We are all going through some unprecedented times right now as a result of COVID-19. With that in mind, we wanted to share some financial tips you may find useful.

Save Those Gardening Receipts!

Do you know you can potentially make a portion of your home maintenance costs, including those gardening expenses, tax-deductible? If your employer has required you to work from home, you are able to designate a room or space in your house as an office. Dividing the square footage of that office by the size of your residence and multiplying that by the percentage of your business hours worked from home gives you the portion of home expenses that can be applied against the income you earn from your job. Start saving all property tax bills, telecommunication charges, condo fees, utilities, etc., for next year’s taxes and get your employer to sign off on a T2200 form to file with your taxes.

Behind on Tax Filings? – File It Now!

The government is and has been waiving any new fees and delaying interest payments on filings. While we don’t know exactly what this means for every situation, it will be difficult, administratively, for the CRA to pick and choose who to penalize and who to not as penalties are system generated. If you or your business is behind on filing any personal, business, payroll, or HST filings, now may be the best time to do it.

The Importance of a Will

As your province starts opening up, one of the areas of fallout will be Probate/Estate courts. All current court cases have been delayed by the government shutdown. Add to those cases already in the system, all the new cases related to people who pass away intestate (without a will) or those that have a contestable will, and the backlog could be years rather than months.

The problem with not having a will, or having a contestable will, is that an inheritance may be tied up and thus not available to those that need it. If you intend to will your assets to your spouse but someone else in your life objects, the assets can be tied up in the courts until the case is resolved. If your spouse needs that money to live right now, it may mean serious hardship for them until the case is resolved in the courts.

Please get your will professionally done. The will kits you can buy on the internet can be easily contested. A professional will make sure you and your beneficiaries are protected.

Review Your Will Regularly

Your assets may have been on a bit of a roller coaster ride these last few months. Be it a significant move in the market or a change in the value of your real estate or other investments, it is important to review your will from time to time to ensure that your assets will be distributed as you intend. Think of the situation where you want to give one beneficiary a family cottage and another a piece of your investment portfolio, with the intent of providing both with equal value. The beneficiary that receives the lower amount may contest the will. Again, a professional will help protect you and your beneficiaries from this situation.

When you review your will, you should also review your Powers of Attorney (POA). Your POA for Property allows the individual you designate to deal with your financial affairs on your behalf. Your POA for Personal Care allows the designate to make decisions regarding your personal care (including medical) if you are incapacitated. Make sure the people you choose for these roles are still willing and able to do so.

Investing for the Long Term

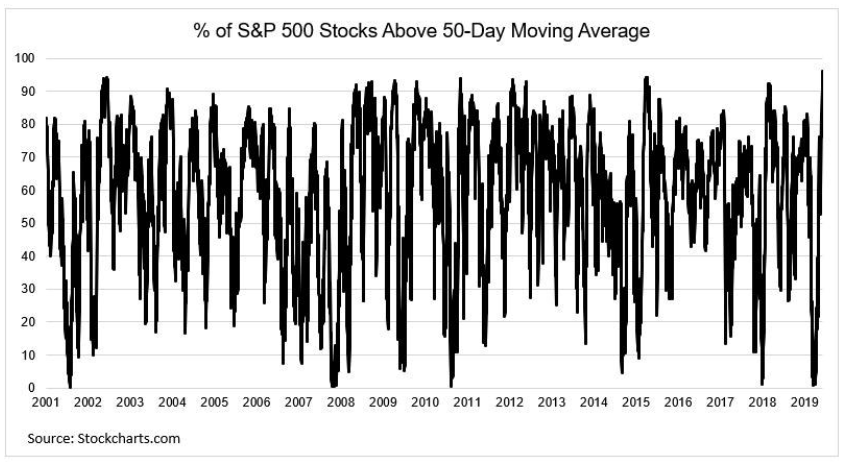

Having experienced the recent dramatic drop in the stock market caused by COVID-19, you may be asking yourself if investing in equities is right for you. At times like these, it is important to remind yourself that you are investing for the long term. The chart below depicts the rise in the S&P 500 Index from 1970 to 2020.

At first glance, we can see the chart moves higher over time but with several sell-offs lasting 1-2 years.

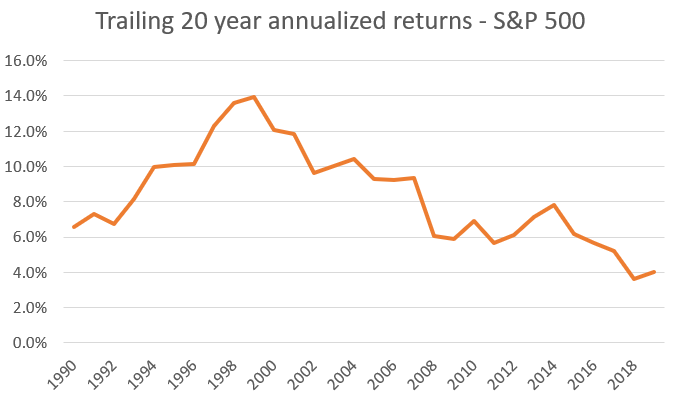

How can we measure its true long term productivity amidst the volatility? We suggest the 20-year annualized return chart.

This chart tracks the 20-year return for different year ends. In simple terms, had you invested on Jan 1, 2000, a peak, your return in December 2019 would equal 4.0% per year. Similarly, an investment in 1980 would have earned a 13.9% return. When you have a long term focus, short term events and volatility is easier to look through. When the market hits 5yr lows don’t sweat it because you are a long-term investor. When the market reaches all-time highs don’t go on a spending spree because you are a long-term investor.

Even if you are approaching or in retirement, you don’t need all your retirement savings all at once. Depending on how long you live retirement can last 40+ years. You too are considered a long-term investor.

Excellent long-term savings accounts include TFSA’s and RRSPs.

If you have not taken advantage of tax optimization accounts this year or at all, please contact us at The Murray Wealth Group and we can help.

This piece is written by our CFO, Ryan McCabe.