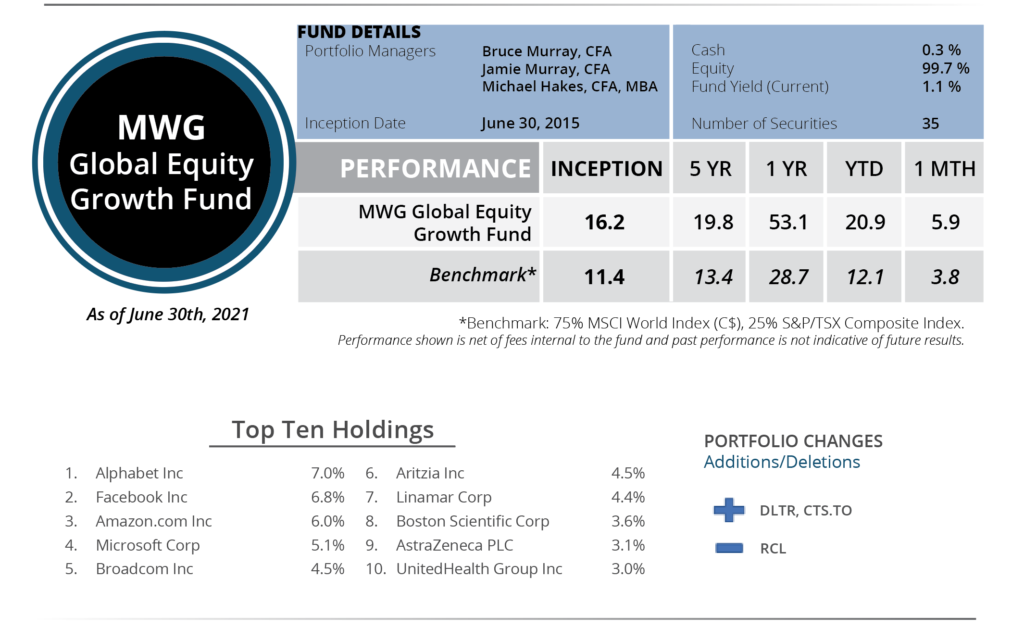

Thoughts on the Market: June Edition

Global equity markets continued their move higher in June on strengthening expectations for GDP growth in 2021 and 2022. Developed nations are clearly in the final stretch of the pandemic, which should lead investors to turn their focus from earnings recovery to earnings growth.

