Thoughts on the Market: April Edition

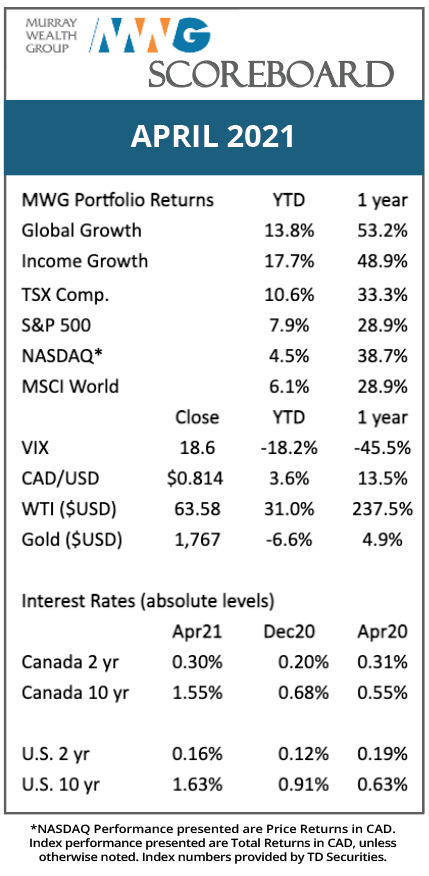

As we enter May, markets are in the midst of a stellar first quarter earnings season. The strength was likely anticipated given the 5% rally markets enjoyed in the first half of the month but confirmed our view that better than anticipated earnings would make the market appear less expensive than indicated by its 23x P/E multiple. Revenue and earnings per share are beating estimates by an average of 72% and 83%, respectively (hat tip to Morgan Stanley). The earnings beats are by a wider margin than usual, although this is a typical early cycle trend. For the third quarter in a row, mega-cap technology companies reported outstanding results. On average, the group beat revenue estimates by 8% and EPS estimates by 35%, demonstrating the operating leverage of internet-enabled businesses.

Berkshire Hathaway held its much-watched annual general meeting where Warren Buffet lamented on the casino-like nature of the market with a reinvigorated retail investor with faster and easier trading access. We would tend to agree with the Oracle on this one. However, we are encouraged by the fact that the 23% fall in the IPOX SPAC Index (an index that tracks special purpose acquisition company share prices) and the associated decline in more speculative companies did not have much impact on the broad market.

With vaccination rates continuing to improve globally, we believe we will see U.S. business activity normalize this summer. Europe is likely 3-4 months behind the U.S. and thus its economic activity should normalize by the end of 2021. Experiential spending is expected to boom, with 18 months of pent-up demand for travel, events, and crowd-based activities, and stay-at-home beneficiaries continue to indicate persistent demand. It feels like the next battleground will be for the consumer’s wallet as it is improbable that both a boom in leisure spending and additional at-home spending (on top of already elevated levels) can be accommodated.

A quick note on the Canadian dollar (CAD), which has rallied about 4% year-to-date to the detriment of the returns of our CAD denominated funds (and our fund benchmarks). Since the funds’ inception in June 2015, the CAD has appreciated by $0.015 versus the U.S. dollar, negatively affecting annual returns by ~0.2% per annum. As long-term investors, we look to own the best opportunities we find regardless of currency.

