Thermo Fisher Scientific (TMO-NYSE)

Written by CEO & CIO, Bruce Murray, CFA.

Target US$650.00 – Return 21%

We recently added Thermo Fisher Scientific (TMO) to the Global Growth Portfolio. Having completed over 100 acquisitions since 2006, TMO has consolidated the highly fragmented life sciences tool & diagnostics (LST&Dx) industry.

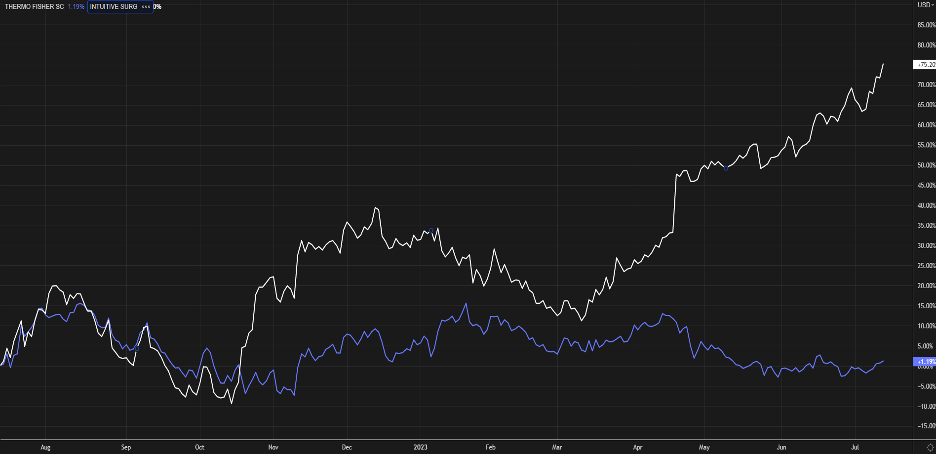

In so doing, it has created a virtual one-stop shop for the tools required to develop new products for the biopharma industry. TMO’s products and services cover equipment and tools for the medical industry to the management of research and patient care. To fund the purchase, we sold our position in Intuitive Surgical (ISRG). As the chart below illustrates, ISRG (white) has massively outperformed TMO (blue) over the last year.

Figure 1. Thermo Fisher Scientific (TMO – blue) VS Intuitive Surgical (ISRG – white)

The surge in ISRG is the result of anticipation of the pickup of medical procedures delayed during covid and the increased use of robotics by surgeons. We believed the premium in ISRG was too high.

TMO dominates its industry, with $44 billion of annual sales. Its P/E of 26x is in line with its industry-leading quality and growth potential. With this trade, we are reducing our portfolio risk as we move to the leading equipment supplier versus a single high-growth sector which may be ahead of its fundamentals.

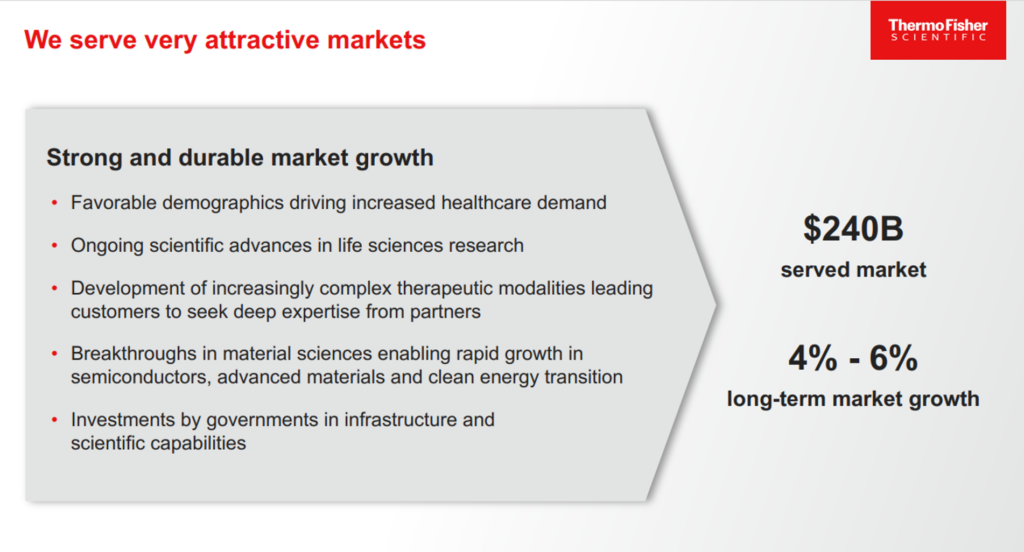

TMO is unmatched in its capabilities across the biopharma market from instruments through research, production, and patient care across a $240B market. This biopharma market is growing at a rate of 4%-6% p.a., and we expect this rate of growth may pick up as new technologies like mRNA and other breakthrough medical technologies move forward.

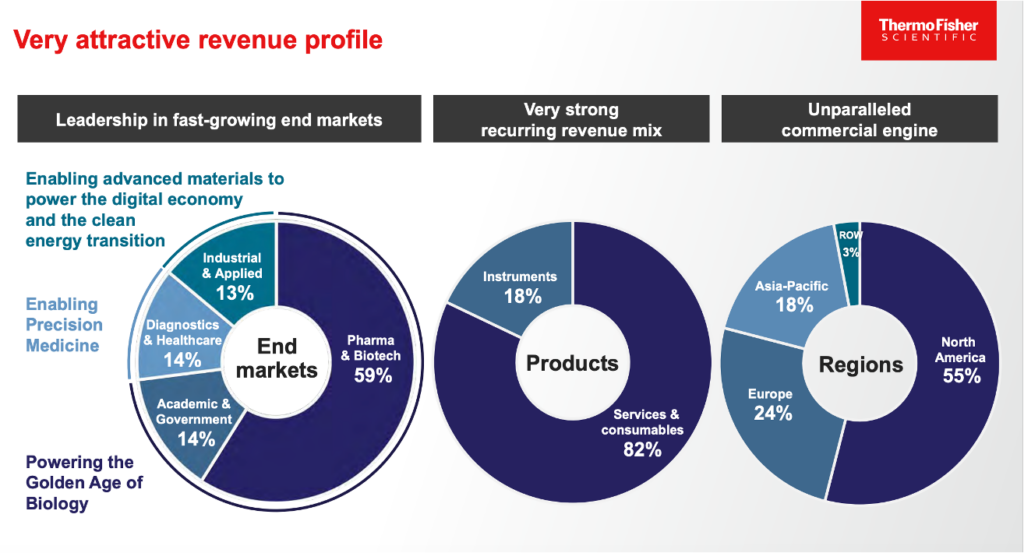

TMO’s incredible product diversification and wide geographic penetration are shown in Figure. 2 below.

Figure 2: Thermo Fisher Revenue Profile

Over the past decade, TMO grew its revenue and EPS 14% and 17% per annum, respectively. Over the next several years, the company is expected to increase its revenue and EPS by 8% and 12% per annum, respectively, as the company benefits from the leverage inherent in its capital structure (about 35% debt).

Spending on medical research continues to grow and we believe TMO’s estimates of future growth are overly conservative and the stock could return towards its all time high of $672.34.

This Focus Stock is written by our CEO & CIO, Bruce Murray.

The purpose of this is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.