Thoughts on the Market: August Edition

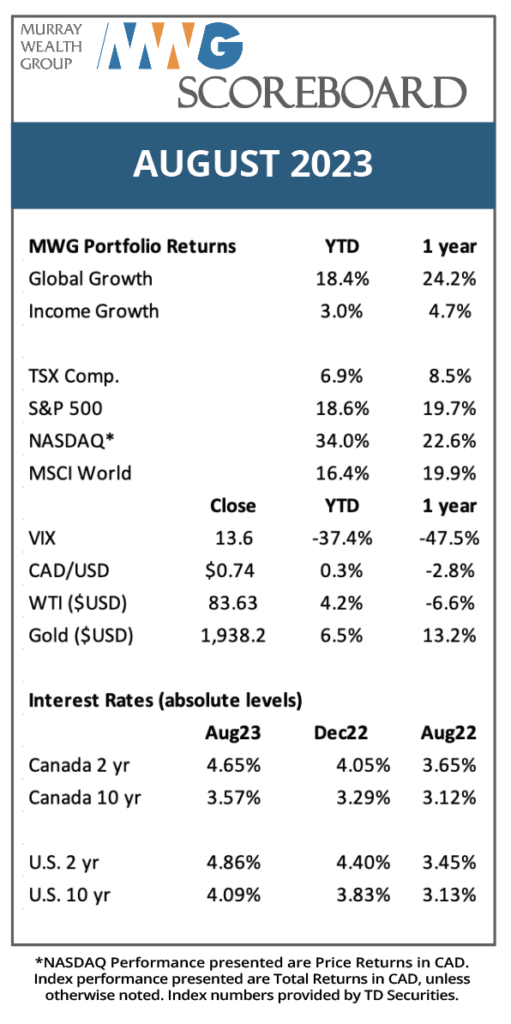

Markets softened across North America in August as interest rates ticked higher despite a strong earnings season in which profit guidance increases were the highest in two years and there was a good ratio of earnings beats-to-misses.

We witnessed the bifurcation of economic engines this summer in Canada and the U.S. as interest rates moved higher. The U.S. has been able to effectively manage the inflation shock of 2022 with a series of swift interest rate hikes. Its currency is strong, which helps keep the cost of imports down, the consumer is hanging in despite a series of haircuts to disposable income and businesses are starting to see their earnings grow again. Even the tech sector, so maligned in 2022, has proven that its success is not simply a product of low interest rates. GDP Tracker GDPNow by the Atlanta Fed forecasts that GDP has grown an astonishing 5.6% thus far in Q3. This is subject to change as more data is released through October, but the U.S. engine continues chugging along despite the higher interest rate environment.

On the flip side of the coin is Canada. As of this writing, the Loonie is bouncing near five-year lows of $0.73. This is great for exports (Canadian oil companies are selling crude at C$115 per barrel), but the opposite for the inflation outlook as imports are relatively more costly. Outside of energy, the impact of the weak housing market was felt in Q2, with Canadian GDP falling 0.2% in the quarter. This weakness provided the Bank of Canada the opportunity to pause its rate hike but leaves the country vulnerable to further inflation should U.S. rates hold at current levels.

Figure 1. USD/CAD Exchange Rate is near its five-year low ex-COVID

Source: Refinitiv Workspace

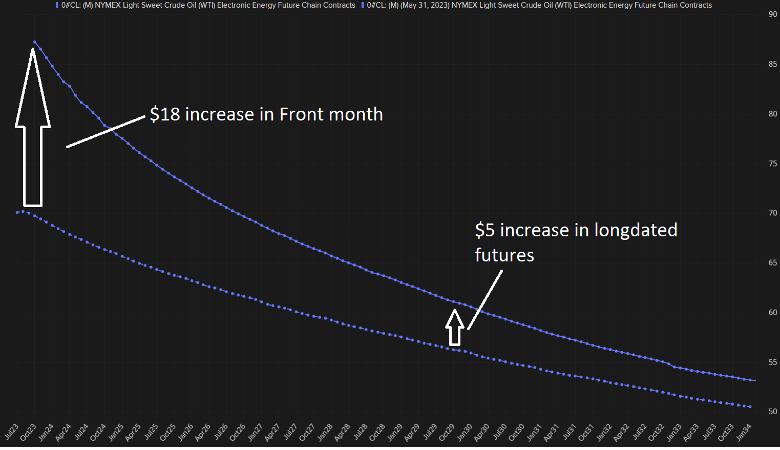

The inflation outlook is also hurt by a resurgence in oil prices. Figure 2 compares the crude futures strip (used to hedge and speculate on future crude prices) from June 1 and September 6, 2023. Two points are most evident. First, the price of crude is higher for near-term delivery and falls as it moves in the future. This inversion, known as backwardation, indicates that traders of crude can lock in sales or purchases at lower prices for future delivery. Somewhat counterintuitive, this is a bullish indicator, as it implies there is a shortage of crude and a scarcity premium to secure crude today. Second, is the steepening of the curve. Notice how the near-term price for crude has rocketed higher since June 1, with crude for October 2023 delivery higher by US$18 per barrel. At the other extreme, crude for delivery in December 2029, for example, is only about $5 per barrel higher. This suggests that unless we see spot crude prices fall back to the mid-$70s, we expect the strength in energy to continue.

Figure 2: Crude Oil Curve (Present vs. June 1, 2023)

Source: Oil Curve (Present vs. June 1, 2023)

As we have previously written, we believe inflation will trend down on a year-over-year basis for the remainder of the 2023 based on declining housing contribution. For background, housing accounts for ~1/3 of the U.S. CPI calculation and was calculated at 7.7% inflation in July 2023. However, this includes lagging data which remains higher than real-time market indicators. However, growing energy prices will add to inflation pressure in 2024.

