The return of Nuclear Power and Cameco

Global electricity demand is expected to grow by 50% over the next 30 years. This demand, when combined with growing societal pressure to remove carbon from the atmosphere, will be a challenge for the world.

Nuclear Power has been controversial for most of its history due to the seriousness of reactor accidents. Three Mile Island, Chernobyl and Fukushima spring to mind. However, with much of the politics of the Western World focused on the reduction of carbon and the move to green energy, nuclear is regaining consideration. The other green energy solutions, wind and solar, simply cannot reliably deliver the power that will be required, especially as we move a large part of our transportation to electricity. Here in Canada, coal has largely been abandoned and hydro opportunities largely developed, leaving nuclear as a more attractive source of power.

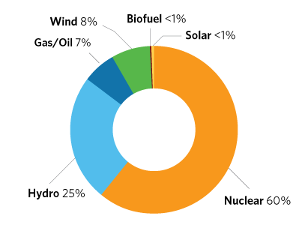

Figure 1 shows the mix of power generated in Ontario in 2020. We can see that the newer “green” technologies generate about 10% of the province’s energy. With wind only capable of producing power about 30% of the time, and not necessarily coincident with peak demand and other power generation capacity, its potential to fill the gap is limited.

Figure 1:

Another issue affecting green technologies lies in the fact that solar and wind power installations generate small amounts of power per site and collecting and conditioning their power to grid specifications is expensive.

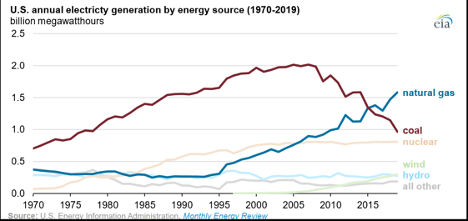

The U.S. and Western Europe either have or are well along the way to abandoning coal. As illustrated in Figure 2 below, the U.S. has been substituting natural gas for coal-fired power. In so doing, it has reduced its carbon emissions by about 20% from the 2005 baseline. However, while much cleaner than coal, natural gas still generates about half the CO2 of coal. President Biden recently announced that U.S. electricity generation will be carbon-free, which implies that gas is only a temporary energy source. So far, only Nuclear can offer the production scale to fill this gap.

Figure 2:

Cameco

Cameco is a leading producer of uranium, owning the world’s richest mines in Saskatchewan’s Athabasca Basin. In addition, the company has processing facilities in Ontario to prepare it for use in nuclear power plants. Cameco shuttered its McArthur River mine in 2017 for market purposes and its Cigar Lake Mine, due to Covid, in 2020. Each of these mines can produce about 10% of current world demand. The certainty of these mines along with Cameco’s control of 24% of the global capacity to upgrade to uranium hexafluoride, the first step in producing nuclear fuel, has historically allowed Cameco to sell uranium under long-term contracts at substantial premiums.

The decision to shut its McArthur River mine was based on its ability, at the time, to purchase uranium in the spot market and save its own reserves to meet future demand at hopefully much higher prices. Cameco has recently reopened its Cigar Lake mine, which is so rich (16% average grade) that it can only be mined robotically.

Following the Fukushima accident, the price of uranium plummeted as the Japanese shut down their fleet of 33 nuclear reactors. The Japanese had sufficient uranium supplies to run their reactors for several years, and the miners had brought on the capacity to supply a growing industry. As indicated in Figure 3, This led to a collapse in the price of uranium, with Japanese selling upsetting the traditional markets.

Figure 3:

Japan has now restarted nine of its 33 reactors and has another 17 in the process of restarting. Fifty-four new reactors are under construction worldwide. Sixteen are being built in China, 7 in India, 4 in South Korea, 4 in the UAE, 2 in the USA and 2 in Russia. In addition, Russia is supporting new projects in various stages of preconstruction in 16 other countries.

With the price of uranium now below the cost of production, we believe excess inventory is behind us and that we should see a rise into the $45-$60 range. If Cameco investors are fortunate, we may get a buying panic akin to what was experienced in 2005-2007, when operators of nuclear plants panicked to ensure supply.

The company has a strong financial position and recently ended its long-standing tax dispute with the CRA with a complete legal victory, freeing substantial cash assets the CRA had required as security for its tax avoidance case.

We believe that the price of uranium has the potential to double over the next two to three years as it recovers from a decade of oversupply following the Fukushima disaster and that Cameco’s stock price will benefit from that recovery. We believe the price of uranium will rise as nuclear power is accepted as a major requirement of carbon-free electricity. Fuel cost is a small part of the overall cost of nuclear generation and, therefore, has little price elasticity to demand. We think the price of uranium could double before a supply response is stimulated and that Cameco stock will move into the mid $30s as the price of uranium recovers over the next three years.

This Focus Stock is written by our CEO and CIO, Bruce Murray.

The purpose of this is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.