3i Group plc

Written by Head of Research & Portfolio Manager, Jamie Murray, CFA.

3i Group plc is a U.K. private equity company with investments in 39 mid-market companies across the consumer, healthcare, and industrial technology sectors. The company has been shaped from the top by CEO Simon Borrows, who we credit with much of its success over the past decade. When he took on the top role in 2012, the company was struggling with poorly performing investments, bloated management, and high debt. In short order, 3i cut 40% of its headcount, shrank its investment portfolio by 100 companies to 30-40 and worked with its underperforming investments to improve their results. The outcome is evident in 3i’s share price performance with the value rising 10-fold in that time. Unlike traditional private equity firms that raise third party capital and manage on behalf of limited partners/outside investors, 3i invests its own capital (the main exception being 3i’s Infrastructure fund, which is structured as a traditional fund). It targets companies with holding periods of about five years and a goal of doubling its money, equating to a 15% return per annum.

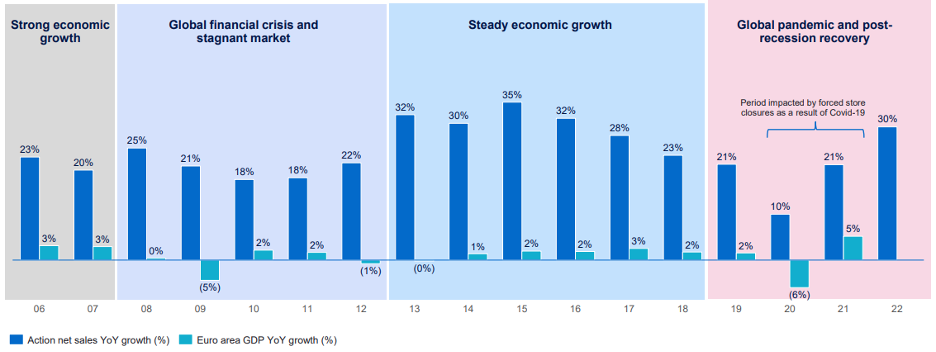

Key to our investment in 3i is its holding in a retailer named Action, which currently represents about 75% of 3i’s market value. Action is a European low-price leader with some of the best retail metrics in the world, namely for extensive store growth (and the opportunity for more), high inventory turnover and strong margins. Sales have grown tenfold over the past decade, weathering tough economic conditions in some years, highlighting the resilience of its business model (Figure 1). 3i owns 55% of Action but has been steadily acquiring further ownership.

Figure 1. Action has achieved strong sales growth driven by new store locations and increased sales per location.

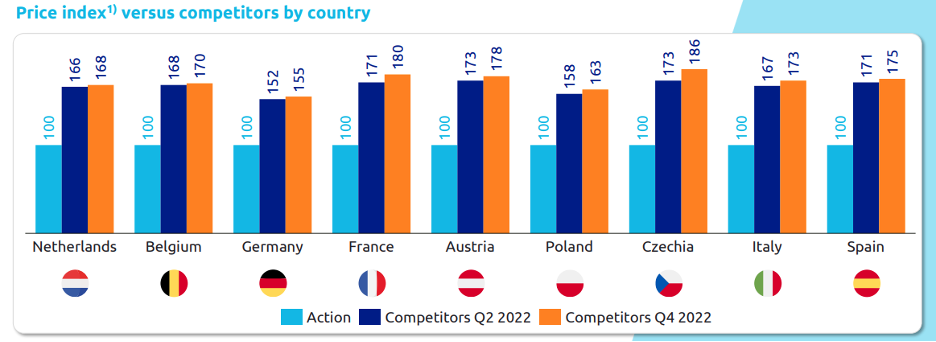

Action is all about price. Most of its products sell at the €1- €2 price point. This drives high inventory turnover (its best stores turnover ) and provides significant buying power to secure discounts from suppliers. It is not uncommon for Action to price certain SKUs (a stock keeping unit is a single product code that identifies the item at the register) at a 30-40% discount versus competing retailers. In fact, Action has been further lowering prices on some items, given lower product costs, widening the gap. Figure 2 highlights this dynamic in the markets in which it operates. This attractive value proposition has led to above industry same store sales growth.

Figure 2: 3i price index versus nearest competitors in major markets

Store growth is an essential pillar to 3i’s investment in Action. It currently operates 2,500 stores, with potential expansion to 6,000 stores at maturity in its current markets. Moreover, it can scale very quickly. In France, for example, it grew from 1 pilot store in 2012 to 726 stores by year-end 2022. Its stores have short investment paybacks, averaging 10 months, which provides for a high return on equity and the quick rollout of further locations. Figure 3 provides a regional breakdown of its 2,263 stores by country at year-end 2022 (note that by December 2023, Action had added 303 stores for a total of 2,566). We highlight Italy, Spain and Slovakia as new markets that could successfully scale quickly.

Figure 3: Action store count by country (December 2022)

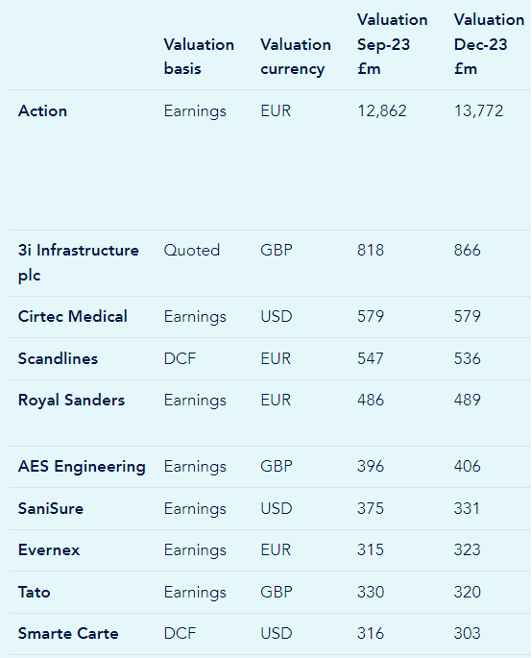

Beyond Action, 3i’s investment portfolio is diverse and focused on infrastructure, value-for-money retail, private label and healthcare technology. Figure 4 provides the breakdown of its top 10 holdings and their carrying value on 3i’s books.

Figure 4: 3i Group’s 2nd to tenth largest investments make up just 22% of company value with Action equating to ~75% of its net asset value.

Management highlights Royal Sanders and European Bakery (not yet in the top 10 by size) as investments that could deliver outsized growth over the next decade. Both companies are consolidating private label operations across Europe. European Bakery is focused on private label baked goods. It was started in 2021 with the purchase of Dutch Bakery and has expanded its base in this market with two further acquisitions. Royal Sanders is a manufacturer of personal care products. It has been in 3i’s hands longer and has tripled sales since 2018 through acquisition, providing it with the scale to offer best of breed service.

Figure 5. European Bakery and Royal Sanders share similar attributes for success in private label operations.

We believe 3i shares will continue to outperform on the strength of its Action investment. The company is carried on its books at just 18.5x EBITDA, which is in line with other high-growth retailers despite Action showing superior growth and returns. Thus, we believe we are buying a diamond at gold prices. 3i has demonstrated an ability to drive value within its portfolio companies. Moreover, it has several promising opportunities that could be long-term compounders like Action but are dwarfed near term in size and their potential effect on the value of its portfolio in the near term.

|

This Focus Stock is written by Head of Research & Portfolio Manager, Jamie Murray, CFA. The purpose of this is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries. |