Thoughts on the Market: May Edition

The future is today.

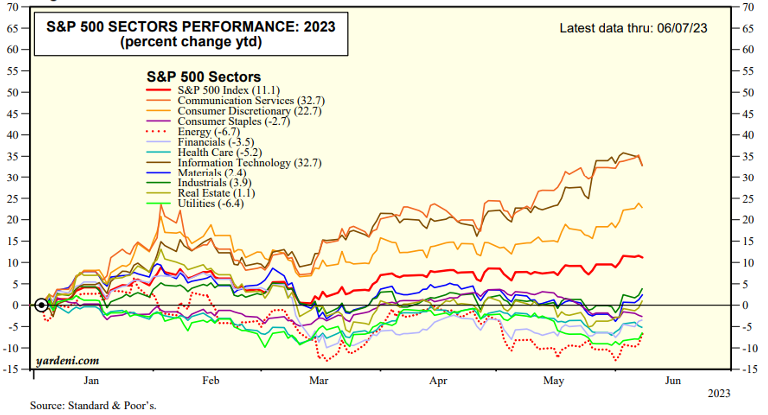

We believe great returns are made by investing in companies that can scale, where their high-margin products and services can be distributed far and wide to customers, with the intent of creating repeated purchases. Internet technology companies like Microsoft, Alphabet and Amazon fit this bill, and this is the primary reason we have been comfortable holding them through such a challenging economic environment. The Internet provides a low-cost distribution medium and the platform business model allows for repeat usage by facilitating valuable exchanges across an ever-larger number of participants. As usage grows, profits can scale quickly. It is up to the business to continue the innovation of new products to deepen its moat around the platform, either by increasing output or reducing costs. For example, Amazon can deliver most household products at a faster speed and/or lower cost than other retailers due to its delivery network. It continues to build this service (and its value) through even faster delivery times for the same cost. Technology companies were by far the strongest performers in the month of May and have bolstered their year-to-date return to 32% (Figure 1). Their performance can be attributed to increased interest in artificial intelligence (AI), particularly generative AI, whereby new computer outputs (be it software code, imagery, text, or grocery lists) can be created by the AI program.

Figure 1. Information Technology and Communication Services (which includes Meta and Alphabet) are the best-performing sectors in 2023.

Source: Standard & Poor’s, Yardeni Research

This requires a tremendous amount of computing resources, which the tech majors can both afford and leverage by reselling AI-based services to their customers without the financial, computing or software engineering resources. In our March 2023 Mid-Month Research, we detailed why we believed AI products would usher in new products and revenue lines for the mega-cap companies as opposed to posing the existential threat some investors were betting on late last year:

“Although we believe AI is set to power the next decade of growth for major technology companies, it is a continuation of the theme of higher productivity enabled by the internet economy. We believe our internet holding discussed in this note (Alphabet, Amazon, Meta, & Microsoft) will all benefit from AI implementation. As well, Broadcom and Qualcomm should benefit through continued demand for semiconductors.”

Tying it all together, AI products and services fit perfectly with the scaling models of internet technology companies. It is a further evolution of what took place in the last decade, when mobile phones and the improvement in cellular data speeds ushered in a new set of opportunities. We believe we are still in the early days of its potential given that generative AI is but a subset of AI’s potential uses. Others include adaptive AI (see this video with Bill Gates) and predictive AI.

We would underline the words early days. Most of the price appreciation in this sector has come from expanding valuation multiples (for example, Microsoft now trades at 27x P/E, up from 23x in January). We believe valuation multiples remain reasonable and within historical ranges, but AI products will need to prove a durable source of revenue and earnings to justify the moves in the sector. Early indications such as Nvidia increasing its Q2 revenue forecast by $4B (from $7B to $11B) and Microsoft generating $1B of incremental cloud revenue highlight this possibility. However, markets move early and fast in anticipation of the ‘the next thing’ and it appears we are on the cusp of one with AI.

