Target

Written by Senior Portfolio Manager, Michael Hakes, CFA, MBA.

Not Your Average Growth Stock

We recently added Target to the Global Growth portfolio at a 2% weight. The stock has pulled back from its high of $260 in late 2021 and is now trading around $110. Target is not a typical growth company per se as it is a mature retailer in a competitive market. We believe, however, there is the potential for substantial cyclical recovery over the next 12-18 months. As part of our risk control process, we monitor the overall characteristics of the portfolio to ensure it continues to maintain a strong secular growth profile.

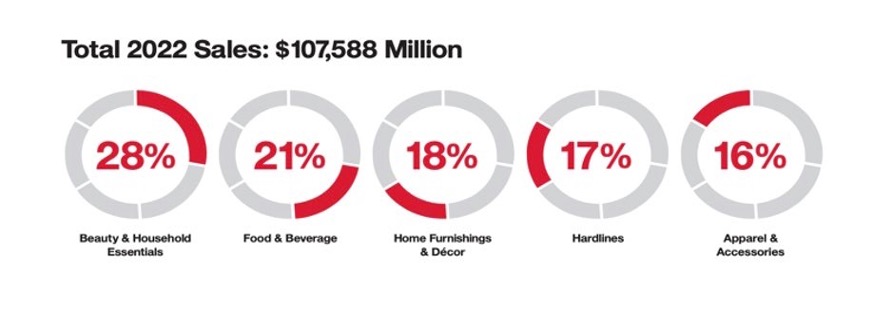

Target is a well-known general merchandise discount retailer with almost 2,000 stores in the U.S. and over $100b in sales. It was founded in 1902 and offers a variety of products, from clothing and household goods to groceries. Figure 1 shows the sales mix. The sales skew more to discretionary than non-discretionary purchases.

Figure 1: Target Sales Mix 2022

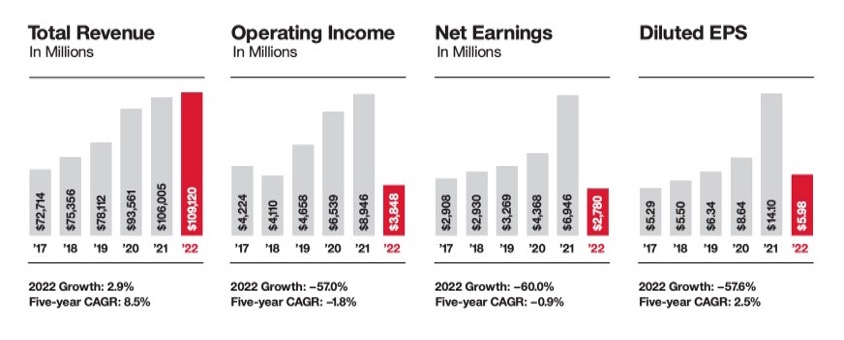

Figure 2 shows Target’s huge setback (red) in operating income, earnings and EPS in 2022 vs. previous years. Operating margins declined 490bp (basis points) to 3.5% from 8.4% in 2021. Historically, operating margins for Target have ranged from 5.5% to 8.5%.

Figure 2: Target Financials 2022

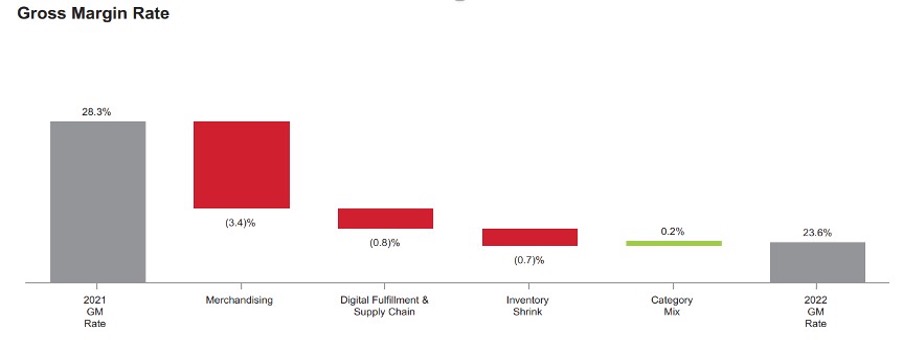

Gross margins also declined, dropping 470bp to 23.6% in 2022 from 28.3% in 2021. You can see the gross margin ‘bridge’ between 2021 and 2022 in Figure 3. This helps explain the causes for the pullback over the period. Merchandising and Supply chain caused a good part of the pressure and included things such as higher clearance and promotional markdowns, higher freight and labour costs and inventory impairments as the consumer moved away from discretionary purchases. The Fed rate hikes clearly have had an impact on consumer behaviour.

Figure 3: Target Gross Margin Rate 2021 VS 2022

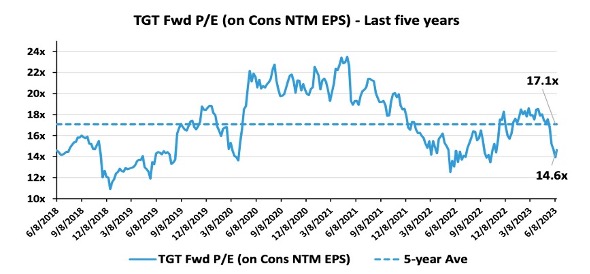

Target now trades well below its long-term average P/E. Figure 4 shows that the company is now trading at 14.6X, which is 2.5 multiple points below its 5-years average of 17.1X .

Figure 4: Target Forward P/E over Last Five Years

We feel the operational challenges are close to turning around and barring an outright recession, the company will begin to show good margin improvements over the next 18 months or so. We believe the stock price should return to the $200 level over this time and therefore think this is a great entry point for long-term investors.

|

This Focus Stock is written by Senior Portfolio Manager, Michael Hakes, CFA, MBA. The purpose of this is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries. |