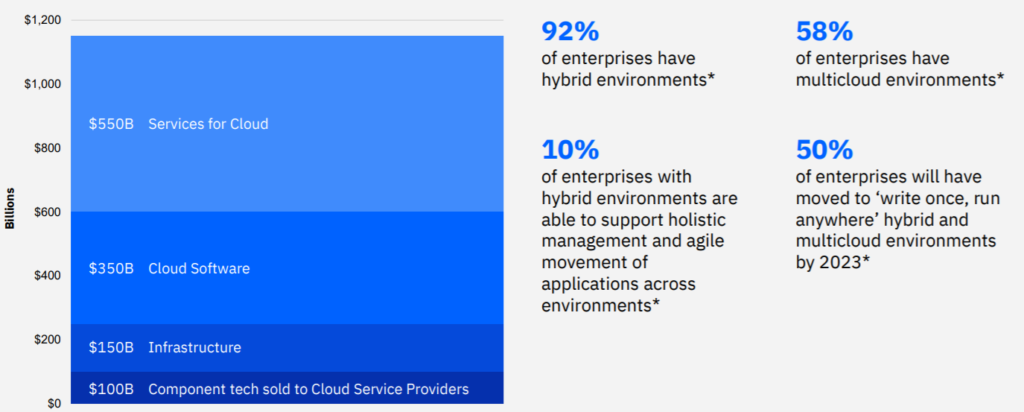

To put it frankly, IBM does not have a great reputation for its culture. It is a sales first organization and has missed large strategic opportunities over the past two decades. However, we believe the company is working hard to improve its culture. The two quickest ways to achieve this are work environment and strategic positioning. We cannot comment directly on the day-to-culture which invariably would be dependent on location and department. However, employees have a good pulse on the health of a business franchise. Sales people will notice a change in win rates, engineers receive product feedback based on product acceptance and management understands profit/loss opportunities and future incentive opportunities. To measure this, below we highlight IBM’s culture trends from Glassdoor in Figure 2 (Glassdoor is a website that allows employees to anonymously review its company).

Figure 2: Glassdoor Employee Ratings Changes

These are modest changes over a year, but we note that with an organization of 350k employees, we would expect to see change occur slowly especially when it comes to an ingrained culture.

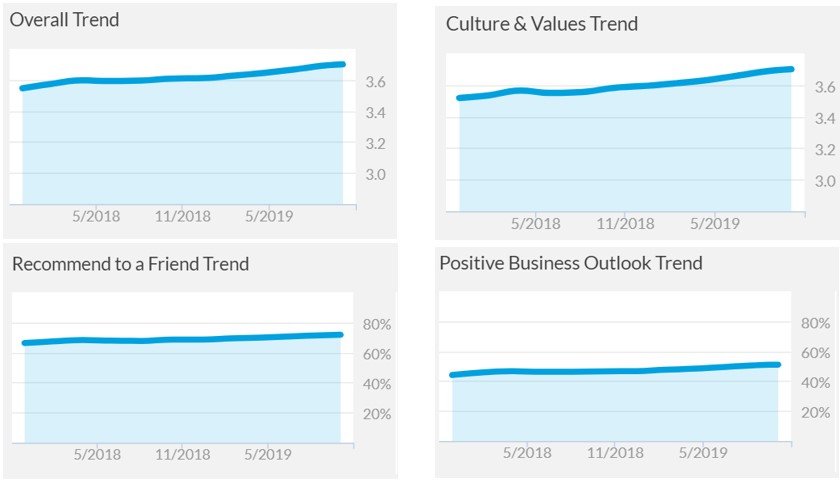

Under-owned with low expectations

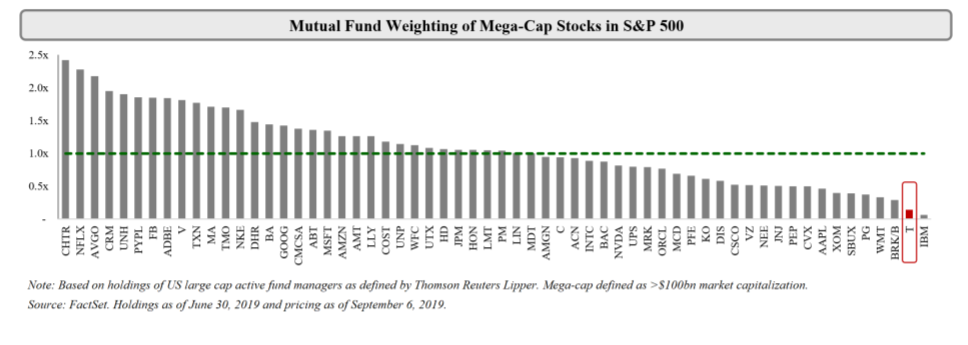

When Elliott Management released its AT&T activist playbook, it highlighted AT&T as the second least actively owned stock in the index. One spot to the right was IBM. We believe that any improvement in financial results and investor sentiment could be a catalyst for IBM shares. As well, the valuation is attractive with the company trading at 10x FCF, 10.5 P/E and a 4.5% dividend yield. We have a US$179 target on IBM.

Figure 3: IBM is the most underweight stock among active mutual funds

Figure 4: IBM Valuation Multiples