Thoughts on the Market: July Edition

Earnings are rising again.

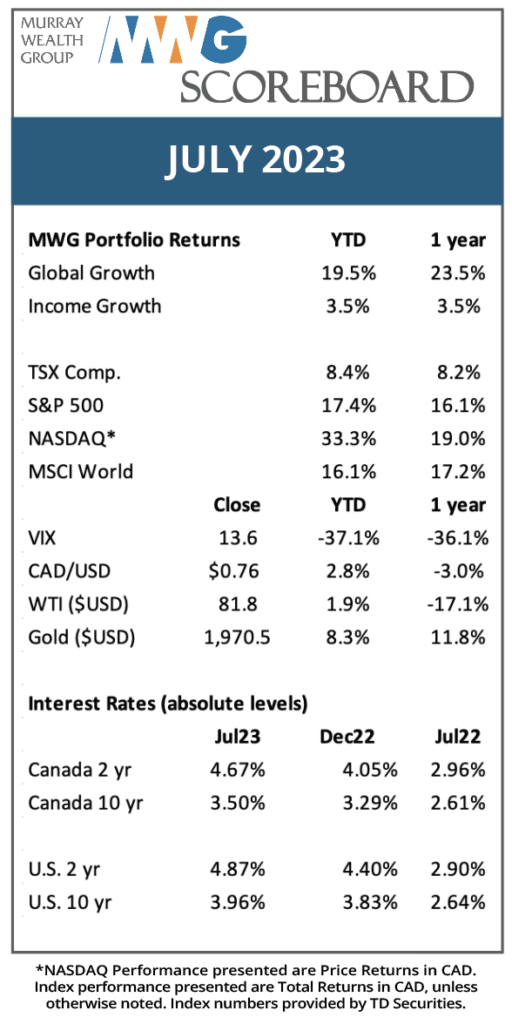

The markets capped off July 2023 with another strong month of gains. The S&P 500 rose 3.1% and the TSX Composite nearly 3.0%. Over the last 12 months (ended July 31), markets south of the border are strongly outperforming as evidenced by an 16.1% rise in the S&P 500 and a 19% return in the NASDAQ versus an 8.2% gain for the TSX in Canadian Dollar terms. Long-term performance is never achieved in a smooth or straight line when investing in the equity markets. Although earnings per share growth drives performance over the mid to long-term, the relationship is not linear, as returns are affected by other factors such as sentiment and financial flows in and out of the market. Volatility is a feature, not a bug. From their 52-week lows, the S&P is up 31%, NASDAQ up 42% and the TSX up 16%.

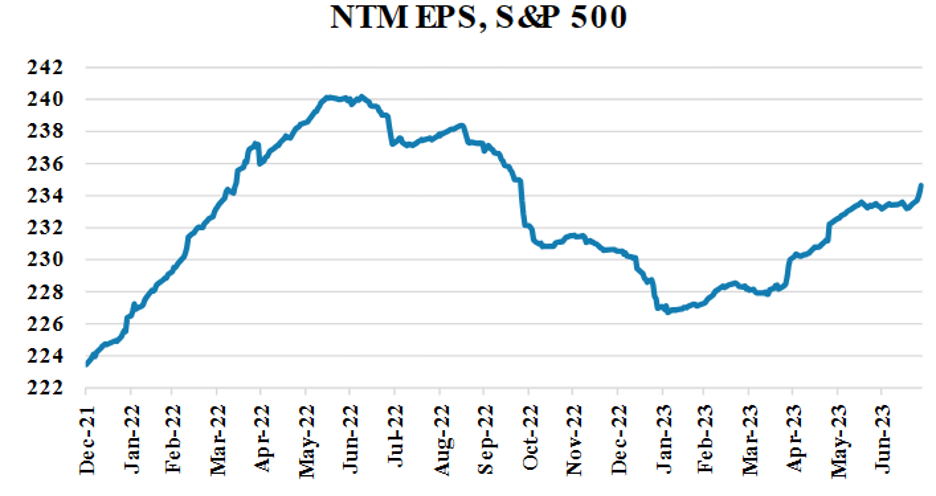

A main driver of the recovery in markets (and the initial sell off) is captured in Figure which provides the consensus earnings estimates for the S&P 500 looking forward one year (NTM = next twelve months). While several individual factors (e.g., inflation, interest rates and, governments rolling back stimulus for example) contributed to the equity selloff in 2022, it was largely the cumulative effect of declining earnings expectations that led the market down. Likewise, the subsequent recovery correlates to a reversal of that trend (earnings increasing). We expect the earnings outlook to improve further and surpass the level witnessed in early 2022 by December of this year.

