Amazon is about to make a lot of money…

Amazon is a customer-centric company that strives to make life easy and convenient for customers. Although well known as an online retailer and e-commerce site, Amazon’s other business units are increasingly driving the profitability of the company. We believe Amazon is on the cusp of an explosion of profitability that will drive the share price higher.

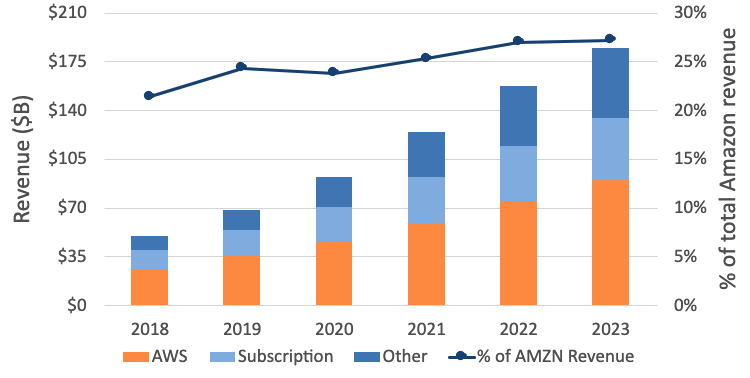

Amazon’s well-known retail business, consisting of both first and third-party delivery of products, is expected to generate a 5.2% margin in 2021. In contrast, revenue generated by Amazon Web Services (AWS), Prime membership subscriptions, and other business segments like advertising and promotion generate operating margins that far exceed its retail margins. AWS is the only line item broken out at 30% but other sources like digital advertising may be generating margins as high as 40% if Google/Facebook margins are comparable. As shown in Figure 1, these high margin revenue sources are expected to become 27% of total revenue in 2023, up from 21% of Amazon’s total revenue in 2018 (an increase from $49.9 billion to $184.7 billion).

The vitalness of each business individually enhances our conviction in the company’s long-term growth potential. Amazon’s subscription service, Amazon Prime, has over 200 million paid members and offers access to music and video streaming, eBooks, exclusive deals and ever-shortening shipping times for the price of $119 per year (equivalent to a basic Netflix subscription). Subscription services help maintain customer loyalty and influence consumers to spend more money within the same ecosystem for additional value-added services and features. Prime Video, for example, has seen an increase in usage as streaming hours have increased by 70% year over year. New content initiatives such as Thursday Night Football (a recently signed ten-year deal beginning in 2023) will only enhance its value.

Amazon Web Services provides the critical computing infrastructure needed to support the shift towards global digitalization through cloud computing. AWS offers over 200 services making use of technologies such as machine learning, artificial intelligence and data analytics to help companies innovate and lower costs. AWS and Microsoft are competing for the lead in cloud computing infrastructure, which should create strong market dynamics in the future.

Digital advertising is the main driver of Amazon’s ‘other’ business segment and exceeded expectations in Q1/21, with 77% year-over-year revenue growth to a $7 billion quarterly run rate. Amazon is still in the early stages of leveraging its membership base to 3rd party sellers that want a premium position in Amazon’s search results. We believe we are still in the early stages of digital advertising growth as detailed here.

The combined strength of Amazon’s businesses is reflected by robust financials and cash flow as they generate excess cash from operations and realize economies of scale. Last year’s EPS of $42 is expected to grow to $97 in 2022. Free cash flow is also increasing, with 2020’s $26.9B expected to nearly triple to $70B in 2023. Amazon trades at a 3.5% free cash flow yield and a 33x P/E on 2022 numbers. We believe this valuation is compelling given that Amazon is still in the early stages of monetizing its high-margin businesses.

Figure 1: Amazon’s high margin businesses are growing faster than its core e-commerce business

This Focus Stock is written by our Head of Research, Jamie Murray and MWG Summer Analyst, Jenna Lawrence.

The purpose of this is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.