Thoughts on the Market: January Edition

Written by Head of Research, Jamie Murray, CFA

The Recession That Wasn’t There.

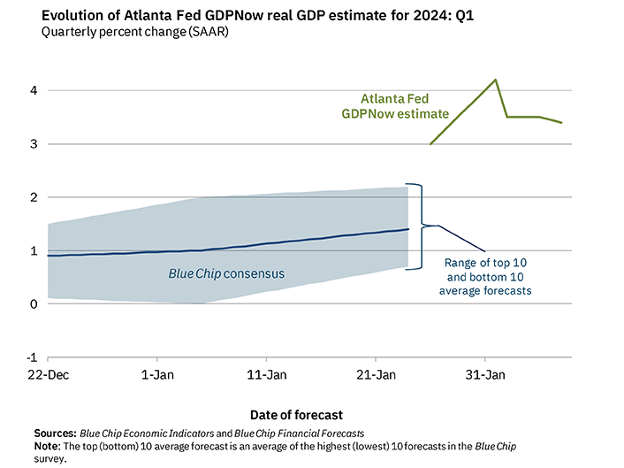

Any slowdown in the U.S. economy from higher interest rates appears to be fading. Gross Domestic Product (GDP) for the fourth quarter of 2023 grew at a 3.3% pace, according to U.S. Commerce Department data released in late January. As well, real time measures of GDP indicate that this trend is continuing in Q1/24, with the Atlanta Fed GDPNow tracker indicating a 3.4% expansion based on January data releases. This pace is well above Wall Street economists’ models, as can be seen in Figure 1. We believe there are several reasons for the strength, starting with a rebounding technology sector, a resilient U.S. housing market and declining inflation.

Figure 1: Atlanta Fed GDPNow estimate for Q1 2024 GDP growth 3.4% (green line)

Source: Atlanta Fed

Technology earnings dominated January market leaderboards, with stocks like Meta Platforms, Microsoft and Broadcom reaching all-time highs. Companies are in an arms race to build artificial intelligence platforms, which require billions of dollars of capital for servers and associated infrastructure. We argued in March 2023 that the incumbent tech leaders are best positioned to win AI markets because they have the captive customer base and product portfolio to leverage AI spending, the financial capacity to fund the required investment and, most importantly, the proprietary data to train AI models.

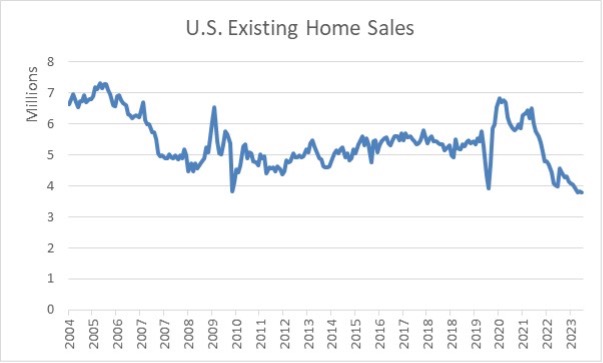

With respect to the housing market, the supply shortage of available homes is proving to be a boon for builders. This shortage is exacerbated by the fact that the millennial cohort is solidly in the family formation years and looking for single-family homes versus condominiums. Existing home sales have gone stagnant, as shown in Figure 2, with sales below the level seen in the 2007 housing collapse. The builders, as creators of new housing supply, can benefit with higher sales and margins. This financial performance is reflected in the U.S. homebuilder ETF (Ticker XHB), which has increased 35% in the past year.

Figure 2: U.S. Existing Home Sales

Source: MWG, National Association of Realtors

Inflation readings continue to decline globally, as supply constrained markets start to catch up from pandemic-driven shortages. Markets have normalized on different timelines, but it appears slack is finding its way back into supply chains. For example, domestic auto inventories doubled in 2023. This corresponded with a meagre 1% increase in New Vehicle Prices in 2023. We would expect additional inventory in 2024 to further cap any price increases and potentially lead to slight deflation in new prices. Airfare is providing another deflationary example. Airline fare prices were down 9.4% in 2023 as airline capacity continued to recover to pre-pandemic levels. For 2024, we would expect lower shipping and commodity costs to flow through to food and personal care products, creating a tailwind for moderation of prices.

