Airbus

Written by Senior Portfolio Manager, Michael Hakes, CFA, MBA.

Airbus, now taking orders for 2030!!

Airbus has been in the Global Growth portfolio for well over 5 years now, and we hold it at a 4% weight.

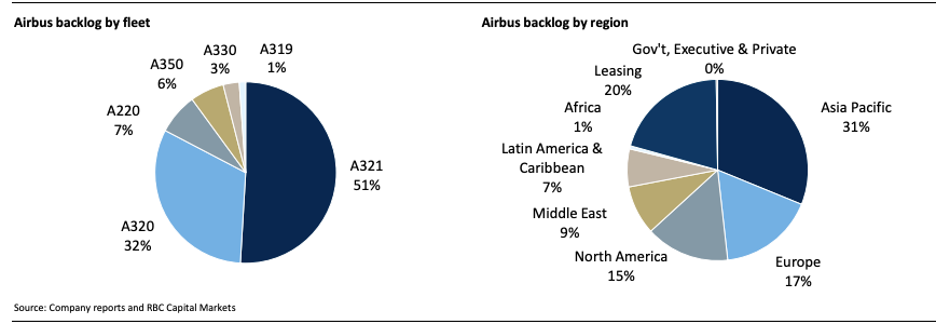

Airbus operates in a duopoly with Boeing in the narrow-body and wide-body aircraft (narrow-body planes have one aisle, wide-body have two) manufacturing market. The barriers to entry are, needless to say, very high. The continued growth of the middle class around the world continues to create strong growth in demand for air travel. Also, new airplanes are more fuel efficient due to improved engine design and materials technology and this has led to an upgrade cycle amongst carriers that are looking at lowering costs and improving efficiency. As a result, orders for new planes have grown rapidly, creating a 10-year backlog for some models. The A320 is sold out until 2030. The most recent Paris Airshow supported the long-term demand thesis as Airbus received 801 new orders. To put that in perspective, that is over a year’s worth of deliveries during one airshow! You can see, in Figure 1, the Airbus backlog by Region and Fleet.

Figure 1. Backlog by Region and Fleet

The biggest risk (and opportunity) for Airbus continues to lie in its supply chain. Airbus works with more than 13,000 suppliers worldwide. In 2021-2022, much of the delays were due to the engine supply chain. That now seems to be stabilizing. If we look into the 2nd half of 2023 and 2024, however, delays are expected in interiors and electronics. To put this into perspective with regards to deliveries, in 2022, Airbus guided analysts to 720 deliveries but were only able to deliver 661 due to supply chain delays.

As these supply chain issues resolve, we expect Airbus will improve annual deliveries to close to 1000 by 2025/2026. This will help Airbus drive its revenue above the 2019 peak of 70.4b euro to over 85b euro in 2025.

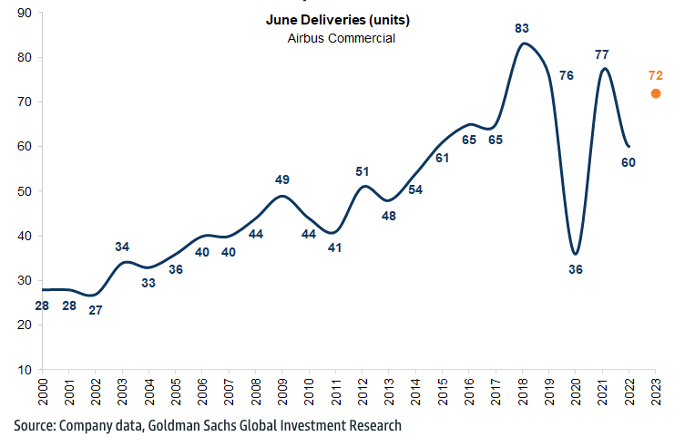

Figure 2 shows how Airbus deliveries were impacted by COVID and how they are rebounding, with June 2023 deliveries shown in orange.

Figure 2: June deliveries for Airbus since 2000

As Airbus ramps up deliveries with help from an improved supply chain, we expect the stock will react positively and could see it 20% higher over the next 18-24 months.

|

This Focus Stock is written by Senior Portfolio Manager, Michael Hakes, CFA, MBA. The purpose of this is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries. |