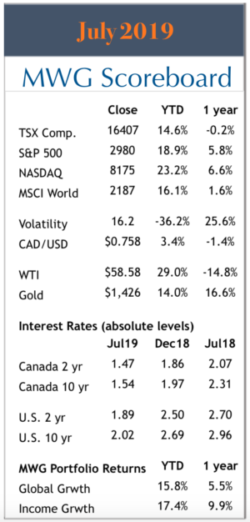

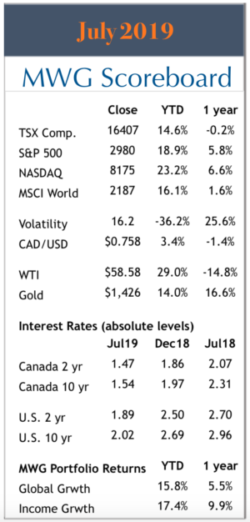

Powell delivered the rate cut the market wanted on July 30. The first decrease in interest rates since 2012. The question was (is) whether this would be a ‘one and done’ scenario or if additional cuts should be expected before 2020. Fed Chairman Powell was non-committal indicating the rate cut was “a mid-cycle adjustment to policy,” and not “the beginning of a lengthy cutting cycle.” While the market negatively reacted to Powell’s commentary, ultimately the rate cut helped the market rally through June and July.

Powell delivered the rate cut the market wanted on July 30. The first decrease in interest rates since 2012. The question was (is) whether this would be a ‘one and done’ scenario or if additional cuts should be expected before 2020. Fed Chairman Powell was non-committal indicating the rate cut was “a mid-cycle adjustment to policy,” and not “the beginning of a lengthy cutting cycle.” While the market negatively reacted to Powell’s commentary, ultimately the rate cut helped the market rally through June and July.

Attention quickly turned from Fed-watching to trade wars when President Trump tweeted a new round of tariffs on US$300B of Chinese goods. Trump and Powell have publicly clashed on the pace of rate cuts and it’s speculated that Trump is using trade and tariffs to stall the economy and build the case for additional rate cuts. Trump would then be in position to make a trade deal with China in 2020 and spark the economy into the next election.

Overall, the U.S. earnings season should be viewed positively with a focus on technology bellwethers beating on revenue and reducing capex (hello, MSFT, GOOG, IBM, FB, AAPL) all while the outlook for cloud-based computing remains strong. We highlight a news release from LinkedIn, indicating its intention to move from its in-house servers to the Azure public cloud Infrastructure (not shocking as LinkedIn and Azure are both Microsoft companies). The real nugget is that the migration will be multi-year initiative, again indicating the long runway for cloud growth. LinkedIn is a relatively simple company with website and user data as well as its apps for various platforms. That it will take three-plus years to fully migrate highlights the complexity as well as the opportunity. Consider AT&T’s cloud deal announced with Microsoft – the largest ever (upwards of US$2B of revenue although timeframe and other relevant was not provided). AT&T (recently integrated US$85B Time Warner merger) would have dozens of legacy data systems to migrate over time as well as new use cases such as its apps for its soon to launch streaming platform. Best of all, cloud computing has so far eschewed any scrutiny from U.S. antitrust watchdogs even though four companies (MSFT, AMZN, GOOG, IBM) are poised to control much of the server infrastructure housing U.S. corporate, government and citizen data (our crystal ball thinks this will be an issue at some point).

TSX-listed companies will report en masse in the first two weeks of August providing additional information into the domestic economy. The TSX continues to suffer from a lack of institutional dollar flow as capital flees Canada. In July, the market increased a meagre 0.1%. The market remains concerned about elevated housing risks and negative energy sentiment. We are not immune to these effects with holdings in commodity producers Stelco, Cameco and Enbridge (pipelines) as well as an 80% weighting to Canada in our Income Fund. However, the banking sector remains healthy and there are a number of global champions headquartered in Canada that present opportunities. Read

Powell delivered the rate cut the market wanted on July 30. The first decrease in interest rates since 2012. The question was (is) whether this would be a ‘one and done’ scenario or if additional cuts should be expected before 2020. Fed Chairman Powell was non-committal indicating the rate cut was “a mid-cycle adjustment to policy,” and not “the beginning of a lengthy cutting cycle.” While the market negatively reacted to Powell’s commentary, ultimately the rate cut helped the market rally through June and July.

Powell delivered the rate cut the market wanted on July 30. The first decrease in interest rates since 2012. The question was (is) whether this would be a ‘one and done’ scenario or if additional cuts should be expected before 2020. Fed Chairman Powell was non-committal indicating the rate cut was “a mid-cycle adjustment to policy,” and not “the beginning of a lengthy cutting cycle.” While the market negatively reacted to Powell’s commentary, ultimately the rate cut helped the market rally through June and July.