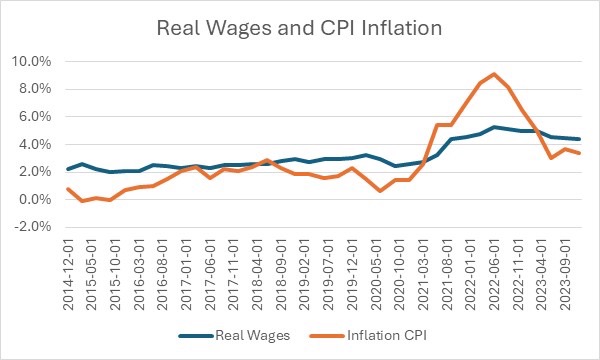

Figure 3 shows Real Wage growth versus CPI Inflation. Wage growth is now outpacing inflation (in December 2023, wage growth was 4.3% versus 3.4% for CPI). This creates higher real disposable income for consumers and increases spending power, coinciding with a strong economy.

Figure 3: When Real Wages (blue line) outpaces Inflation (orange line), real disposable income is increasing.

Source: MWG, Refinitiv

With stocks at all-time highs, some investors may hesitate to put new money to work in the market. Given the tailwinds of lower inflation, increasing transaction activity and anticipated growth in earnings, we believe markets are heading higher. After all, markets at all-time highs are a feature of bull markets.

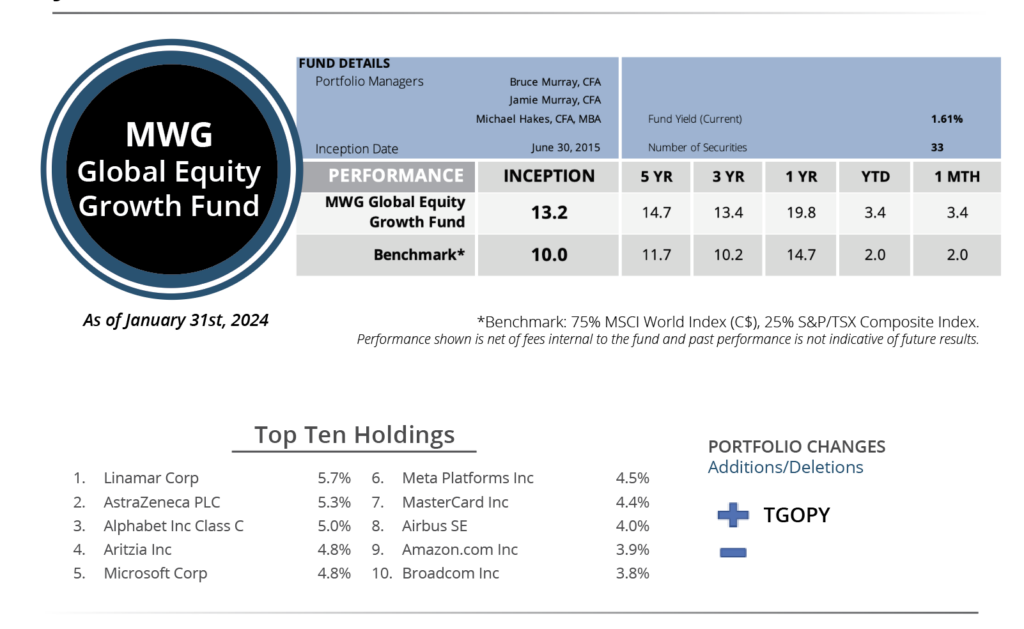

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund increased 3.4% in January versus a 2% return for its benchmark. The Fund’s top three performers in the month were Aritzia (+19%), Eli Lilly (+12%) and Meta Platforms (+12%), while Major Drilling (-10%), Docebo (-8%) and Prudential PLC (-7%) were the biggest detractors.