Figure 1: Through the worst of earnings

Source: Morgan Stanley

A word on short-term moves in markets. Short-term market movements are usually due to changes in investor sentiment or expectations. These mechanics are difficult to forecast, and basing an investment strategy on these short-term indicators is close to a guessing game. Long-term investors focus on earnings per share growth and acquiring shares in those companies with strong earnings growth rates at attractive valuations. This vantage helps us maintain a long-term focus and look through periods of volatility.

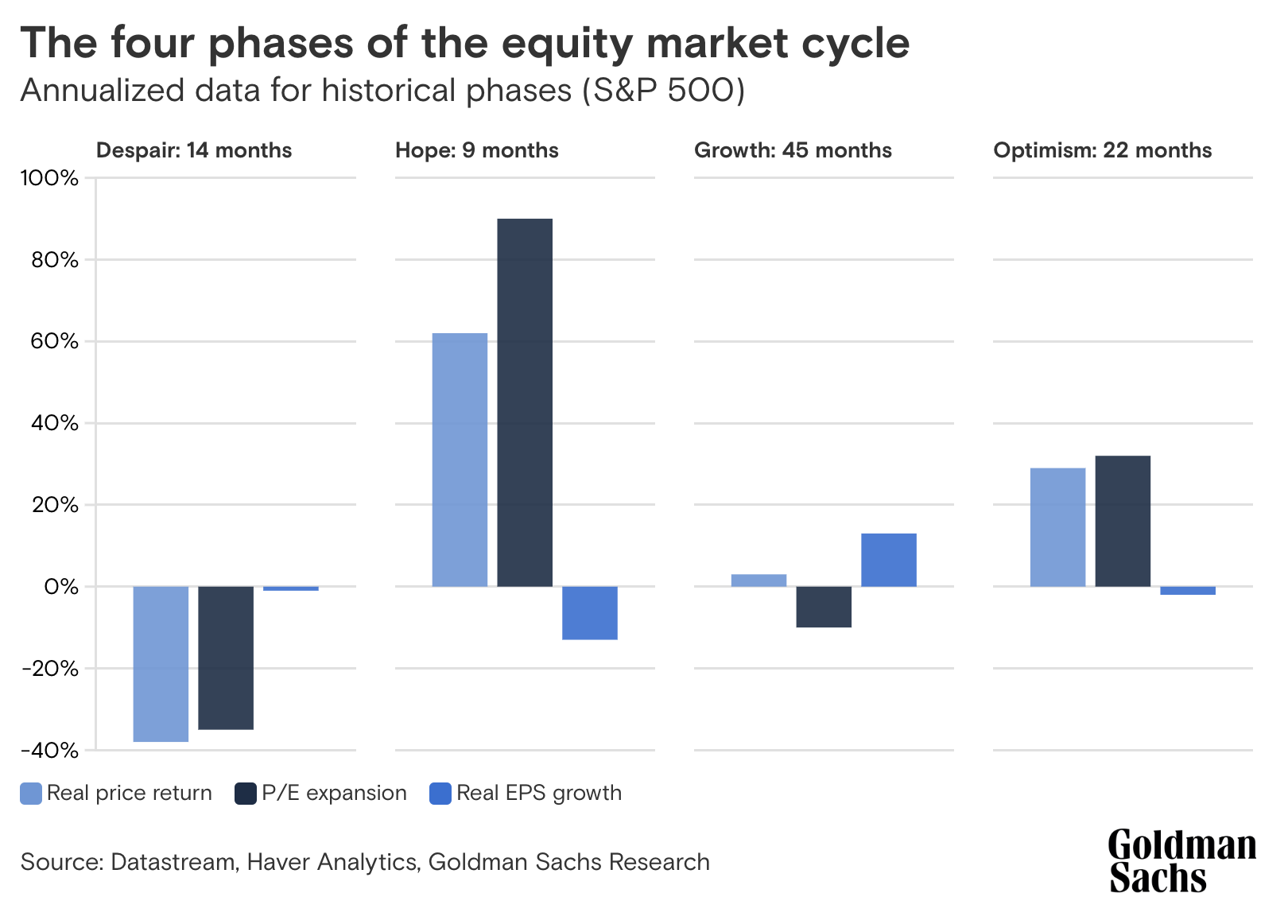

The other main component of stock price returns is valuation, or what multiple an investor is willing to pay for a stream of earnings. Several factors go into determining Price/Earnings multiples, but we find this chart from Goldman Sachs handy in determining the expected change in multiples through an equity market cycle. Based on Figure 2, we are likely exiting the “Hope” phase, with a sharp market rally driven mostly by the expansion of P/E multiples (after a year of multiples compressing) and entering a “Growth” phase. This phase is typically led by earnings per share growth, with P/E multiples compressing slightly (which makes sense to us given the market multiple is currently elevated versus long-term averages).

Figure 2: Goldman’s Four Phases of Equity Market Cycle

Source: Goldman Sachs

