The buck starts here…

Dollar Tree (DLTR) is the second-largest operator of discount variety stores across North America, offering a range of basic and seasonal goods. The company’s brands include Dollar Tree and Family Dollar, split between roughly 15,000 locations. This is our second round owning DLTR stock (we will refer to the corporate company as DLTR to distinguish it from its store brand). We previously exited in early 2019 as management failed to execute on its post-merger strategy after acquiring the Family Dollar brand in 2015. Ingrained in the DLTR culture at the time was a commitment to the $1.00 price point, and despite showing a willingness to adopt a multi-price point strategy, the previous management was stubbornly slow to implement. This led to sluggish growth at Dollar Tree and unrealized synergies with the acquired Family Dollar stores.

A new CEO has rekindled our interest in the company. DLTR is starting to execute (in earnest) its multi-price strategy within its Dollar Tree banner. Through the creation of Dollar Tree Plus, DLTR is expanding its current product line to offer new items at prices of $3.00 and $5.00. DLTR has enacted the change in 500 stores and will continue to roll out the new product line over time through its store base. This multi-price strategy mirrors Dollarama’s strategy in Canada. Dollarama shares returned over 1000% from its IPO price in 2009 (which is known as a ten-bagger).

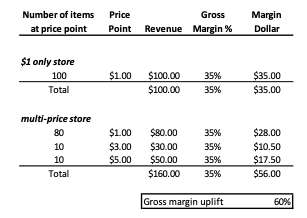

In Figure 1, we can see the potential effect on gross margin per store of adopting a multi-price strategy. Let’s imagine a dollar store that sells 100 items at $1.00. Management decides to source higher value items, and soon 10% of items are each sold at $3 and $5. Assume uniform purchasing of the 100 items, revenue per store will increase to $160 versus $100 at the $1 price point store. If we assume constant product margins of 35% on each item, gross margin dollar increases to $56 from $35 and improves store contribution margins by 60%.

Figure 1: Store Economics Uplift Illustration

Also, DLTR is now integrating Dollar Tree and Family Dollar by both selling Dollar Tree discretionary items in stand-alone Family Dollar stores and building rural combo stores (management believes there is potential to open 3,000 combo stores). This creates more buying power for items that can be sold in both locations and simplifies distribution.

Altogether, these catalysts should improve same-store sales and margins. Bernstein Research believes gross margins may expand by as much as 1000 bps over the next decade if Dollarama is used as a comparable (~43%). We think DLTR can sustain low-teens EPS growth for many years, an attractive growth rate for a company that trades at 16x P/E. We believe the risk/reward is strong with DLTR.

This Focus Stock is written by our Head of Research, Jamie Murray and Summer Analyst, Nick Hakes.

The purpose of this is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.