Whitecap Resources dollar cost averaging into its inventory.

Dollar cost averaging (DCA) is a simple investment strategy first coined by Benjamin Graham in his book The Intelligent Investor. A DCA strategy calls for investing an equal dollar amount every period, which helps diversify the purchase price (or book value) of an investment. It reduces the effect of market timing and ensures new purchases are made throughout the investment cycle. It has been shown to be an effective strategy for generating steady long-term returns when used consistently.

In the oil and gas sector, companies are using a similar strategy to grow their production base and cash flow. Oil and gas companies generate their revenue and cash flow through ownership of producing oil wells and own an inventory of undrilled well locations that will add to their production when brought onstream in the future. The cash flow from their producing wells is used on an ongoing basis primarily to drill new wells to replace the natural declines of their production bases, but also to purchase land rights to replenish and add to their inventory. In addition, cash flow can be used to acquire competitor operations or be returned to shareholders through dividends, share repurchases or debt reduction.

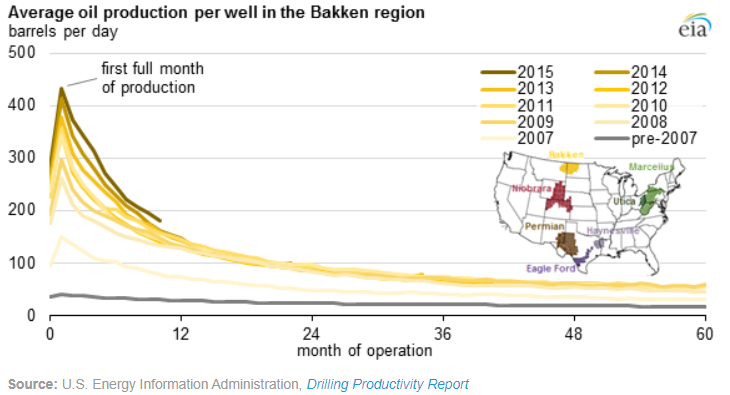

The production rates of shale wells, which attract most of the capital in North America, are extremely front-loaded, with high declines following the first year of production. Figure 1 highlights this decline in the North Dakota Bakken field (Whitecap does not have operations in this oil field, but it is representative of shale well production profiles across North America). Although improvements in drilling techniques year after year have enhanced overall production rates, notice the sharp drop in monthly production by month twelve (to about 150 barrels per day) versus the initial six months. By year five, production will have fallen by an extra 50% of the month twelve production rate. These wells can cost upwards of $12M to drill, and the high decline rates mean the selling price realized in the first year can have an outsized effect on overall economic returns. Managing this decline while generating acceptable economic returns is an ongoing challenge.

Figure 1: Representation of Shale well production decline in the North Dakota Bakken Oil Field

In addition to managing production, companies need to replenish well locations by acquiring mineral rights. Like all things in real estate, location is paramount and land that is most likely to be economic for oil development is more costly to acquire. New land is typically acquired in government auctions or by acquiring assets from a competitor (including outright corporate acquisitions). Thus, a company with a large inventory base should be relatively more valuable without inventory depletion looming overhead.

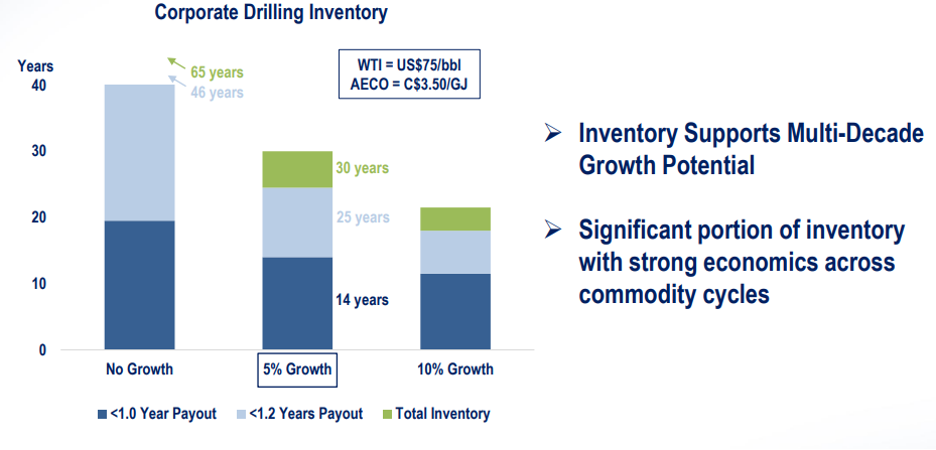

Which brings us back to Whitecap, a company owned in both our Global Equity Growth and Income Growth Funds. Whitecap considerably expanded its inventory when it acquired XTO Energy Canada in June 2022 from Imperial Oil. While the acquisition was costly, it provided Whitecap with a multi-decade inventory base as seen in Figure 2. The light and dark blue bars represent top-tier drilling inventory that provides Whitecap with 46 years of inventory at flat production levels. Forty-six years is a long time, and thus, Whitecap has communicated a strategy of growing its production at 5% per year, which it estimates would still provide 25 years of inventory. This is a more balanced approach to growth and inventory management. Even a more aggressive option of growing production at 10% per annum would still provide about 18 years of drilling inventory and represent a reasonable approach, in our view.

Figure 2: Whitecap drilling inventory depth at various growth rates.

Whitecap internally estimates it recoups the cost for its best wells in fifteen months. This then begs the question as to why Whitecap doesn’t accelerate its drilling program and capture these highly economic returns sooner. The answer is that Whitecap is dollar-cost averaging into its inventory. In 2023, Whitecap will allocate about $1B to capital expenditures (about 60% of its cash flow from operations), and we expect this amount will stay consistent over the next 3-5 years. By deploying its capital in a methodical way, the company will reduce several risks, including drilling many wells right before a commodity crash, overspending on drilling services*, financial risk from over-leverage and the risk of rapid production decline.

We believe current valuations are attractive for a low growth, high dividend model. Starting in November, Whitecap plans to increase its monthly dividend to $0.73 annually, for a 6.2% dividend yield. Combined with its targeted 5% production growth and added share buybacks (potentially another 5%), Whitecap should generate shareholder returns in the 10-16% range over the next three years. Of course, commodity prices will play a starring role into the ultimate return, but we believe the bands are narrowed given its measured capital allocation policy.

*Drilling and Completion (D&C) refers to the work performed to drill and ready a well for production. “Completion” work can be a significant component of total well cost with the innovations in hydraulic fracturing (fracking). Most oil companies in North America outsource D&C work to third party contractors. Pricing levels can be volatile depending on the demand from oil companies and supply of rigs and crews.

This Focus Stock is written by our Head of Research, Jamie Murray.

The purpose of this is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.