There is a lot of talk comparing the current market to that of 1999-2000. True, technology is eating the world, and while the current outlook for further penetration is favourable, the same arguments could have been made about the millennium market (the dawn of smartphones, expanding internet access, better compute efficiency). However, we believe there are substantial differences that make today’s sector much more defensive. As the world entered the new century, there was fear (Y2K) that the large base of installed computer and communications systems was not programmed to handle the new millennium. This was accompanied by the rapid rise of the internet and a plethora of new issues based on ideas for how to use the internet. Many went to large valuations without any real business traction. We also saw a complete rebuild of the world’s communications networks, with a shift from copper to fibre transmission, which led to massive overcapacity. Nortel peaked at about 35% of the S&P/TSX. Read

Monthly Archives: August 2020

July Portfolio Update | 2020

Thoughts on the Market: July Edition

Technology remained in focus in July, with results from the technology leaders speaking to the durability of these businesses. Economic activity plunged in the Q2 of 2020 (recall the Coronavirus did not affect North American economies until the last 3 weeks of Q1), with U.S. GDP falling at a 32.9% annualized rate. Recently released financials for most internet technology companies, however, reveal how the world is adjusting to a digitally enabled future.

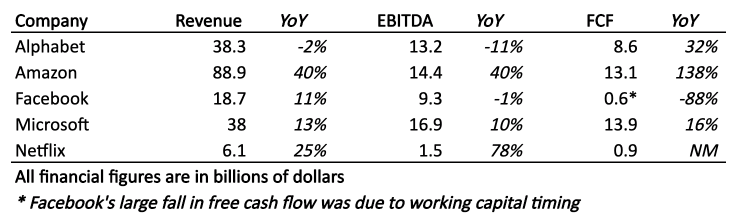

Figure 1: Revenue, EBITDA & free cash flow growth for mega-cap technology companies

The companies highlighted in Figure 1 above grew their revenue, on average, 18% during a quarter in which many companies will report revenue or cash flow declines in excess of 20%. This resiliency further proves out the concept of valuing these companies more like stable utilities as opposed to obsolescent-prone technologies. Smaller, high growth software companies have fared even better. For example, Global Equity Growth Portfolio holding Twilio grew its Q2 2020 revenue 46%. According to Bernstein Research, tech outperformed the broad market by 22% in the first half of the year.

Sectors like banking, retail and commodities, which tend to be more affected by the cyclicality of the economy, continued to plough forward. Many companies are reporting gradual improvement through July. However, the economic trough is so deep that a gradual improvement is unlikely to move the needle financially. While COVID-19 remains an issue, the fact that a resurgence in cases in the southern U.S. is not leading to widespread deaths or market panic should be viewed positively. This supports our recovery thesis, although economies will remain choppy until a COVID-19 vaccine is available.

We believe society will continue to adjust to social distancing measures as a new normal and thus expect markets will shift focus to the U.S. Presidential race. Betting odds have shifted in favour of Joe Biden (from a 40% to a 60% chance of winning) since June in response to the Trump Administration’s handling of the Coronavirus pandemic (the U.S. has far and away the highest number of cases per capita in the G7).

