Thoughts on the Market: December Edition

Written by Head of Research, Jamie Murray, CFA

At Tale of Two Markets: 2024 Outlook

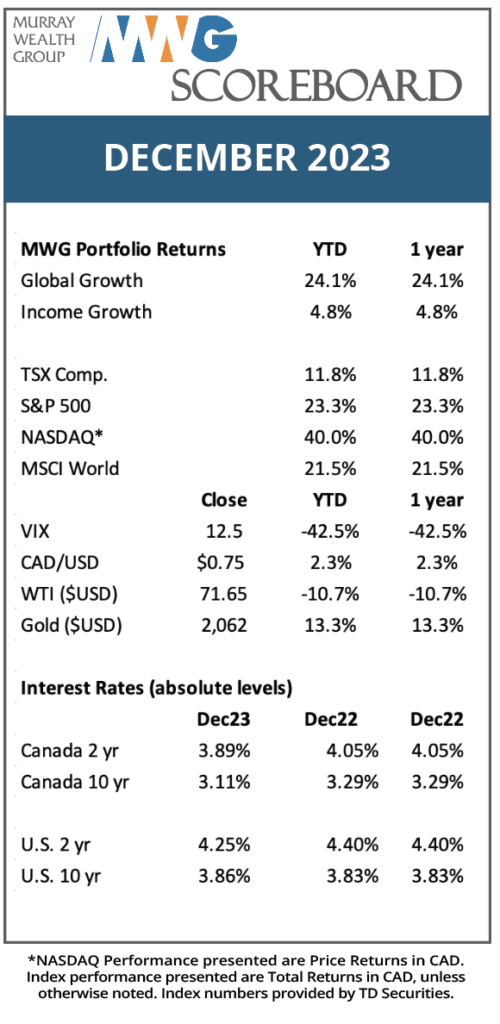

If 2022 was the worst of times, 2023 was the best of times. The S&P 500 returned 24% in US dollar terms. The NASDAQ returned an even greater 43%. This was a welcome reprieve as the two indices returned -18% and -33% respectively in 2022. The Russell 2000 Index, which tracks the performance of U.S. small and medium size equities, returned 15%, although all the gains came in the final two months as the index was down 6% as late as October 30, 2023.

Not every asset class was mirrored in both years. Interest rates continued their climb globally, with most central banks keeping overnight rates at their highest levels in over a decade. Expectations for the rate cutting cycle have been priced into the markets, with long-term interest rates falling by about 1% in North America. The catalyst for the shift in expectations is declining inflation, which is running at 2.57% on a 6-month annualized basis and close to 3% year-over-year. With inflation running between 2% and 3%, the real interest rate is close to 2.0%, which is a historically restrictive level for economic output.

So what is in store for 2024?

Let’s examine 5 key questions….

Can the NASDAQ, which has returned ~150% over the past 5 years, continue its torrid pace? The Magnificent 8 led markets with returns of about 75% as a group in 2023, again mostly reversing their weak performance in 2022. The group is selling at a P/E multiple of 28x, which is a large premium to the remaining market, and makes up 27% of the index market capitalization. Thus, the performance of the group will continue to have an outsized effect on the market.

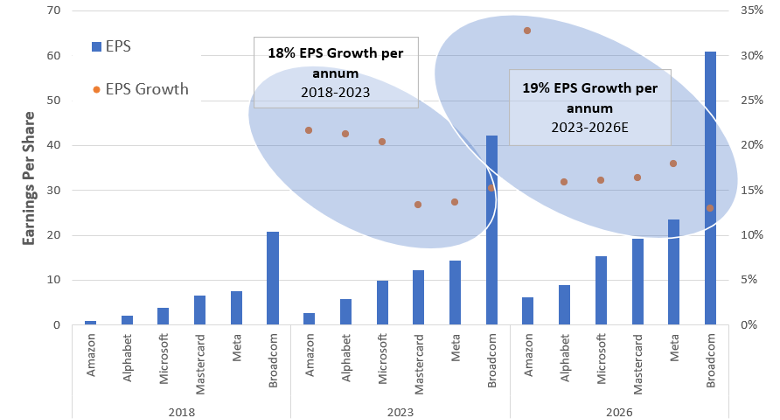

We believe the good times will continue in technology. The sector is emerging from recessionary conditions in 2022 and has adjusted its cost base to levels supporting greater profitability. At the same time, revenue is accelerating as Artificial Intelligence applications continue to emerge. When we look at some core technology holdings in our Global Equity Growth Fund, we find that historical earnings growth mostly justifies the share price performance to date, and expected earnings growth should support additional capital gains in the future (Figure 1).

Figure 1. After growing EPS at an 18% annual growth rate, tech companies in our portfolio are forecast to grow EPS at 19% per annum through 2026.