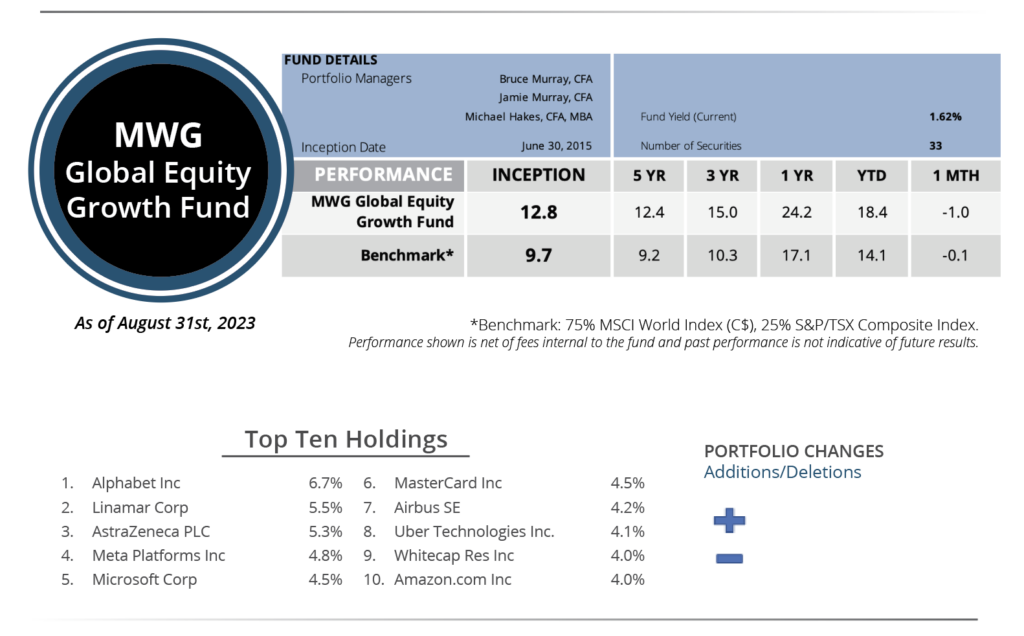

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund fell -1.0% in August, more than the -0.1% return for its benchmark. Year-to-date, the Fund has returned 18.4% versus the benchmark return of 14.1%. The Fund’s top three performers in the month were Eli Lilly (+26%), Docebo Inc (+16%), and Aon PLC (+8%), while Adyen (-54%), BMW (-11%), and Qualcomm (-10%) were the biggest detractors.

We made no portfolio changes to this Fund in August.

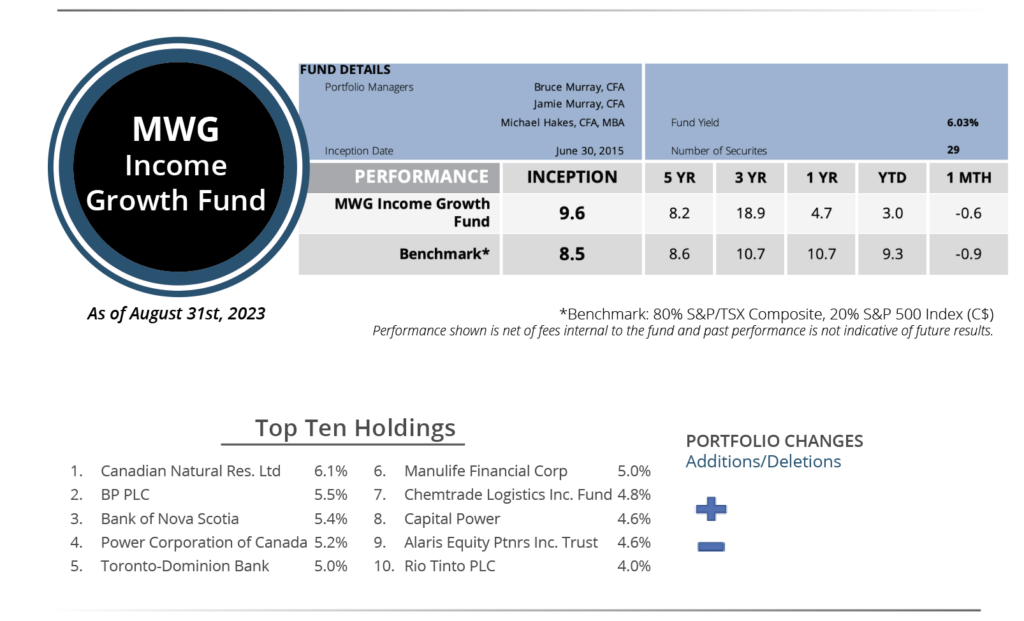

INCOME GROWTH FUND

The MWG Income Growth Fund fell -0.6% in August versus the -0.9% decrease for its benchmark. The Fund is up 3.0% year-to-date versus the benchmark increase of 9.3%. Cogent Communications (+20%), Doman Building Materials (+15%), and Canadian Natural Resources (+9%) led the portfolio, while European Residential REIT (-9%), American Hotel Income Properties (-6%), and IGM Financial (-6%) were the top detractors. The fund yield was 6.03% at month end.

We made no portfolio changes to this Fund in August.

This Month’s Portfolio Update is written by our Head of Research, Jamie Murray, CFA.

The purpose is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.