Thoughts on the Market: June Edition

Written by Head of Research, Jamie Murray, CFA

Equity markets capped off a strong first half with June performance for the S&P 500 and TSX indices 6.6% and 3.3% higher on a total return basis. The rally was broad-based with 8 of 10 sectors up in the month. Of course, technology was the standout during the first half of 2023 with a 30% rally in the NASDAQ. We touched on the rally in tech in our May 2023 monthly and how we believe AI will provide the next investment cycle for the tech majors.

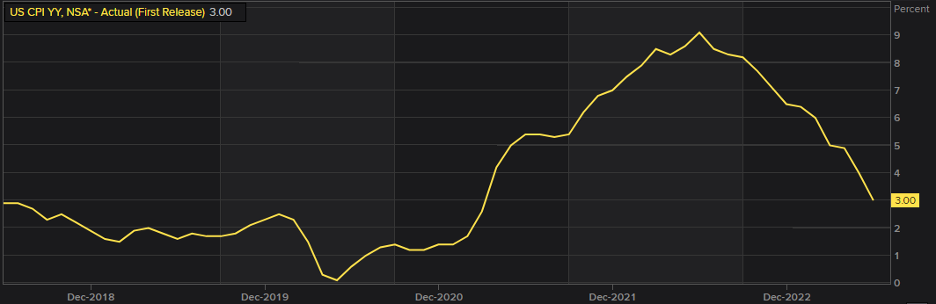

We believe second half performance rests largely on the path forward for inflation. The outlook has improved dramatically from 18 months ago, when the Fed started its hiking cycle, despite its continued hawkish stance (read: higher rates needed) as inflation remains too high for its comfort. The just released June U.S. Inflation Update showed the CPI at 3.0%, the lowest reading since March 2021. Core inflation (which excludes food and energy) was 4.8%, down from 6.8% nine months prior, and the near-term trend is resoundingly lower given moderating housing inflation in the U.S (economist David Rosenberg argues U.S inflation may fall to 1.5% in 2025 on falling rents). Other financial indicators confirm that the inflation fire is subdued. Inflation expectations priced into bond yields remain low at just 2.2% over 5 years. As well, alternative data provider Truflation shows the year-over-year increase of the basket of goods it tracks as just 2.51%.

Figure 1. US CPI Inflation rate has decelerated sharply over the first half of 2023

Source: Refinitiv

Our view at The Murray Wealth Group has been that the inflation shock of 2021/22 was temporary in nature and caused by an increase in government stimulus, supply/demand dislocations and bottlenecks from COVID-driven behavioural trends and the War in Ukraine. These shocks have mostly reversed and should not play a large role in the inflation outlook.

Let’s be clear… forecasting is just educated predicting. Nobody truly knows the path of inflation, or how interest rates will adjust, or how the Fed and other central banks will react to future inflation readings. Central bank policy may prove to be too tight and create recessionary forces that cause inflation to undershoot. A lot of debt remains in the financial system, and current rates may need to come down by 2024. This is likely the market consensus, as suggested by the inverted yield curve. Typically, short-term interest rates are lower than long-term rates. The inverted yield curve suggests lenders need additional compensation to lend on a short-term basis. When we do the math, we find the market is assuming a re-investment rate of 3.95% in 2025 for a 3-year term, about a full point lower than current rates.

At this point, the inverted yield curve aligns with expectations for disinflation in the medium term (disinflation is a slowing rate of inflation but still implies prices are higher year over year). Take the 3-month interest rate. If an investor can purchase a 3-month T-bill with an implied interest rate of 5.35%, with inflation averaging 4.0%, the real 3-month interest rate (nominal interest less inflation) is about 1.35% (5.35% interest rate – 4.0% inflation). A similar relationship exists for 5-year interest rates. The current five-year bond yield of 4.38% provides a real interest rate return of 2.18%, based on the implied 5-year inflation level of 2.2% (inflation breakevens are defined here).

It is possible inflation re-accelerates in 2024, when the current bout of disinflation is lapped, given some long-term political and environmental initiatives. Programs such as government-subsidized power projects (wind and solar), carbon taxes, or the nearshoring trend of manufacturing may equate to higher input costs over the long term.

However, we believe inflation will continue to trend down in the second half of 2023, easing the pressure on the Fed. This should continue to support equity valuations, which remain near historical averages. Corporate profits, the most important driver of equity markets, should achieve higher profit margins as they benefit from pricing increases over the past year and falling input costs such as shipping and material costs. We remain watchful of demand indicators that could lead to slowdowns in consumption and employment.

