Thoughts on the Market: December Edition

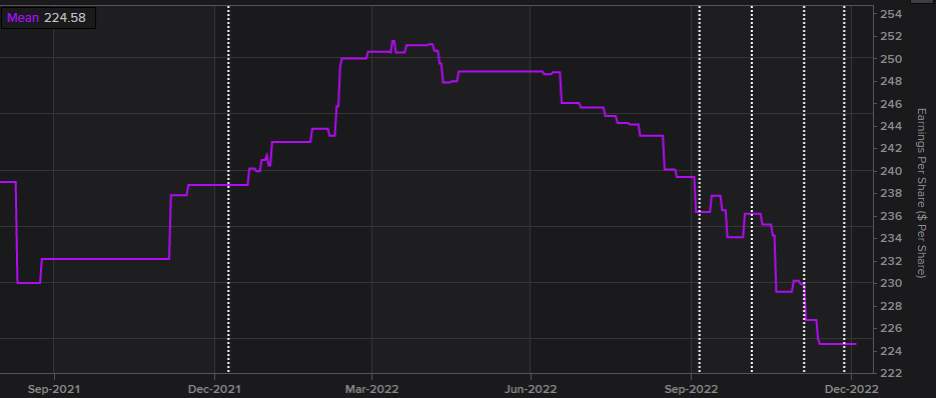

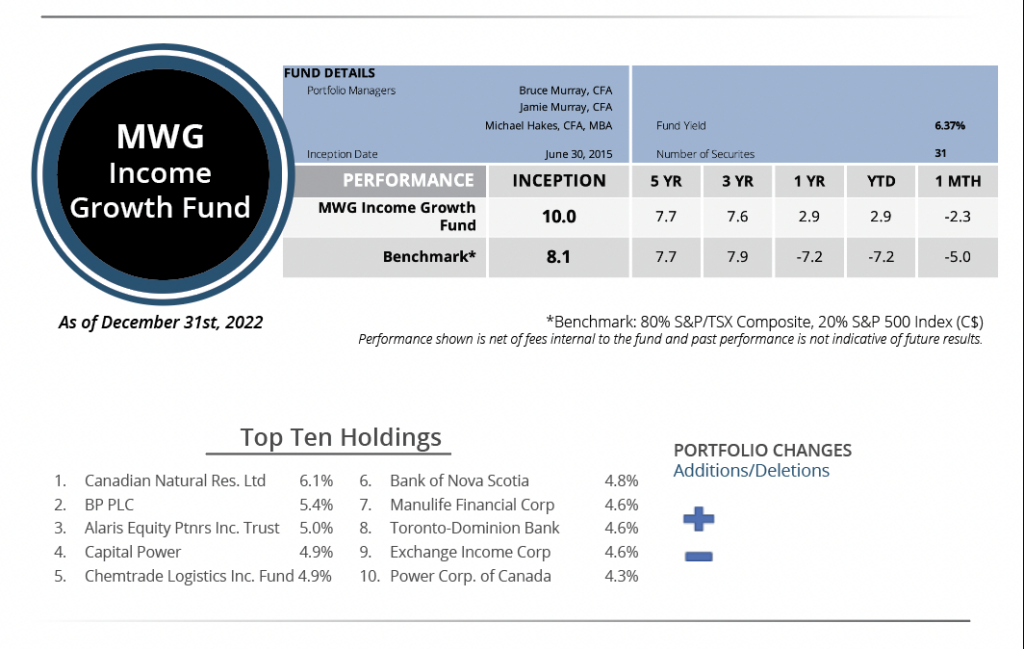

We close the door on yet another year and thank our clients for your continued trust in The Murray Wealth Group. The Global Equity Growth Fund had disappointing performance in 2022, declining 15.8% as rising interest rates squeezed the P/E multiples of quality growth stocks. However, our Income Growth Fund recorded positive performance of 2.9% and outperformed its benchmark by 1,010 basis points. Please see our portfolio review section below for full details.

