Thoughts on the Market: October Edition

Earnings are turning positive. When will stocks do the same?

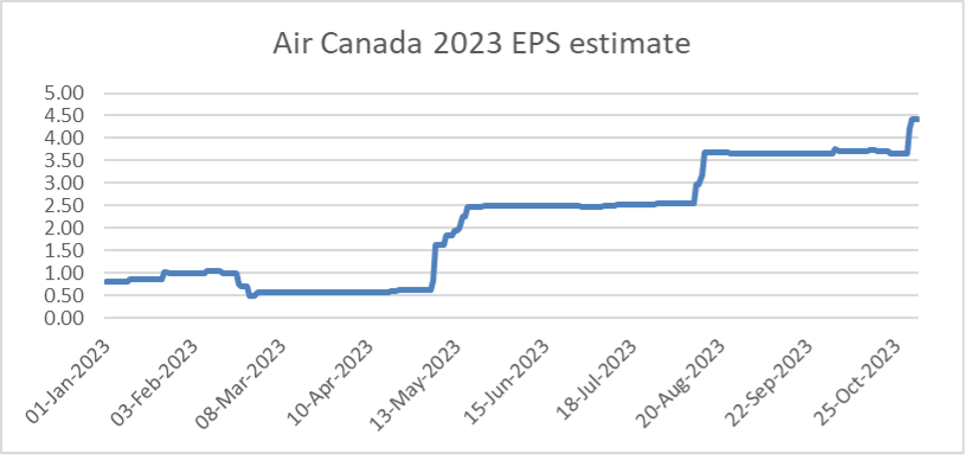

Interest rates remain in the driver’s seat for short-term market performance, as evidenced in October 2023, as markets sold off in sympathy with rising rates. Through the first week of November, we’ve seen this sharply reverse, with markets up 5% through the first four trading days.

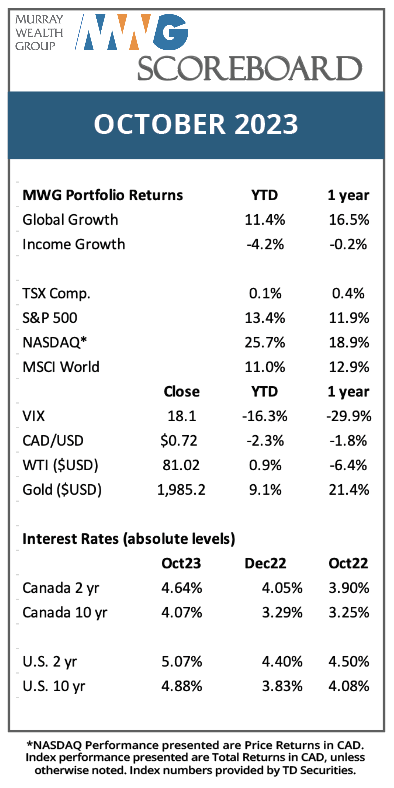

Earnings season is recognized as a critical indicator of the dynamic interrelationship between financial performance and market sentiment. Importantly, earnings growth is turning positive again at 3.5% following a period of lower year-over-year growth. Additionally, with 80% of the S&P 500 now having reported Q3 earnings, companies have reported earnings beats (which happen when financial results are better than expected) at a higher-than-normal ratio. Earnings beats have been tilted towards the communications services, information technology, and industrial sectors (Figure 1). Misses are found in the interest rate-sensitive sectors like real estate and utilities as well as consumer discretionary. The solid earnings gains are due to improved margins, given that revenue trends have been weak because of a slowdown in economic growth.

