Thoughts on the Market: November Edition

To the Victor Goes the Spoils.

The technology sector has outperformed in 2023, as growth and profitability came roaring back following a disappointing year in 2022, when the sector fell 29%. The focus has been on the Magnificent 7 (MAG 7) group of stocks (or 8 when Netflix is included), expanding on the FAANG acronym of 2018, with the group rising ~73% year to date.

While the sheer size of these companies exerts a heavy influence on markets, numerous other “magnificent” technology companies are performing equally as well as these market leaders. Interestingly, these other winners are dominating their respective markets and experiencing faster revenue growth and better profitability than their competitors, who continue to struggle achieving any shareholder recovery. These top performing companies share similar traits, e.g., they all have global scale, are internet-enabled (either cloud or mobile/app based), are beneficiaries of artificial intelligence and have financial strength. This group includes companies such as Uber (up 134% year-to-date), Broadcom (+63%), ServiceNow (+76%), Adobe (+77%), Intuit (+45%), and Docebo (+36%). In contrast to these winners in the technology sector in 2023, there are a vast number of technology companies whose stock prices remain well below 2021 levels (e.g., Peloton and Zoom).

We highlight Uber (a Global Equity Growth Fund holding) as a perfect example of the progress made by some of these companies. After years of subpar profitability, Uber made headlines on December 1 by earning inclusion in the S&P 500 Index (the index requires that companies be profitable on an accounting basis, which Uber recently achieved). The company has significantly outperformed Lyft, its closest rival (Figure 1). At one point, Lyft was considered a potential challenger for Uber, but the company has struggled to profitably grow its business. Uber has grown revenue faster, thanks to both the synergies between ride hailing and food delivery and its global presence, which allows the company to spread its technology R&D over a larger base. Uber expects further gains in profitability as it rolls out new features like loyalty programs and benefits from improved financial performance in newer markets like Spain and Germany. Lyft on the other hand, has no food delivery and operates only in the U.S. and Canada, thus limiting its scale.

Figure 1: Uber shares are up 62% since January 2022 vs. Lyft down 68% over two years.

Source: Refinitiv, Murray Wealth Group

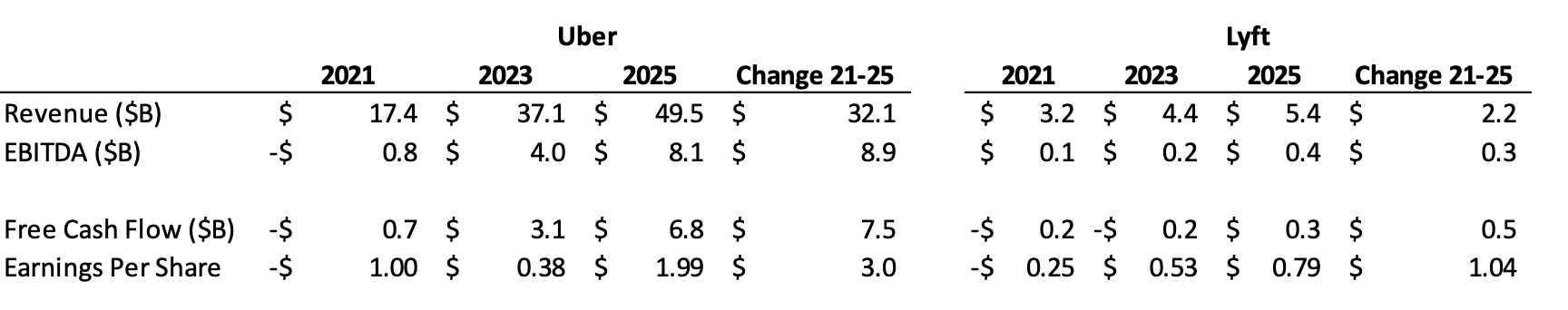

The stark difference in the share price performance of the two companies, depicted in the above chart, can be explained by the marked difference in their financial performance. While both were losing money as recently as 2021, only Uber is now profitable. By 2025, Uber should increase its revenue by $32 billion (representing growth in excess of 250%) and generate an additional $7.5 billion of free cash flow. Lyft is expected to add just $2 billion of revenue (60% growth), of which $0.5 billion will be free cash flow over the same period. Its massive scale advantage allows Uber to invest more heavily and return more capital to shareholders via buybacks. We break down the financials of both companies in Figure 2 and include 2023 results to provide a benchmark for progress.

Figure 2: Uber vs. Lyft Financials 2021 (actual)-2025 (projected) Period

Source: Refinitiv, Murray Wealth Group

Scale in internet-enabled businesses definitely provides an advantage to the largest players in each field. As such, these companies are best primed to benefit from new Artificial Intelligence (AI) applications given the cost and complexity of implementation. AI spending has grown 26% this year to $300B and is expected to double by 2026, according to the IDC. We believe this represents the next leg of revenue growth for the sector.