Source: Workspace, MWG

As we wrote in our November Portfolio review, we believe the market is differentiating the winners and losers in the technology space in 2023, which should mean consolidation and higher margins, albeit at lower levels of revenue growth. Share prices may need to trade sideways for a few months while the market gets comfortable with the longer-term growth outlook, but we believe technology still has a long way to run.

Energy stocks are mostly flat since Russia invaded Ukraine. What gives?

Since February 2022, the Canadian Energy Index (XEG) is up about 15% including dividends. However, much of the gains came in the first three months as oil rocketed to US$120/bbl. Since then, share prices have declined. Unsurprisingly, commodity prices are the biggest driver of oil and gas stock returns. This is even more so as the proliferation of shale drilling in North America has turned oil producers into manufacturing operations versus exploration. Inputs and outputs like production rates, gas/oil ratios, facilities buildouts and drilling expenditures are well understood (subject to inflationary forces), but the ultimate selling price of the commodity is the largest factor in returns on capital (many companies can and do lock-in the selling price through derivatives, although investors are unenthusiastic about investing in companies with large hedge books).

Over the past 22 months since Russia invaded Ukraine, North American oil and gas prices are down significantly, with oil trading near US$72/barrel (down 25%) and natural gas at US$2.85 (down 45%). Thanks to warm weather and a higher supply response, the initially anticipated widespread drawdown in energy inventories has not occurred. Two years into the conflict, it is becoming an afterthought in the energy trade, with the new focus on Middle East instability. Thus, the positive return in the index highlights the early returns of a more disciplined North American energy space. It’s likely that the oil price will remain in the 18-month range of US$65-85/bbl, with shareholder returns coming from dividends and minor share buybacks.

Will transactional services rebound in 2024?

2023 was the second poor year for transactional services like mergers, IPOs and real estate activity. According to data from the law firm Skadden, global M&A volume fell 27% on a dollar basis, with deals down 7% through September 2023. Similarly, global real estate brokerage firm Colliers experienced an 8% decrease in transactional revenue. This activity drives a meaningful amount of economic activity from the associated professional work in fields such as banking, legal, advisory/brokerage and boutique services like architecture.

With longer-term interest rates off about 1% from their October peak and central banks hikes pausing and potentially cutting rates in 2024, we believe buyers and sellers will be able to close the gap on transaction prices, allowing the pent-up activity in transactional services to flow through the economy. This should provide a direct boost for revenues in sectors like the financial sector. Additionally, firms that would like to optimize capital structures may sell down assets to reduce their levels of indebtedness.

Will Inflation re-accelerate with a rebound in economic activity?

Inflation has trended down to the 2.5% level, with persistent inflation found in shelter, motor vehicle services, medical services and food away from home. Wage rates, which provide the ammunition for inflationary forces to become entrenched, have also slowed as labour market conditions normalized. We do not believe a softening in interest rates will lead to a resurgence in inflation. For starters, rental prices have flattened and that should flow into CPI data this year. In addition, real goods like apparel, consumer durables and commodities are well supplied. Moreover, interest rates are still projected to remain well above 2020/2021 levels, and government/monetary stimulus levels are low. As well, we believe AI will provide additional benefits to productivity over the next several years. While the strong economy and stimulus for green energy development may keep inflation above its historical 2% level, we do not believe that the conditions for stagflation (where inflation is high and economic growth is low) are evident.

Copper is needed for electrification of our transportation grid. Are we on the verge of a super cycle?

The copper and industrial metals markets are in flux as China, consumer of 60% of global copper production, slows its consumption amid a property glut, while electrification around the world is providing a new source of demand. Copper supply and demand trends can be difficult to discern as only changes in inventories at global metals exchanges are available to be analysed in the short term, which is further exacerbated by large trading house that manipulate inventory levels at the exchanges in efforts to boost trading profits. Thus, short-term price movements can be poor indicators of supply and demand.

Longer term, we believe that copper reserves need to be replaced with new mining capacity if the world is to maintain current output levels. There has been a dearth of investment over the past decade, and the average reserve grade at existing mines is declining. 2024 will provide additional data to answer the demand side of the equation as China continues to grapple with an overbuilt property market and industrial production rebounds in the developed economies. We lean to the positive on the mining space in 2024 and expect copper to eclipse US$4/lb.