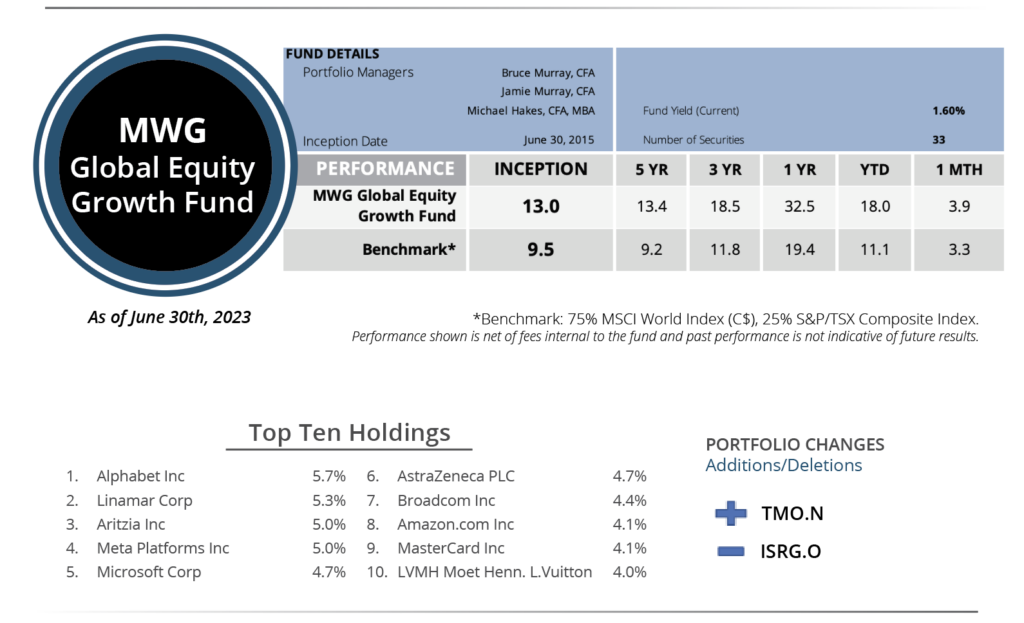

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund rose 3.9% in June, beating the 3.3% return for its benchmark. Year-to-date, the Fund has returned 18% versus the benchmark return of 11%. The Fund’s top three performers in the month were Air Canada (+17%), Linamar (+16%) and Docebo (+13%), while Converge (-15%), AstraZeneca (-4%) and Alphabet (-4%) were the biggest detractors.

During the month, we purchased Thermo Fisher Scientific, a leading partner and one-stop shop to life sciences and pharmaceutical companies for a buffet of products and services. Thermo saw a large spike in revenue in the aftermath of Covid, from the sale of diagnostic tests and the provision of supplies to vaccine developers. As Covid cases declined globally, Thermo suffered a corresponding decline in its revenue. As well, some inventory oversupply built up in its end markets, leading to weakness in its quarterly results. As a result, the stock is trading at the low end of its historical valuation range (20-30x P/E multiple). Moving forward, the company should be able to grow revenue close to 10% per annum augmented by acquisitions.

To fund the purchase of Thermo Fisher, we sold our position in Intuitive Surgical. Given its strong share price performance and high valuation multiple, our return to target price led us to exit the stock.

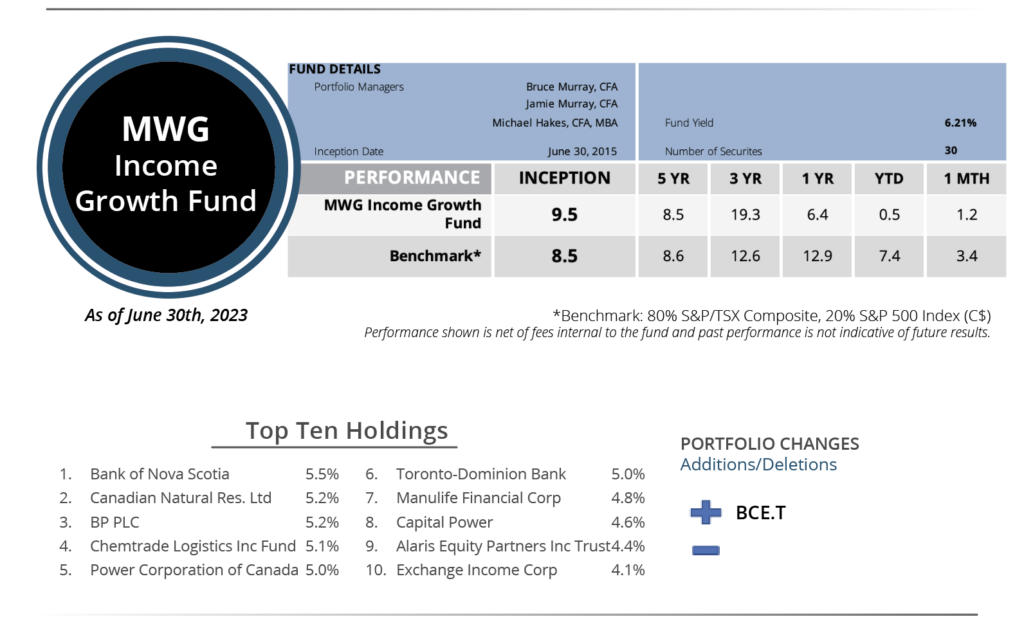

INCOME GROWTH FUND

The MWG Income Growth Fund rose 1.2% in May versus the 3.4% increase for its benchmark. The Fund is flat year to date versus the benchmark increase of 7.4%. Evertz Technologies (+12%), TD Bank (+7%) and Cogent (+6%) led the portfolio, while Northwest Healthcare (-15%), Capital Power (-6%) and Pfizer (-11%) were the top detractors. The fund yield was 6.2%.

During the month, we added shares of BCE, one of Canada’s largest telecom companies, at a 1% weight. BCE shares have pulled back from their April 2022 high and represent an attractive yield at 6.4%. The company is coming to the completion of its fiber network buildout (70% coverage) and should generate strong free cash flow, which will strengthen its dividend coverage as capex falls 7% in 2024. As well, its bundle offering should be more competitive as the telecom market consolidates in Canada in the wake of the Rogers/Shaw merger. Free cash flow should grow 20% per year through 2025.

This Month’s Portfolio Update is written by our Head of Research, Jamie Murray, CFA.

The purpose is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.