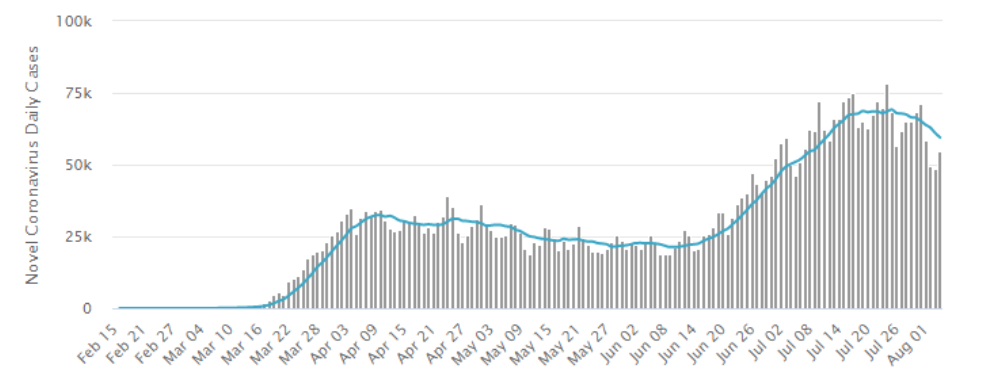

It’s difficult to determine the future course of the Coronavirus but it does appear that U.S. daily case counts peaked in July (see Figure 2 below). If cases continue to trend downward, even temporarily, Trump may be able to shift focus back to the economy and China. However, it’s too soon to call this one just yet.

Figure 2: U.S. Coronavirus case counts with 7-day average

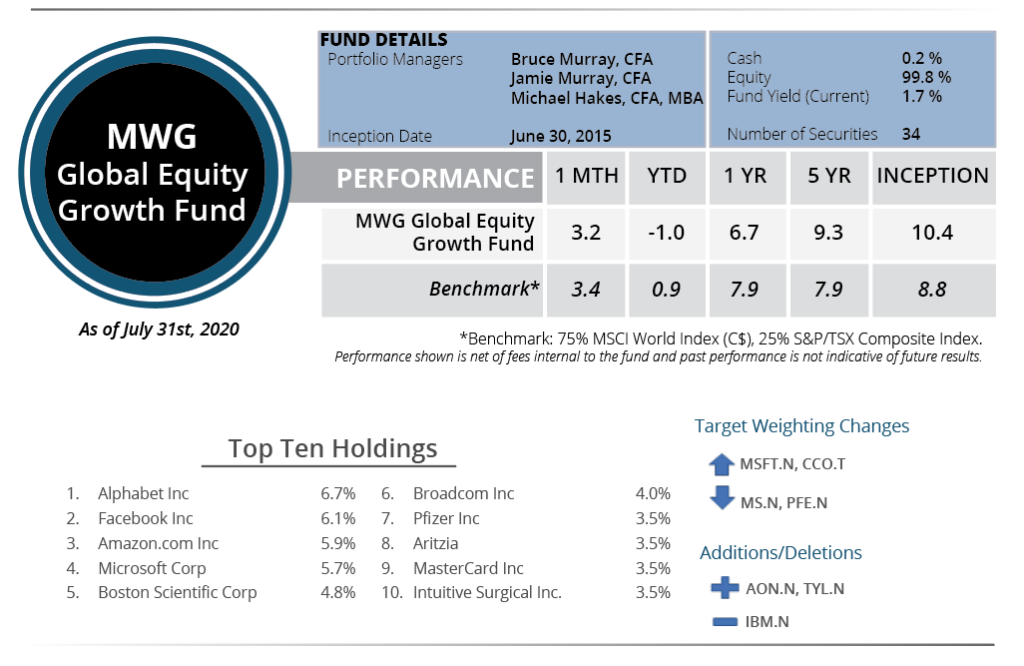

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund rose 3.2% in July, bringing its year-to-date return to -1.0%. Over the past twelve months, the portfolio has returned 6.7%. The top performers in June were Twilio (+25% return), Intuitive Surgical (+19%) and Pfizer (+17%). Raytheon and Aritzia were our weakest performers during the month (-9% and -7%, respectively). Continued strength in the Canadian Dollar also reduced results from our U.S. portfolio when converted to Canadian dollar.

We initiated two new positions in the Fund in July. We started a 2% weighting in Aon, a global Insurance broker and business consultant. The company offers a broad range of solutions, such as risk, retirement, health & benefits, and re-insurance, aimed at large businesses. Insurance brokers enjoy high retention rates (90+ percent) without needing to take on the risk of underwriting or employing regulatory capital. Thus, any organic growth occurs at very high incremental margins. Aon has seen its free cash flow margin increase to 19.1% from 8.2% in 2010, along with a similar improvement in return on capital metrics. Aon (the #2 player in the industry after Marsh & McLennan) is in the process of acquiring the #3 player, Willis Towers Watson, to create the industry’s largest broker. We believe the additional scale and synergies should prove significantly accretive to Aon’s EPS. Valuation is not undaunting at 19x P/E and 5.5% free cash flow yield.