During this month, we bought shares of 3i Group PLC. 3i Group is a U.K. private equity company with holdings in 39 investments across the consumer, healthcare and industrial technology sectors. Key to our investment and the company’s future shareholder returns is its largest investment, which is in a retailer named Action. Action is a European low-cost leader with some of the best retail metrics in the world, namely extensive store growth (and opportunity for more), high inventory turnover and strong margins. Sales have grown ten-fold over the past decade, and we think Action can at least double its store base from 2,500 to 6,000 stores as it expands across Europe. 3i owns 55% of Action but has been steadily acquiring further ownership from other shareholders. Its investment in Action represents the majority of its share value (likely ~75%).

As a low-cost leader, Action is all about price. It has very high turnover (its best stores turnover once per day) and it uses its large buying power to secure discounts from its suppliers. It is not uncommon for Action to sell certain SKUs (stock keeping unit is a single product code that identifies the item at the register) at a 30-40% discount from prices at competing retailers. In fact, Action has been further lowering prices on some items, given lower product cost, further widening the gap. Its same store sales growth has been consistently positive and above industry growth in any economic environment.

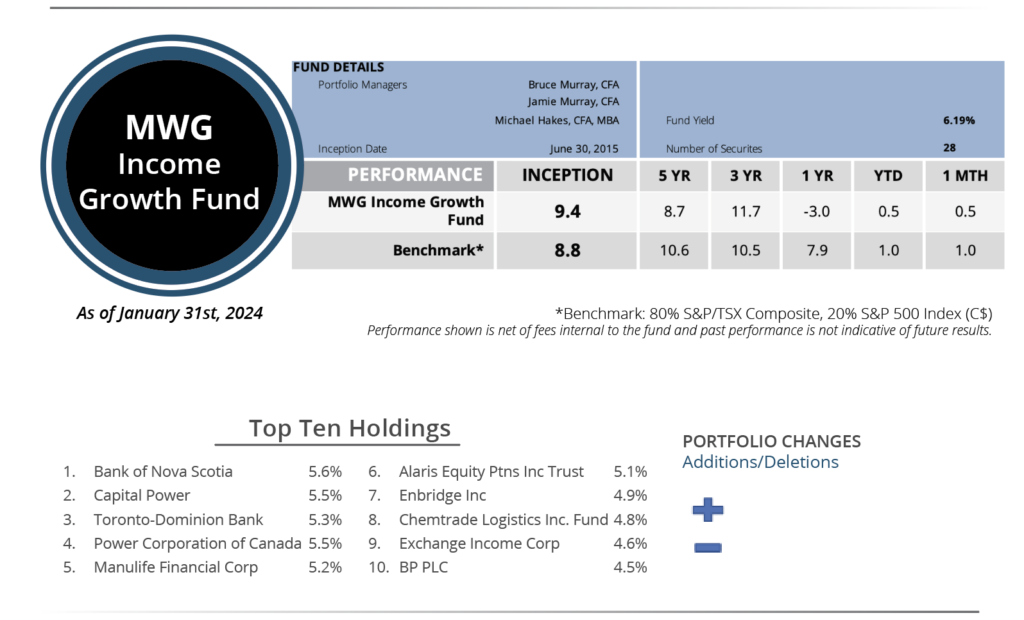

INCOME GROWTH FUND

The MWG Income Growth Fund rose 0.5% in January versus a return of 1.0% for its benchmark. The Fund’s top three performers in the month were PRO Real Estate Investment (+18%), Quarterhill debentures (+7%) and Gibson Energy (+7%), while Aegis Brands (-28%), European Residential REIT (-6%) and Rio Tinto (-6%) were the biggest detractors.

We made no changes to the Fund in January.

This Month’s Portfolio Update is written by our Head of Research, Jamie Murray, CFA.

The purpose is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.