This should lead to equity markets surpassing their previous highs as we move into 2024. The looming threat of a recession that seemingly hovers over the Western economies remains present but, as noted, many sectors such as technology and housing have already gone through slowdowns and are growing once again. We are likely entering a phase of slowing consumer spending in the U.S., but this slowdown is mostly priced into equities (see our newest position in the Global Equity Growth Fund). A recession would provide central banks with an opportunity to lower interest rates, which would normalize the yield curve and provide better profitability to the financial sector.

From both a strategic and financial perspective, we remain committed to investing in strong companies that should be able to navigate the shifting economic sands. These quality companies offer value propositions for their products and services that afford them enduring profits and growth optionality and are led by management teams that have proven capable of executing on these opportunities.

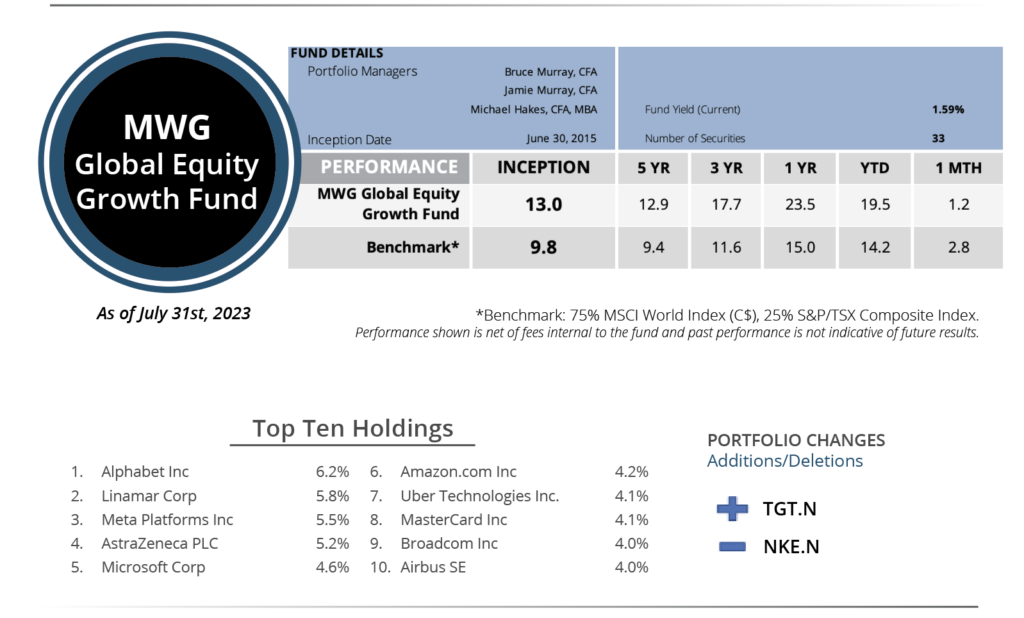

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund rose 1.24% in July, falling short of the 2.8% return for its benchmark. Year-to-date, the Fund has returned 19.5% versus the benchmark return of 14.2%. The Fund’s top three performers in the month were Whitecap Resources (+14%), Uber (+14%) and Qualcomm (+10%), while Aritzia (-32%), RTX (-11%) and Aon (-8%) were the biggest detractors.