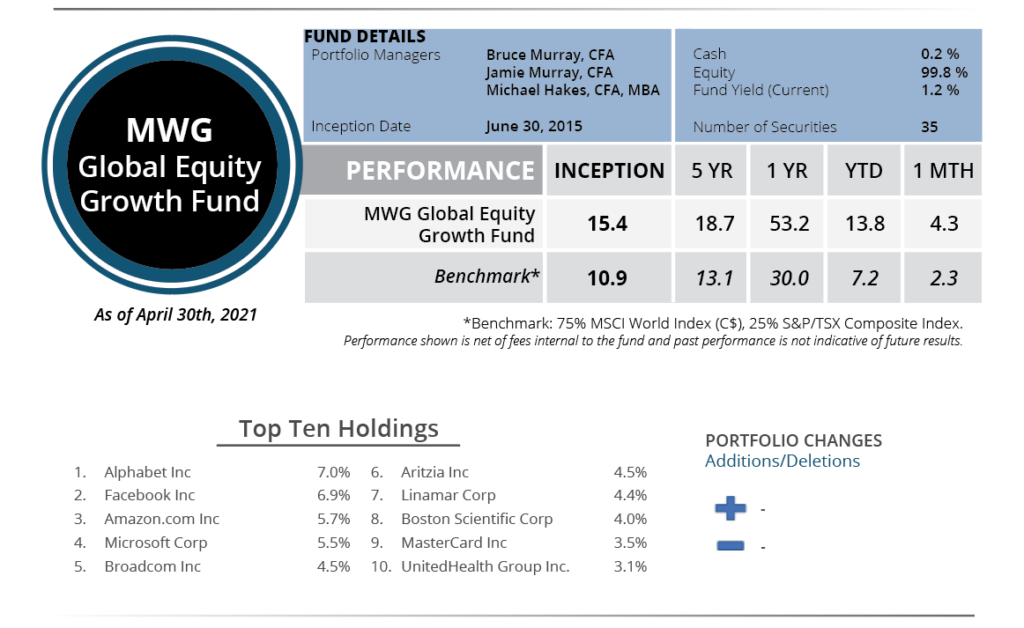

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund returned 4.3% in April, bringing its year-to-date return to 13.8%. The top performers in the Fund were Intuitive Surgical (+15%), Alphabet (+14%), and Boston Scientific (+10%), while BMW (-6%), Air Canada (-5%) and Broadcom (-4%) were the weakest in the portfolio.

We made no changes to the portfolio during the month.

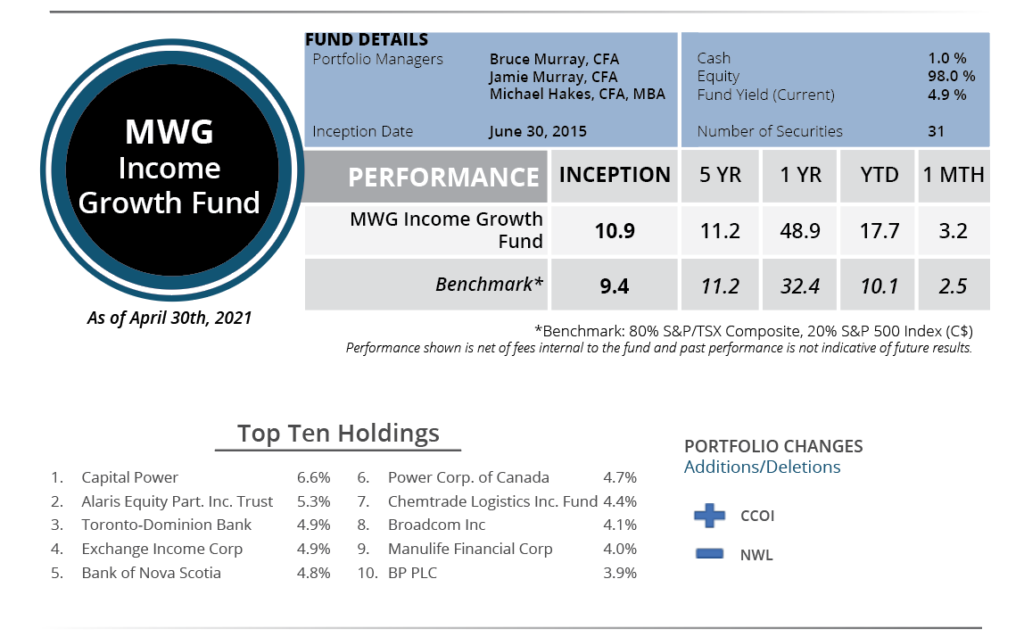

INCOME GROWTH FUND

The MWG Income Growth Fund returned 3.2% in April and has now returned 17.7% in 2021. The top performers in the April were IGM Financial (+15%), Russel Metals (+13%), and Chemtrade Logistics (+11%), while Chorus Aviation (-5%), Canadian Natural Resources (-4%) and Exchange Income (-4%) were underperformers.

We initiated a new position in Cogent Communications during the month. Cogent owns a global fiber cable network that is a necessary and core component of internet functionality with two paths of monetization. The first is providing network access to content distributors like Netflix or Hulu that deliver content over Cogent’s cables. The second is providing internet access to corporate tenants of ~2,000 office buildings around the world that are connected to Cogent’s network, providing a lower cost option versus incumbent telecom providers. As you can imagine, Cogent’s network has experienced improved utilization with the secular growth of digital media, a tailwind we think will continue through the decade. It also has exposure to the reopening of economies as workers return to the office and internet subscribers rebound. Cogent has a history of growing its dividend every quarter. It may need to utilize leverage in the near term to accomplish this, but if the business rebounds back to historical growth trends, free cash flow growth should match up with dividend growth in the long term.

We sold our remaining position in Newell Brands as the yield on the shares fell close to our threshold as the company recovered following the new management team’s turnaround efforts.