GLOBAL EQUITY GROWTH FUND

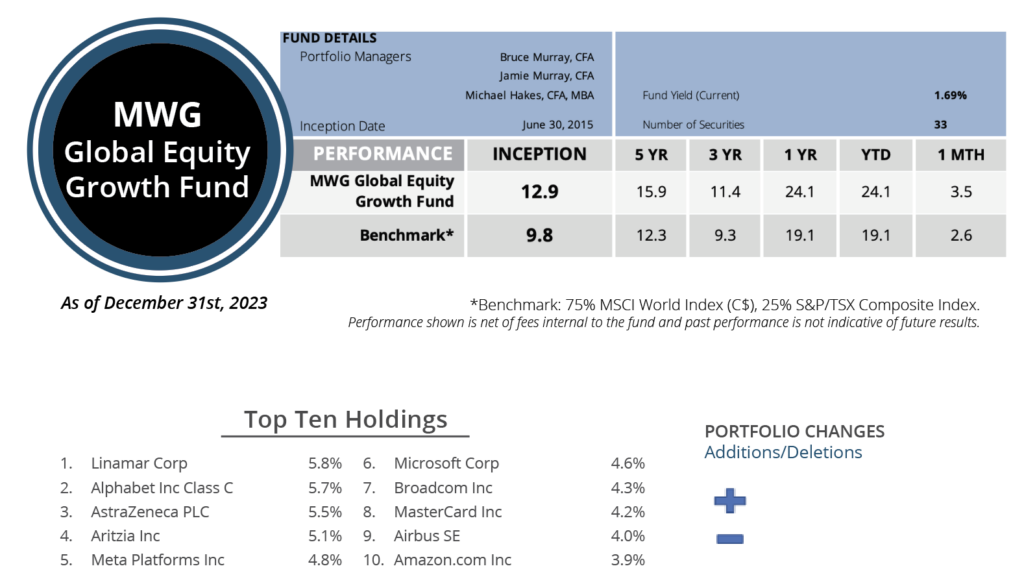

The MWG Global Equity Growth Fund increased 3.5% in December versus a 2.6% return for its benchmark. Year-to-date, the Fund has returned 24.1% versus the benchmark return of 19.1%. The Fund’s top three performers in the month were Major Drilling (+19.4%), Broadcom (+17.8%) and Bank of Montreal (+17.7%), while Aon (-13.8%), United Health (-7%) and Starbucks (-6%) were the biggest detractors.

We made no changes to the Fund in December.

INCOME GROWTH FUND

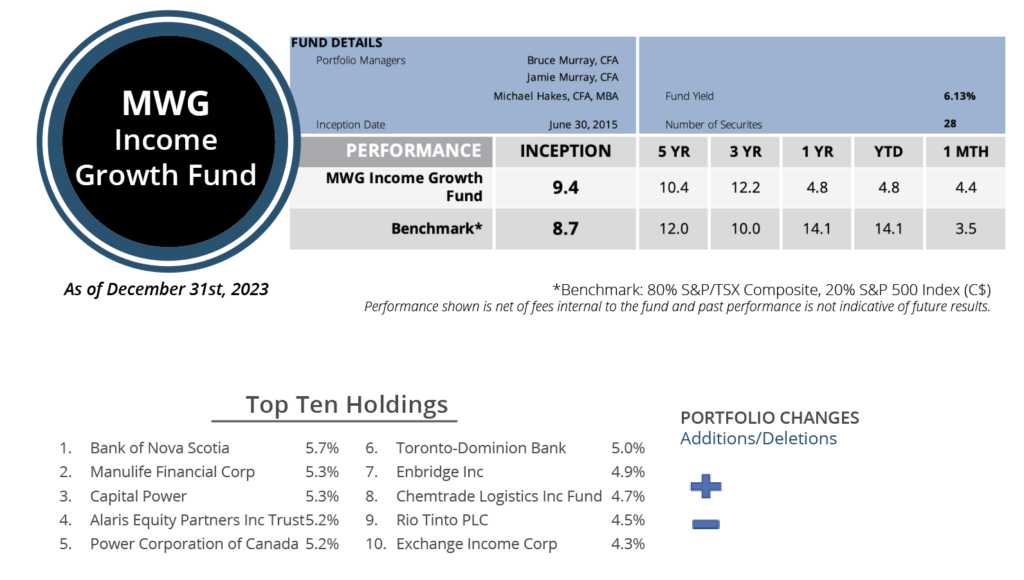

The MWG Income Growth Fund rose 4.4% in December versus a return of 3.5% for its benchmark. Year-to-date, the Fund has returned 4.8% versus the benchmark return of 14.1%. The Fund’s top three performers in the month were Doman Building Materials (+26%), European Residential REIT (+19%) and Northwest Healthcare (+17.7%), while Pfizer (-8.1%), American Hotel REIT (-6%), and BP PLC (-5.1%) were the biggest detractors.

We made no changes to the Fund in December.

This Month’s Portfolio Update is written by our Head of Research, Jamie Murray, CFA.

The purpose is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.