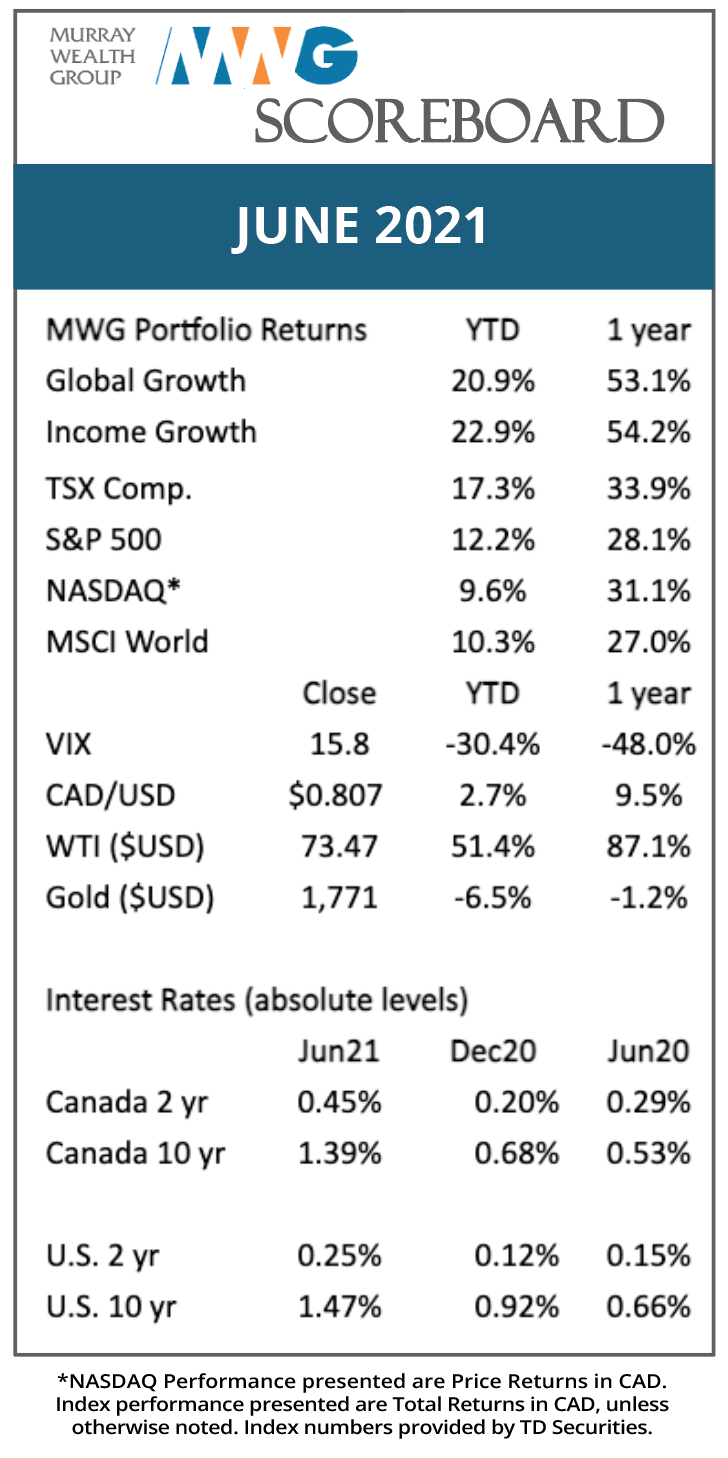

Last month, we noted the recovery in U.S. air passenger traffic as a signal of the near-term economic recovery. This month, we look at OpenTable. OpenTable is an online reservation/operations system for the global hospitality system. For the past 15 months, it has tracked total seated diners across its platform. Notably, in mid-June, seated diners in the United States recovered back to 2019 levels for the first time since the pandemic arrived.

Figure 1: Year-over-year change in seated diners at U.S. OpenTable restaurants

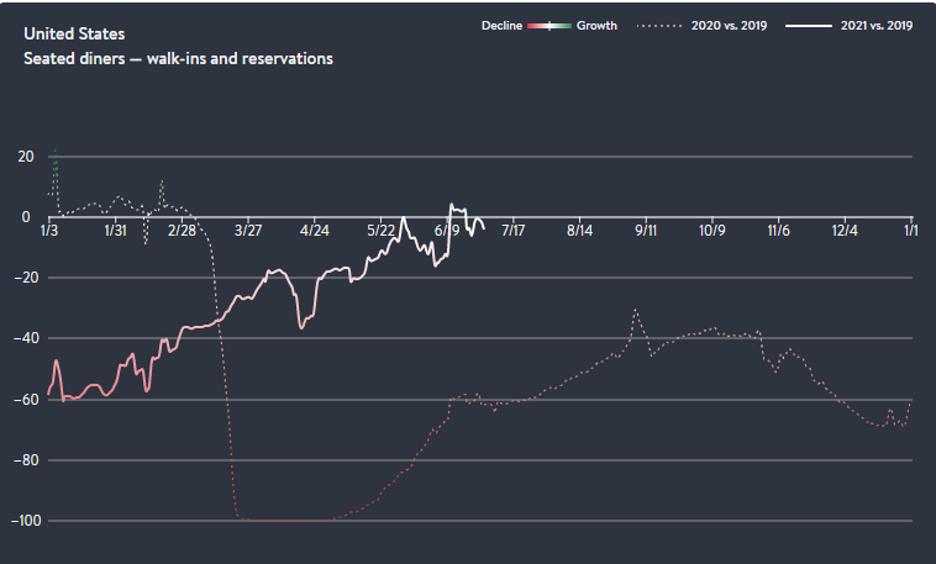

While consumer activity normalizes, we are still seeing lags in the economy, mainly in supply chains. The semiconductor shortage that has affected the auto sector has been well documented, but the transportation supply chain also remains in disarray. Ocean freight has bottlenecks from port labour shortages, port capacity, freighter availability and follow-on effects of the Suez Canal blockage. The trucking industry driver shortage, which predates the pandemic, has been exacerbated by soaring parcel volumes. In response, shipping rates are rising, adding another source of price inflation.

Figure 2: Spot Rates, price per standard 40 ft, non-refrigerated container (from Asia)

A U.S. 10-year government bond yield under 1.5% indicates to us that the market is expecting a strong supply response to the present challenges, rendering these dislocations transitory. We expect technology to penetrate these sectors and continue to see a long runway for cloud services provided by companies like Amazon, Microsoft, Google, and Facebook.