Figure 1. Sectors with Highest Earnings Beats

Source: Factset

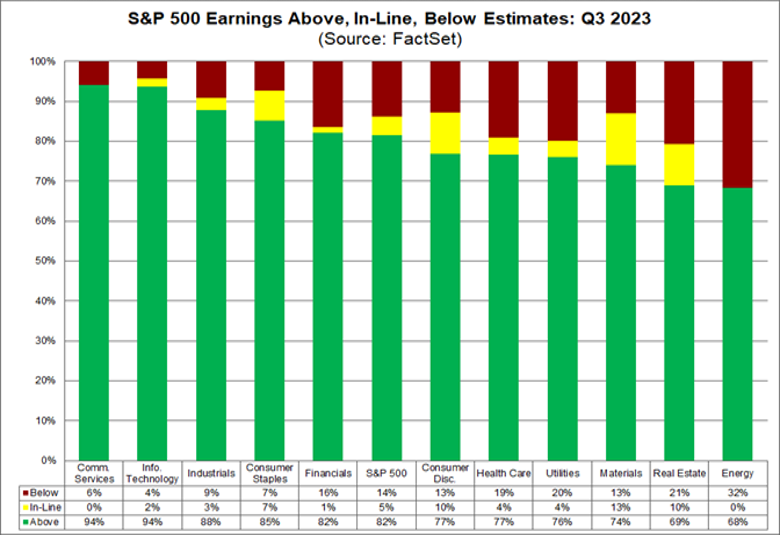

We believe sentiment is overly negative in the markets, with weak economies masking improved fundamentals for many sectors. Take Air Canada, a company we hold in our Global Equity Growth Fund. In the past year, Air Canada has dramatically improved its operations in terms of performance and capacity as demand rapidly recovered from pandemic-related disruptions. With three quarters in the books for 2023, Air Canada is on pace to generate $4.72 in earnings per share (EPS). If we travel back in time to the start of the year, forecasts for Air Canada at the time were for the company to earn below $1 in EPS for 2023 (Figure 2). Despite this improvement and an undemanding valuation, the shares are lower today than at the start of the year (down 13%).

Common pushback from investors is there is a recession coming that will affect air travel (to which we point out that Canada is technically in a recession right now) and oil prices are higher although only marginally higher than this time last year. Estimates for 2024 have moved higher through the year as Air Canada deleverages its balance sheet faster due to the improved profitability and thus the stock trades at a P/E ratio of 5x 2024 EPS and 4x 2025 EPS. We expect the short-term effect of a consumer recession will pale in comparison to the long-term earning potential of the company.

Figure 2: Air Canada 2023 EPS estimate

Source: Refinitiv, The Murray Wealth Group

This is a common position that many stocks find themselves in this year. Despite a headline S&P 500 return of 10%, this has been predominantly led by large technology companies that have proportionally large weightings in the indices. Only 28% of companies in the S&P 500 have outperformed the index and the median return is a negative 3%. However, margins are improving, and corporate balance sheets are in good shape, setting up a strong profitability cycle over the coming years, particularly as financial conditions normalize. With the market trading at a 17.5x P/E, we believe the setup heading into 2024 is strong.