During the month, we purchased Target, a well-known General Merchandise retailer with almost 2,000 stores in the U.S. With over $100b in sales, the company experienced a huge setback in margins in 2022. Gross margins and operating margins declined 470 basis points and 490 basis points, respectively from 2021 levels. These declines were primarily caused by supply chain dislocations and greater than normal swings in discretionary purchases as the Fed rate hikes took hold and impacted the consumer. The stock has pulled back from its $260 high in late 2021 and is now trading at the $133 level. We feel the operational challenges are close to turning around and, barring an outright recession, the company will begin to show good margin improvements over the next 18 months or so. This mature retailer is trading well below its historical valuation, and we feel it could be great value for long-term investors.

To fund the purchase of Target, we sold our position in Nike as we believe shares in Target offer better at this stage of the economic cycle based on its attractive valuation and the current low expectations surrounding the stock.

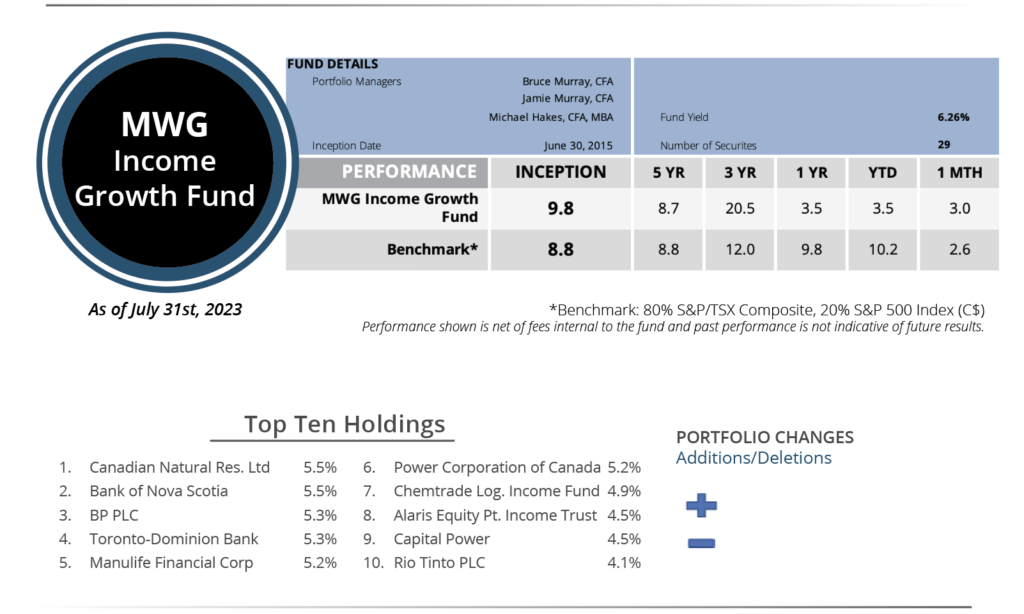

INCOME GROWTH FUND

The MWG Income Growth Fund rose 3.0% in July versus the 2.6% increase for its benchmark. The Fund is up 3.5% year-to-date versus the benchmark increase of 10.2%. Whitecap Resources (+14%), Blackstone (+13%) and Northwest Healthcare (+12%) led the portfolio, while Cogent (-9%), BCE (-6%) and Aegis (-5%) were the top detractors. The fund yield was 6.3%.

We made no portfolio changes to this Fund in July.

This Month’s Portfolio Update is written by our Head of Research, Jamie Murray, CFA.

The purpose is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.