Gibson Energy

Written by Head of Research & Portfolio Manager, Jamie Murray, CFA.

Gibson Energy (GEI) is a Calgary-based energy infrastructure provider. Having divested its more volatile business lines, the company has transformed its asset base over the past decade to focus on the provision of oil and liquids storage infrastructure at key pipeline terminals. A pipeline terminal is a large storage and processing facility that brings together inflow pipelines from various oil fields and prepares petroleum products for export on larger, long-haul pipelines or rail connections that ship products closer to endpoints (which could be a refinery or an export terminal). At the end of 2022, the company’s terminal assets were located in Hardisty and Edmonton, Alberta, which serve as major hubs for oil sands production. Other assets include a heavy crude refining facility in Moose Jaw, Saskatchewan, more than 500 km of feeder pipelines and an energy marketing operation that typically generates $50-100M per year of cash flow.

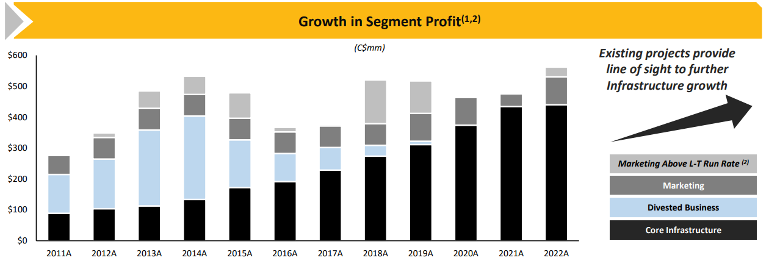

The infrastructure assets produce consistent cash flow, with 75% of revenue under long-term ‘take or pay’ contracts, mostly with investment grade counterparties. At the Hardisty terminal, Gibson has the most inbound and outbound pipelines connections of all its peers, giving it an advantage in the signing of new contracts required for revenue growth. This growth is evident when focusing on Gibson’s Infrastructure segment profit, which has doubled since 2017 (Figure 1).

Figure 1: Gibson’s Infrastructure Segment Profit (black bars) Has Grown Strongly Over the Past Decade

Gibson pays a well-funded dividend that yields 7% at today’s price and generates additional cash flow beyond what is required for its capital expenditures, funds that have historically been used to reduce debt and buy back stock. This has provided Gibson with a strong balance sheet and financial flexibility.

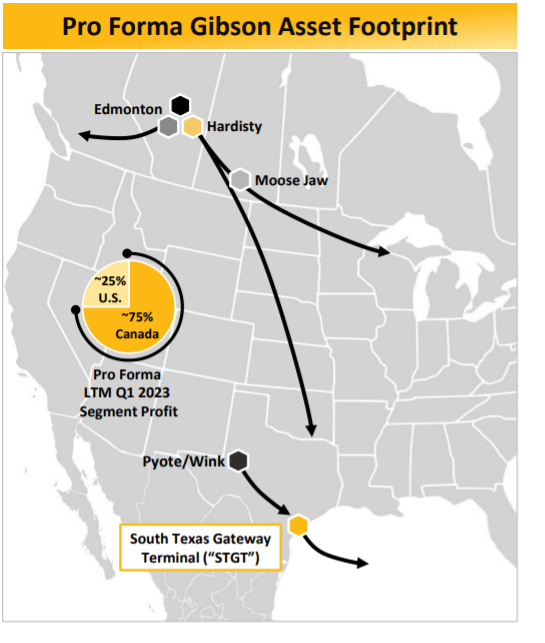

Investors have recently been concerned that future infrastructure growth (and thus profit growth) may be limited given the lack of new oil sands projects in Canada. To add to the geographic diversification of its assets, Gibson last week announced the purchase of the South Texas Gateway Terminal, a major new infrastructure hub along the Texas Gulf Coast, for $1.5B. The project should generate EBITDA of $150M+ for Gibson annually (a 35% increase) and increases Gibson’s storage capacity by 50% to 25 million barrels of oil. The export terminal is unique in that it is one of only two facilities capable of loading VLCCs (very Large Crude Carriers), the largest oil product vessels, and is better located versus other Gulf Coast terminals, which has helped the facility gain market share. The Texas market has many attractive growth characteristics that the Canadian market lacks, with strong production growth in the Permian basin and surging U.S. petroleum exports. In addition to providing faster growth, it provides more scale and diversification to Gibson’s base of operations (Figure 2).

Figure 2: South Texas Gate Terminal adds diversification outside Canada

We think Gibson will continue to grow its dividend approximately 5%-7% per year. The share price is at the low end of its range given that energy sentiment is weak, but we believe its highly-contracted cash flow, its ability to incrementally add new capacity to its footprint and its strategic asset base provide a sustainable dividend to investors.

This Focus Stock is written by our Head of Research, Jamie Murray.

The purpose of this is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.