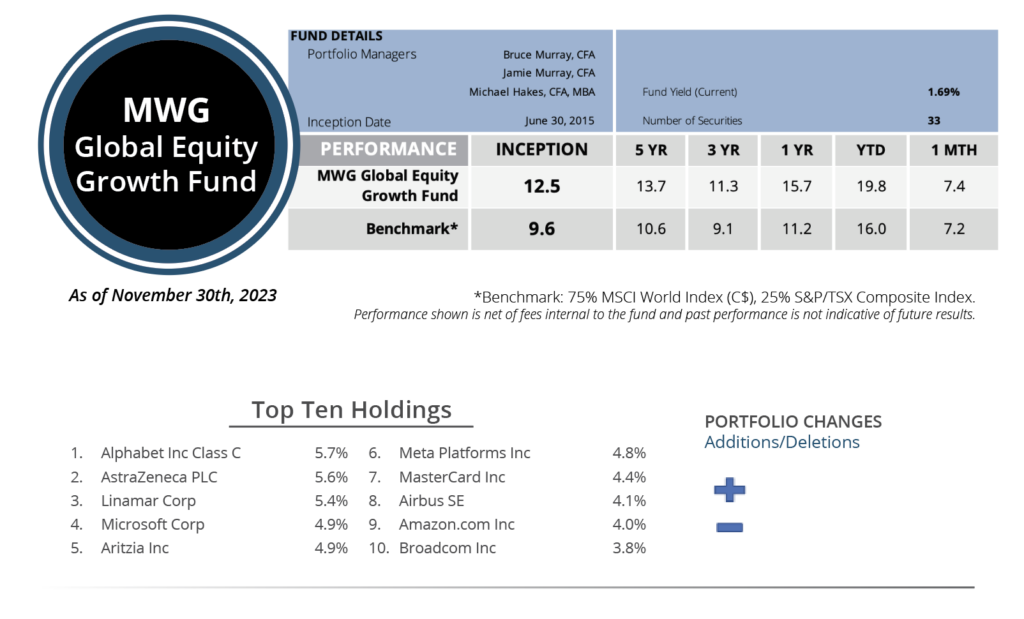

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund rose 7.4% in November, slightly above the 7.2% return for its benchmark. Year to date, the Fund has returned 19.7% versus the benchmark return of 16.0%. The Fund’s top three performers in the month were Adyen (+70%), Converge Technology (+44%) and Uber (+27%), while Whitecap (-12%), Linamar (-4%) and BP (-2%) were the biggest detractors.

We made no portfolio changes to this Fund in November.

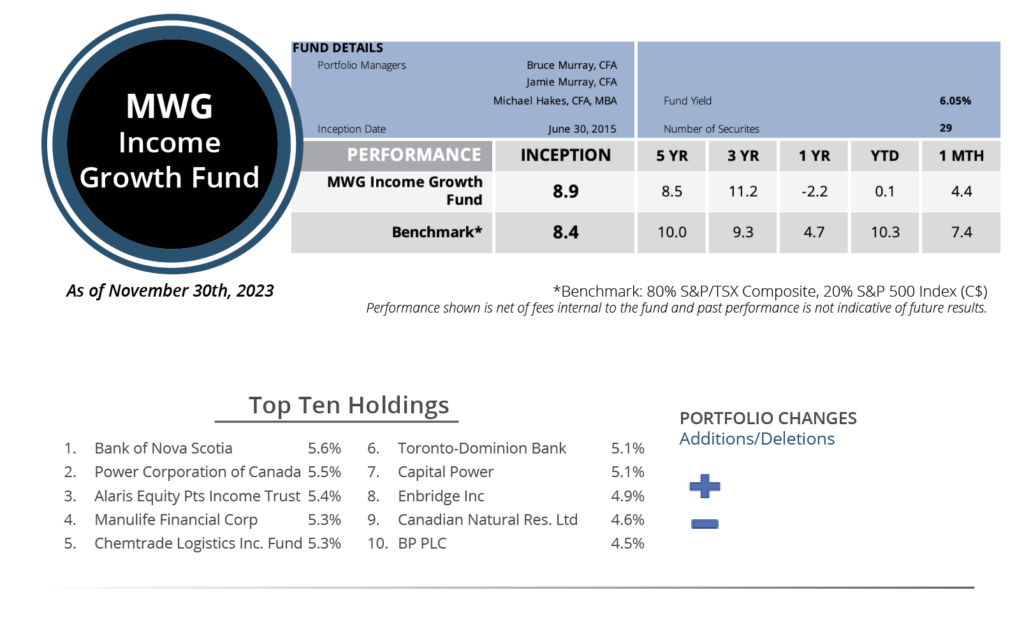

INCOME GROWTH FUND

The MWG Income Growth Fund rose 4.3% in November, compared to the 7.4% return for its benchmark. Year to date, the Fund has returned 0.1% versus the benchmark return of 10.2%. The Fund’s top three performers in the month were Alaris (+21%), Target (+19%) and Blackstone (+19%), while American Hotel REIT (-54%), Whitecap (-12%) and Gibson Energy (-3%) were the biggest detractors.

We made no portfolio changes to this Fund in November.

This Month’s Portfolio Update is written by our Head of Research, Jamie Murray, CFA.

The purpose is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.