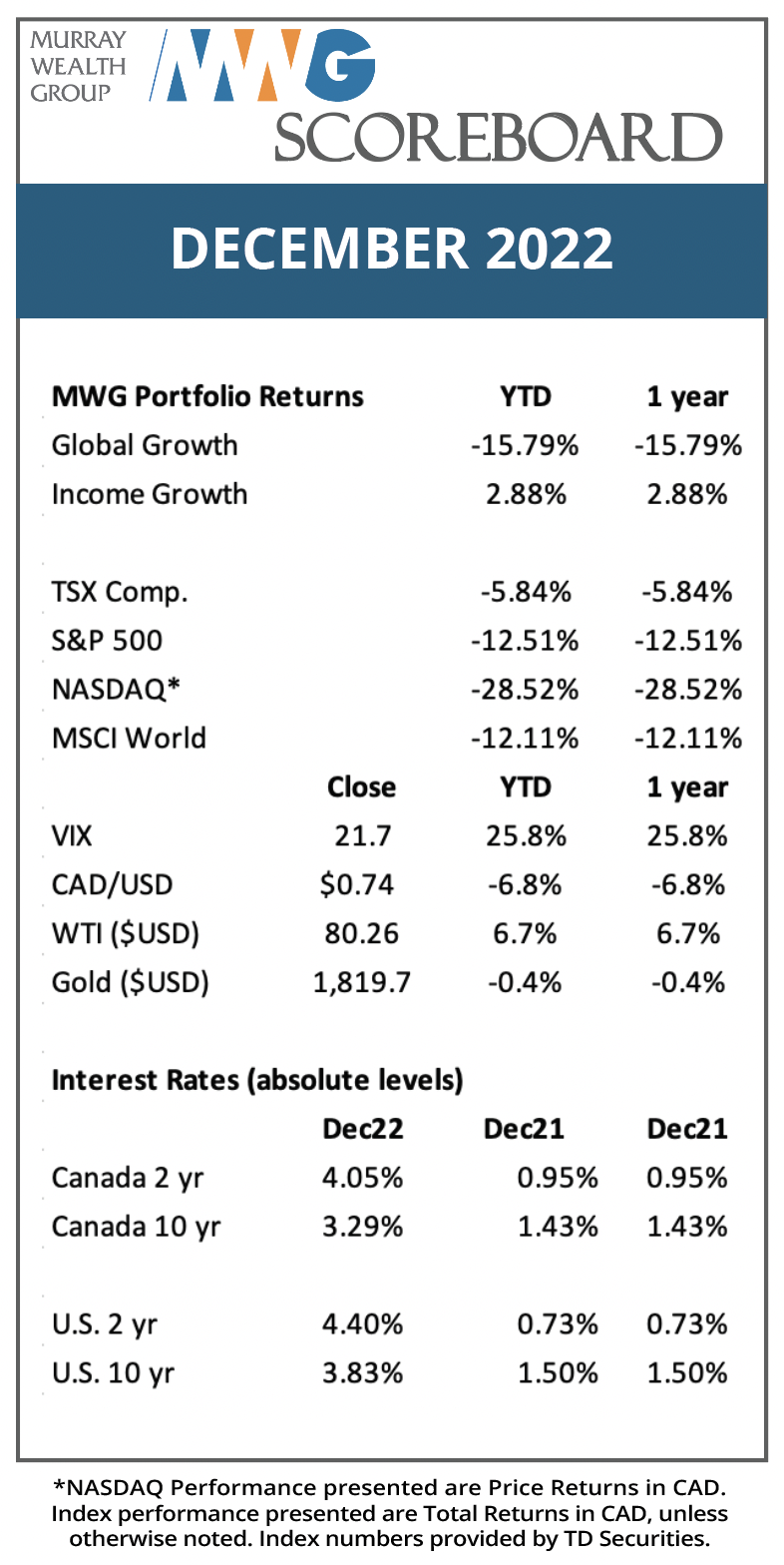

2022 was the worst year for U.S. equity markets since 2008. Figure 1 shows the annual return of the S&P 500 every year since 1928. While approximately 1 out of every 3 years has experienced a negative return, 2022 still ranks as the 7th worst year on the chart.

Figure 1. Annual return of the S&P 500 1928-2022.

Source: Macrotrends.net

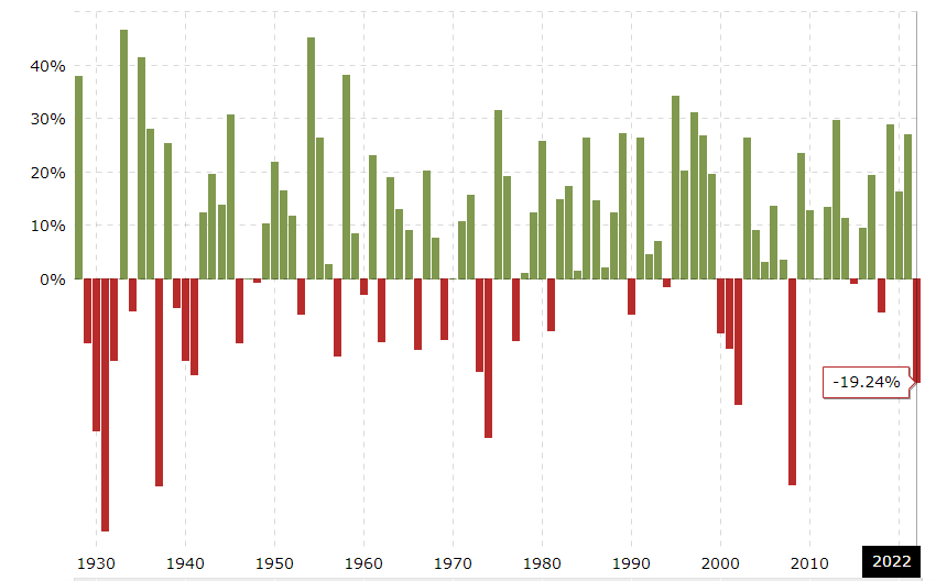

Estimates for 2023 index earnings have fallen from the 250 level to 225 (or 12%, detailed in Figure 2) from mid-year and participants are primed for a further 10% fall, with more bearish strategists like Morgan Stanley, which include a recession in their estimates, forecasting index earnings approaching the 200 level. While a slowing economy and falling estimates are a headwind for equities, this will be offset by declining inflation, a lower US Dollar and lower energy costs, all of which should provide some additional liquidity to markets.

