Technology Investing

Written by our CEO & CIO, Bruce Murray, CFA.

Today vs. dot-com & Y2K

Thirty years ago, we were witnessing the adaptation of the internet in the early stages of acceptance as a tool to enhance work and leisure. This led to a plethora of ideas as to what this new technology could do! All it took was an idea and the ability to code and you too could change the way the world worked. By the year 2000, we were at the peak of the dot-com bubble. Like a horse race, Yahoo, based upon “search” software developed in Waterloo by OpenText, surged to the lead, only to be overtaken by a better idea, Google. For a while, @AOL.com was the hottest email host to have, but it then crashed and burned as internet service providers offered complementary addresses as part of their service. Everything was moving online, and providers were going public. By the spring of 2000, it became clear that many of these ideas were not commercial and even the good ones were overvalued. Shareholder enthusiasm quickly plunged into despair.

Accompanying this frenzy, market guru Ed Yardeni warned that most software only had 2 digits for the year and thus we would go back to 1900 when the millennium occurred (which was not correct) and all electronics would crash. This sparked a massive need by large pension stockholders to have every company become “Y2K Compliant,” leading to a surge of orders to replace computer and telephone systems.

Technology now enjoyed a double bubble! Hardware companies such as Nortel and Lucent surged, as the decades-old telephone systems had to be replaced with fiber optics and new software in a 2-3 year period and everyone was getting a personal computer. Again, by spring of 2000 it was all over, as equipment orders dried up, and with them, many of the suppliers. Canada’s Nortel was a barely breathing corporate corpse within 18 months.

I was fortunate to lead an investment team that reduced our portfolio exposure to technology quite substantially in 1999 & 2000, which led to substantial outperformance.

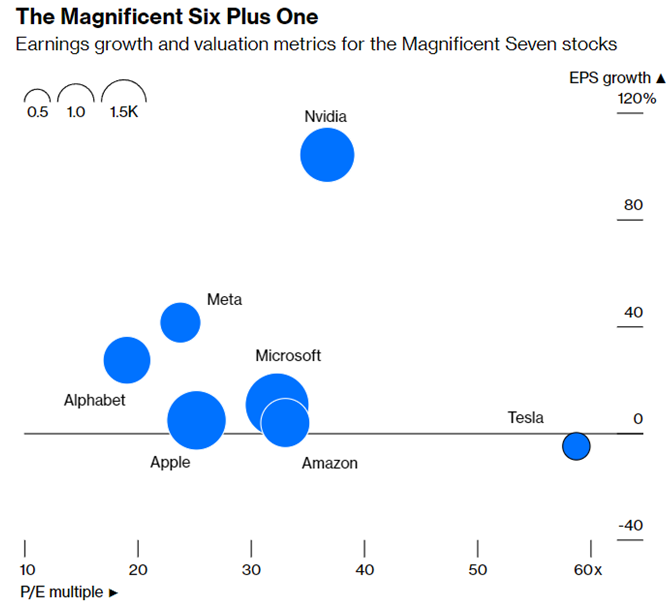

When we look at the leading technology companies today, we see nothing like this. Google (Alphabet) and Meta are embedded in our lives for communicating, entertaining, educating, organizing our lives and much more. They are the most successful tools for advertisers to reach us. This will continue, as the likes of YouTube (Alphabet) & Netflix continue to eat away at television broadcasters’ share of the market. AWS (Amazon), Azure (Microsoft) and Google are the leading Cloud providers, in that order. We are also in the infancy of Artificial Intelligence (AI), the leadership of which will likely involve many of these companies. Thus, we see no revenue cliff that would cause a major collapse of these companies and are excited about their business outlook.

Alphabet and Meta, which we own, are both selling just above 20X 2024E EPS. Both companies are expected to grow their earnings per share 15% plus in each of the next 3 years, which will consistently reduce their multiples over that time period.

Figure 1. Magnificent Six Plus One

A Look at Microsoft in Both Times

The only member of the current “Magnificent 6” to be a significant market darling of the last bubble is Microsoft.

Figure 2. Microsoft Forward P/E

Microsoft’s P/E (Blue) collapsed from a peak of 60X to below 10X by 2008 despite continued growth in earnings on concerns that desktop software would become a commodity. Microsoft continued to struggle through mid-last decade as Apple and Google gained share and many large investors sold their shares. The company was reinvigorated, though, as they moved their customers to an online SAAS (Software as a Service) model with monthly payments and became a leading provider of “Cloud” computing and now AI software. So today, with MSFT trading over 30X EPS and EPS growing at 15-20% per annum, we remain comfortable owning this stock as we believe they have a much stronger business model and a leadership position in monetizing artificial intelligence within the office sector of the business world. History shows, though, that while there may be a runway of years, an investment manager must be cognizant of the duration of these trends and their ultimate impact on valuation.

In summary, the maturing of the internet led to an incredibly profitable business model, never before seen, where the customer does all the input and the financial system transfers payment directly to the internet facilitator. Google and Facebook are cash machines. The emerging boom in AI will provide incredible changes across all aspects of life. We believe we are early in this trend and there is still a lot of money to be made for the discerning investor.

|

This Focus Stock is written by our CEO & CIO, Bruce Murray, CFA. The purpose of this is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries. |