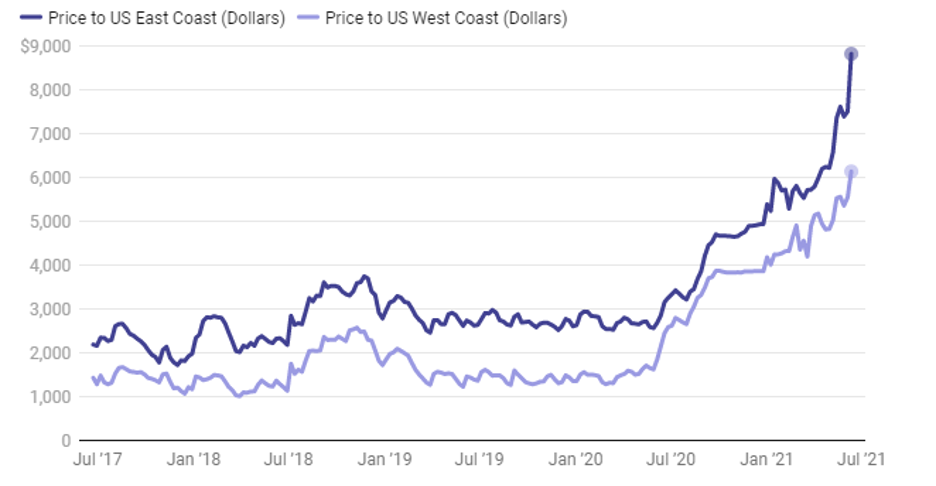

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund returned 5.9% in June, bringing its year-to-date return to 20.9%. The top performers in the Fund were Converge Technology (+27%, see next paragraph for details), Aritzia (+26%) and Twilio (+20%), while Major Drilling (-19%), Alliance Data (-11%) and Air Canada (-7%) underperformed on the pullback in cyclical stocks.

During the month, we made two new purchases. We wrote a short note on our Dollar Tree thesis in June, so we will borrow from that for our readers who missed it.

“Dollar Tree (DLTR) is the second-largest operator of discount variety stores across North America, offering a range of basic and seasonal goods. The company’s brands include Dollar Tree and Family Dollar, split between roughly 15,000 locations. This is our second round owning DLTR stock. A new CEO has rekindled our interest in the company. Dollar Tree is starting to execute (in earnest) its multi-price strategy within its Dollar Tree banner. Through the creation of Dollar Tree Plus, DLTR is expanding its current product line to offer new items at prices of $3.00 and $5.00. Bernstein Research believes gross margins may expand by as much as 1000 bps over the next decade if Dollarama is used as a comparable (~43%). We think DLTR can sustain low-teens EPS growth for many years, an attractive growth rate for a company that trades at 16x P/E. We believe the risk/reward is strong with DLTR.”

Converge Technology is a Canadian technology service provider. The company has embarked on an acquisition program to consolidate local IT service providers across North America, acting as a middleman between clients and IT vendors. Converge can use its scale to achieve margin, working capital and purchasing power synergies across its brand portfolio. This strategy has proven both successful and repeatable, with 22 acquisitions completed to date. The company has guided to $5B of revenue in 2025 (from $1.5B this year) based on the breadth of its acquisition pipeline. Converge will be the focus of our July mid-month research piece, which will provide a more in-depth analysis.

We sold our remaining shares in Royal Caribbean following the strong recovery of cruising companies as the stock reached our target price. The industry should enjoy record levels of demand in 2022 based on future bookings, but we believe there are still some risks to the outlook.

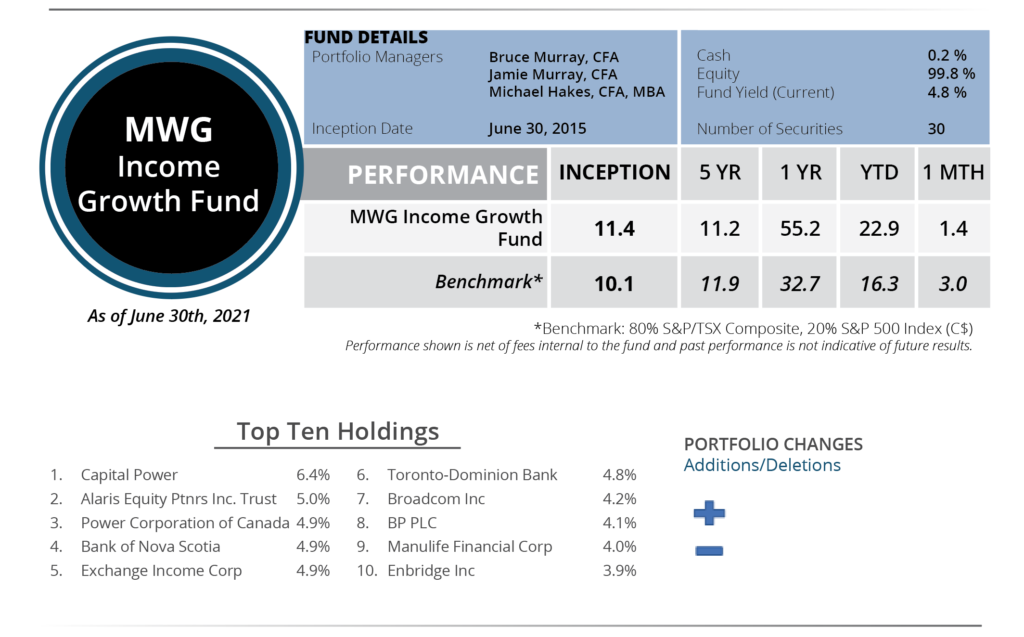

INCOME GROWTH FUND

The MWG Income Growth Fund returned 1.4% in June and has now returned 22.9% year-to-date. The top performers in June were Inter Pipeline (+15%), BSR REIT (+8%, second month in a row in top 3) and Cominar REIT (+8%), while Chemtrade (-11%), Medical Facilities (-9%) and American Hotel Income Fund (-8%) underperformed. The current yield on the fund is 4.8%.

There were no changes to the Income Growth Fund holdings.