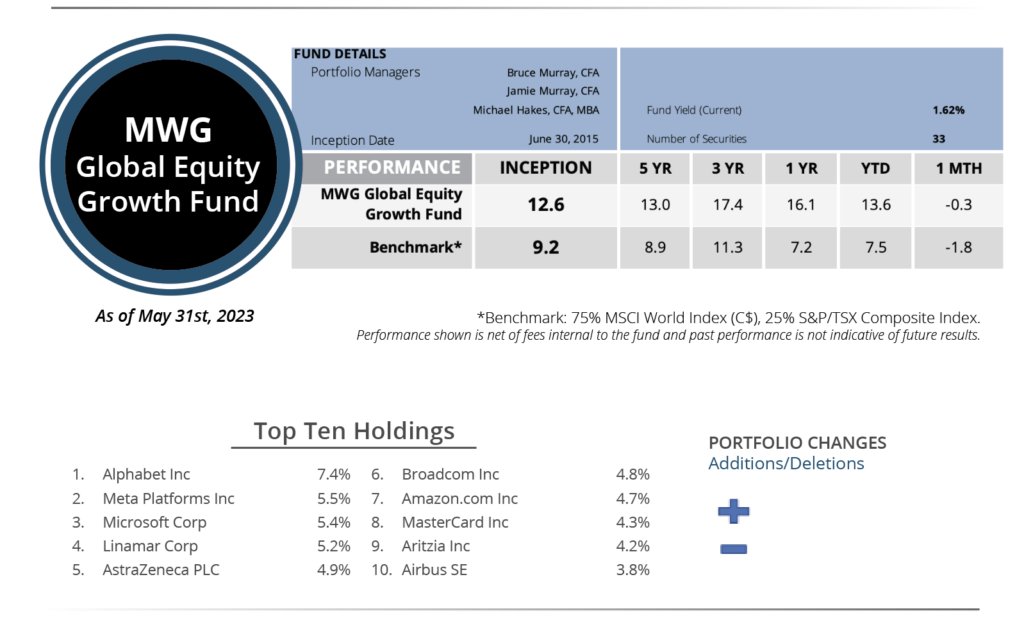

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund fell 0.3% in May, beating the -1.8% return for its benchmark. Year –to -date, the Fund has returned 13.6% versus the benchmark return of 7.5%. The Fund’s top three performers in the month were Broadcom (+29%), Uber (+22%) and Amazon (+15%), while Aritzia (-19%), Nike (-17%) and BP (-15%) were the biggest detractors.

We made no changes to the portfolio during the month.

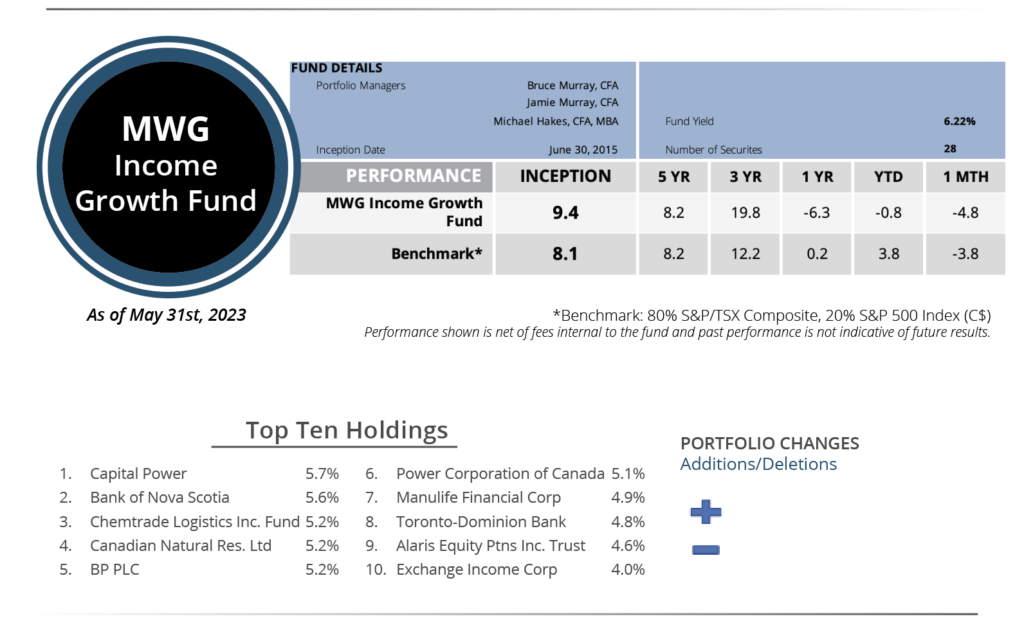

INCOME GROWTH FUND

The MWG Income Growth Fund fell 4.8% in May versus the 3.8% decline for its benchmark. The Fund is down slightly (-0.8%) year –to date versus the benchmark increase of 3.8%. Chemtrade (+8%), Doman Building (+7%) and Evertz (5%) led the portfolio, while three energy stocks, BP (-15%), Whitecap (-13%) and Canadian Natural Resources (-11%) were the top detractors. The fund yield was 6.2%.

We made no changes to the portfolio during the month.

This Month’s Portfolio Update is written by our Head of Research, Jamie Murray, CFA.

The purpose is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.