Powell delivered the rate cut the market wanted on July 30. The first decrease in interest rates since 2012. The question was (is) whether this would be a ‘one and done’ scenario or if additional cuts should be expected before 2020. Fed Chairman Powell was non-committal indicating the rate cut was “a mid-cycle adjustment to policy,” and not “the beginning of a lengthy cutting cycle.” While the market negatively reacted to Powell’s commentary, ultimately the rate cut helped the market rally through June and July.

Powell delivered the rate cut the market wanted on July 30. The first decrease in interest rates since 2012. The question was (is) whether this would be a ‘one and done’ scenario or if additional cuts should be expected before 2020. Fed Chairman Powell was non-committal indicating the rate cut was “a mid-cycle adjustment to policy,” and not “the beginning of a lengthy cutting cycle.” While the market negatively reacted to Powell’s commentary, ultimately the rate cut helped the market rally through June and July.

Attention quickly turned from Fed-watching to trade wars when President Trump tweeted a new round of tariffs on US$300B of Chinese goods. Trump and Powell have publicly clashed on the pace of rate cuts and it’s speculated that Trump is using trade and tariffs to stall the economy and build the case for additional rate cuts. Trump would then be in position to make a trade deal with China in 2020 and spark the economy into the next election.

Overall, the U.S. earnings season should be viewed positively with a focus on technology bellwethers beating on revenue and reducing capex (hello, MSFT, GOOG, IBM, FB, AAPL) all while the outlook for cloud-based computing remains strong. We highlight a news release from LinkedIn, indicating its intention to move from its in-house servers to the Azure public cloud Infrastructure (not shocking as LinkedIn and Azure are both Microsoft companies). The real nugget is that the migration will be multi-year initiative, again indicating the long runway for cloud growth. LinkedIn is a relatively simple company with website and user data as well as its apps for various platforms. That it will take three-plus years to fully migrate highlights the complexity as well as the opportunity. Consider AT&T’s cloud deal announced with Microsoft – the largest ever (upwards of US$2B of revenue although timeframe and other relevant was not provided). AT&T (recently integrated US$85B Time Warner merger) would have dozens of legacy data systems to migrate over time as well as new use cases such as its apps for its soon to launch streaming platform. Best of all, cloud computing has so far eschewed any scrutiny from U.S. antitrust watchdogs even though four companies (MSFT, AMZN, GOOG, IBM) are poised to control much of the server infrastructure housing U.S. corporate, government and citizen data (our crystal ball thinks this will be an issue at some point).

TSX-listed companies will report en masse in the first two weeks of August providing additional information into the domestic economy. The TSX continues to suffer from a lack of institutional dollar flow as capital flees Canada. In July, the market increased a meagre 0.1%. The market remains concerned about elevated housing risks and negative energy sentiment. We are not immune to these effects with holdings in commodity producers Stelco, Cameco and Enbridge (pipelines) as well as an 80% weighting to Canada in our Income Fund. However, the banking sector remains healthy and there are a number of global champions headquartered in Canada that present opportunities.

Global Equity Growth Fund

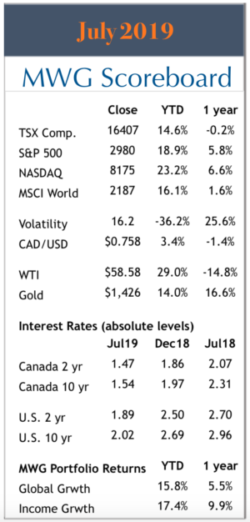

The Global Growth Portfolio returned 0.9% in July and has now returned 15.8% year-to-date. We added two new names in the month, Pivotal Software and Intuitive Surgical.

Sticking with our cloud computing complexity theme, Pivotal is a leader in helping companies navigate clouding infrastructure, providing middle-ware, allowing companies to manage their workloads on multiple cloud vendors or in a hybrid model utilizing in-house servers. Large companies prefer not to be tied to a single cloud vendor for competitive dependency reasons but at the same time, do not want to dedicate resources to navigating the cloud/middleware landscape, preferring to focus IT development on end products or user apps. A brief snippet of Pivotal customers includes Ford, Boeing, Home Depot, NBCUniversal, Comcast, TMobile, and Kroger. We bought PVTL shares after a major pullback due to concerns over the pace of new client additions last quarter as well as some disruptive open-sourced middleware that is lengthening the sales process. However, for a software company (a sector with sky-high valuations), trading at 3x revenue in a sweet spot of strategic long term opportunity, we believed the risk was worth the potential upside.

Intuitive Surgical (ISRG) is a leader in robotic-assisted surgeries. We subscribe to the belief that, over time, tasks that can be performed robotically will be. Intuitive has a strong 20+ history of growth, and the robotic surgery market remains in early stages. Robotic surgeries provide better experiences for patients and surgeons, better success and shorter recoveries. Penetration is still mid-single digits globally. ISRG uses a razor-razorblade model with 70% of revenue recurring from the sale of instruments and services. The shares have underperformed this year on competitive concerns with Medtronic entering the space in a meaningful way this fall but we believe these concerns are overblown.

To fund the purchases, we reduced our positions in MSFT and AAPL into strength with the addition of another technology name. We also sold our position in Teleflex, preferring ISRG’s growth profile with similar valuation multiples.

Income Growth Fund

The Income Growth Fund returned 0.3% in the month and 17.4% year-to-date. The current yield is 6.1%. We made no significant portfolio changes during the month.