At the current level of ~3,800, the S&P 500 is trading at a 17x market P/E assuming earnings of 225 (or a 19x multiple assuming recessionary scenario earnings of 200). However, most forecasts have earnings rebounding to 245 in 2024 (15.5x) and continuing to grow from that level into the next business cycle. We believe that by mid-year 2023, the focus will shift towards 2024 earnings and an accelerating economy, and with it, a higher stock market.

Figure 2: 2023 EPS estimate for the S&P 500 Index

Source: Refinitiv Workspace

We look forward to an exciting 2023! While there may be additional choppiness in the first half of the year as the markets work through higher interest rates. The market almost always looks ahead by 6 to 9 months. Thus, with inflation rates falling and supply issues dissipating as the economy continues to reopen, we can look forward to a market recovery later this year.

We evaluate our investments using a 3 to 5-year time horizon and, hence, our focus tends to lie beyond the near term. We believe our funds contain strong companies that will be able to navigate an economic slowdown thanks to their focus on free cash flow and strong balance sheets and their strong competitive positions. Typically, economic difficulties allow the strong to grow stronger as these companies can continue to invest in their asset bases, employees and strategic initiatives that lead to market share gains and stronger margins once the economy rebounds.

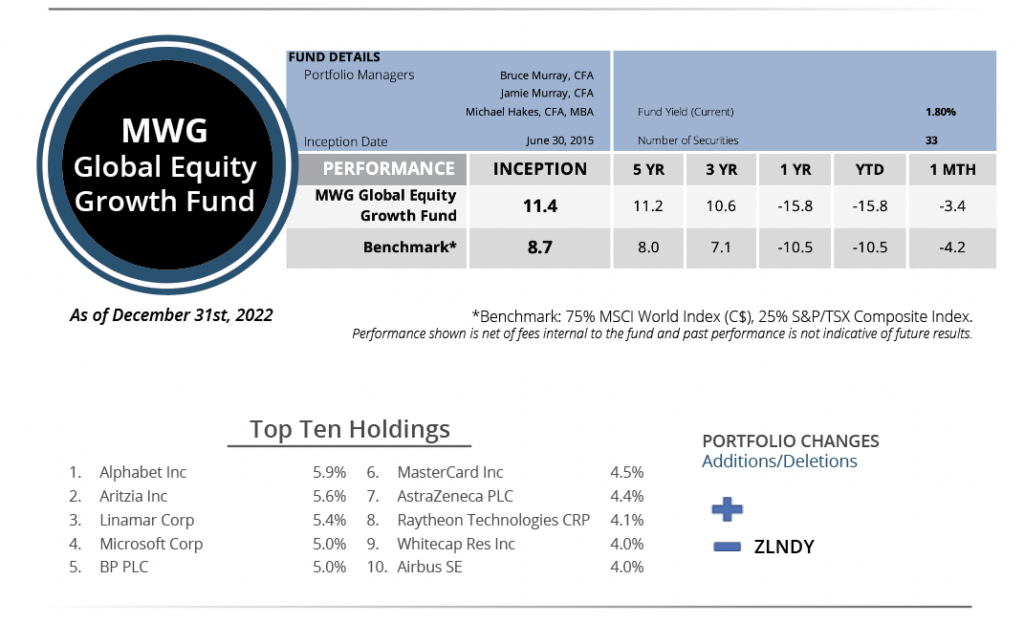

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund fell 3.4% in December versus a decline of 4.2% for its benchmark. For the year, the Fund was down 15.8% versus the benchmark return of -10.5%. The Fund’s return remains ahead of its benchmark since inception and on a 2, 3 and 5-year basis (please reference the table above). The top three performers during the month were Major Drilling (+14%), Nike (+7%) and Airbus (+5%), while Uber (-15%), Qualcomm (-13%) and Amazon (-13%) were the biggest detractors.

During the month, we sold our position in Zalando. The company will continue to grow its share of European apparel by expanding its ecommerce presence, but after rallying 70% from its lows, we exited given the threat of a recession looming. As well, despite falling European energy prices, we remain concerned about the impact limited supply may have on 2023 results.

INCOME GROWTH FUND

The MWG Income Growth Fund fell 2.3% in December versus a decline of 5.0% for its benchmark. For the year, the Fund returned 2.9% versus the benchmark return of -7.2%. The Fund remains ahead of its benchmark since inception and on a 2, 4 and 5-year basis (please reference the table above). The top three performers during the month were Exchange Income (+9%), Evertz (+6%) and Rio Tinto (+3.7%), while Blackstone (-19%), European Residential (-7%) and Pembina Pipeline (-6%) were the biggest detractors.

We made no changes to the Fund in December.

This Month’s Portfolio Update is written by our Head of Research, Jamie Murray, CFA.

The purpose is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.