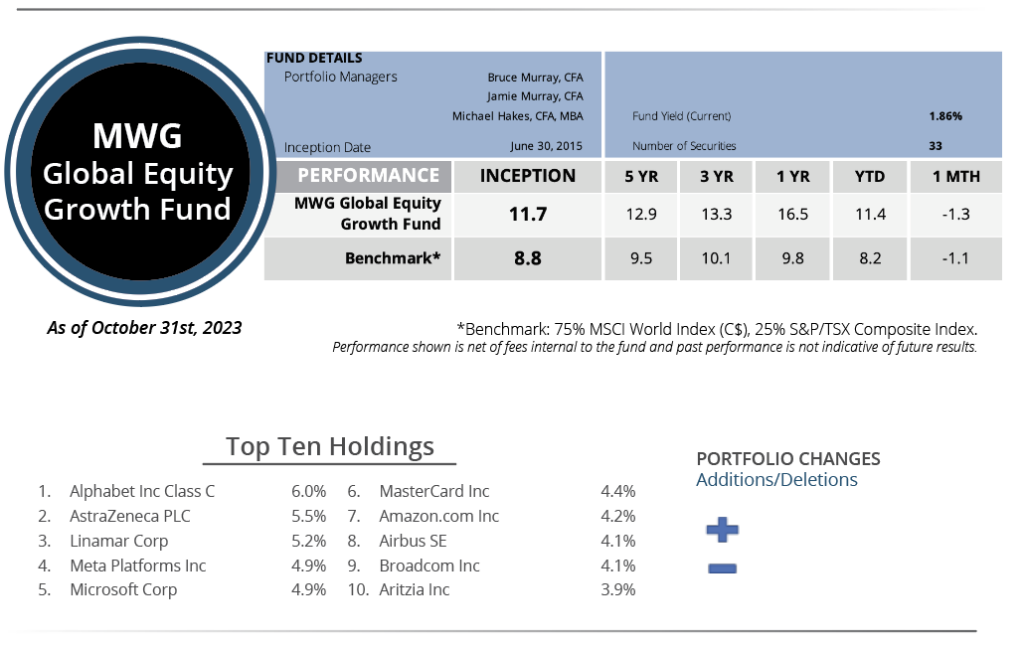

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund fell 1.3% in October, almost equivalent to the -1.1% return for its benchmark. Year-to-date, the Fund has returned 11.4% versus the benchmark return of 8.2%. The Fund’s top three performers in the month were Raytheon (+16.1%), Microsoft (+9.9%) and United Health (+9%), while Air Canada (-13.7%), Major Drilling (-11.2%) and Morgan Stanley (-9.9%) were the biggest detractors.

We made no portfolio changes to this Fund in October.

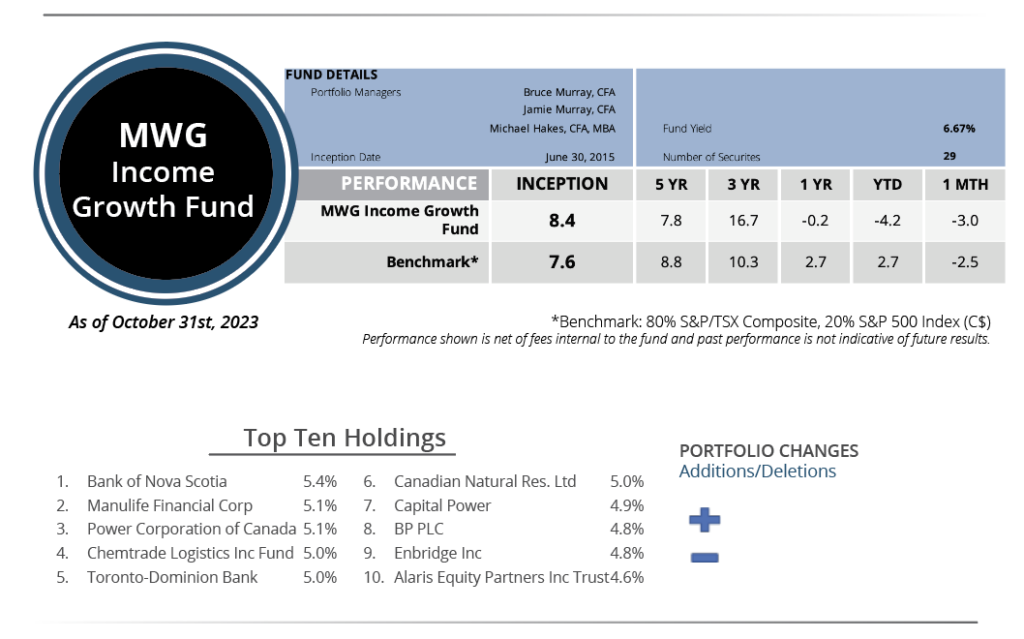

INCOME GROWTH FUND

The MWG Income Growth Fund fell 3% in October versus the -2.5% decrease for its benchmark. The Fund is down 4.2% year-to-date versus the benchmark increase of 2.7%. Gibson Energy (+8.4%), Cogent Communications (+7.8%) and Pembina (+4.5%) led the portfolio while Northwest Healthcare Properties REIT (-20.5%), American Hotel Properties (-14%), and European Residential REITs (-11.25%) were the top detractors. The fund yield was 6.67% at month’s end.

We made no portfolio changes to this Fund in October.

This Month’s Portfolio Update is written by our Head of Research, Jamie Murray, CFA.

The purpose is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.