We also purchased a 1% position in Tyler Technologies. Tyler is a provider of local and state government software in verticals such as financial management, courts and judicial services, record keeping and education (among others). Tyler’s cloud-based solutions are much more dynamic than legacy software systems built in the 1980s and 1990s. Thus, as governments look to modernize systems and empower public services, Tyler should see strong demand. The company estimates that its systems represent about 6% of the installed base and believes that up to 70% of existing systems are candidates for replacement. The company is also an active acquirer, completing 11 tuck-in acquisitions in the past three years. The valuation is stretched at a 67x P/E but Tyler generates strong free cash flow and has a very long runway of growth.

As well, we exited our position in IBM. While we are encouraged with the management changes and the inroads made in its cloud computing division, the Coronavirus has accelerated its clients’ move to the cloud, with some analysts suggesting COVID-19 has pulled forward five years of digital strategy initiatives. At this time, IBM does not have the right suite of products in the marketplace, and we believe IBM’s new management team may have a more difficult time pivoting to the cloud.

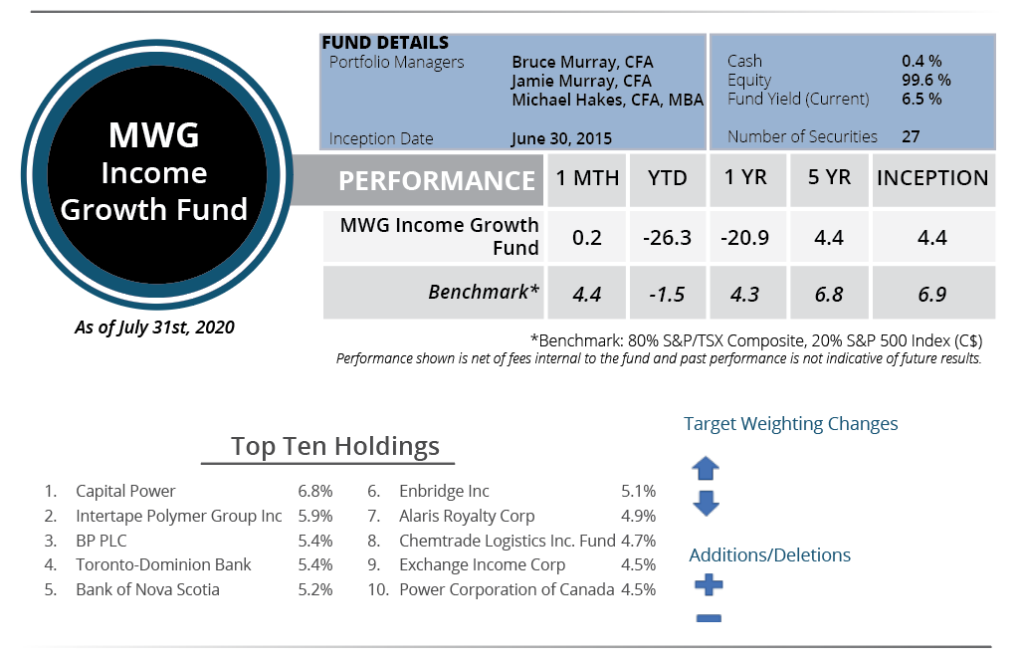

INCOME GROWTH FUND

The MWG Income Growth Fund rose 0.2% in July and is down -26.3% year to date. Over the past twelve months, the portfolio has returned -20.9%. Intertape Polymer (+33%), Evertz (+12%) and PRO Reit (+8%) were the top performing equities during the month. Chorus Aviation (-21%), Corus Entertainment (-16%) and American Hotels (-15%) most hampered performance.

We made no portfolio changes and continue to believe the portfolio will recover with continued increases in economic activity. Specifically, banks should see loan losses decline.