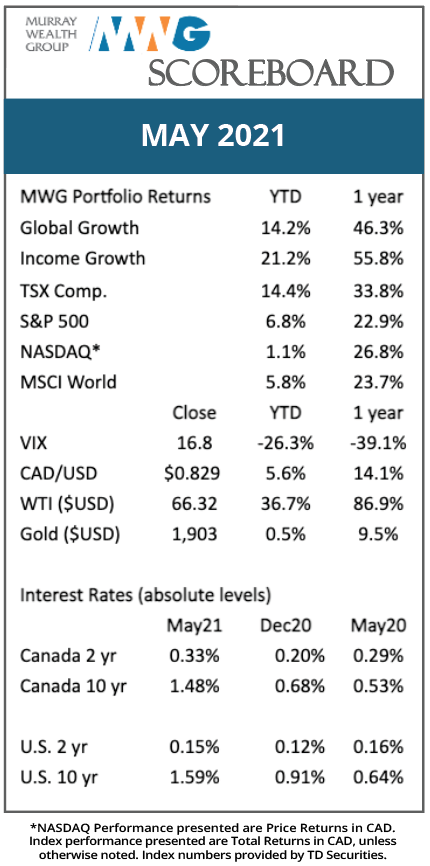

Thoughts on the Market: May Edition

Economies are in full recovery mode with vaccination rates improving daily across OECD countries. Worldwide COVID-19 cases have fallen 17% week over week with G7 nation cases falling 25-30%. As anticipated, most of the Western world will be vaccinated by fall, setting up a return to normal economic activity. Investors need to decipher the permanence of change in consumer and industrial companies as a return to normal will spur different behaviours from a locked-down economy.

We are already seeing the recovery play out faster than expected in the aerospace market. We have long held the belief that air traffic will recover quickly once vaccines are distributed and herd immunity is reached. TSA travel throughput has recovered to 70% of 2019 levels and is climbing every day. Once international travel resumes (likely in earnest by fall 2022), we expect the numbers to eclipse 90%. In anticipation of a faster than anticipated recovery, Airbus called on suppliers to stand ready for increased production rates in 2023 as there is strong pen-up demand for its narrow body A321 NEO airplane. We maintain broad exposure to aviation markets in both pooled funds.

Commodity prices (ex-lumber) continued to grind higher in the month. There is significant upside to commodity stocks if the market enters another ‘supercycle’ in which supply cannot meet demand given the extended time it takes to build a new mine or ramp up oil production. Case in point, Stelco could generate half its market cap in free cash flow at current steel prices in the next 12 months. Similarly, according to RBC, oil producer Canadian Natural Resources trades at a 20% free cash flow yield at US$64/bbl after accounting for capital spending.

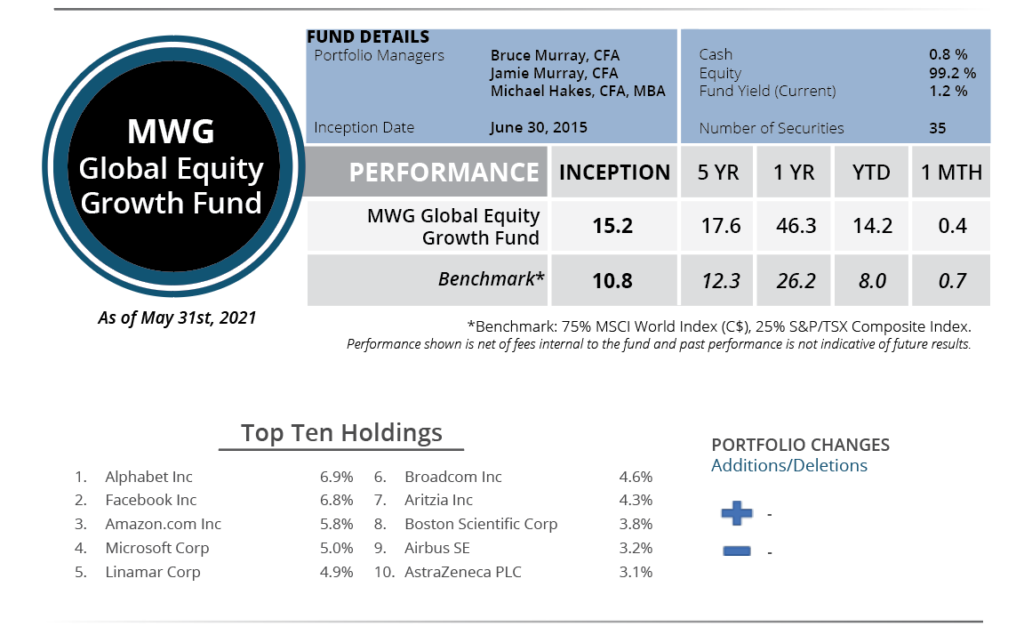

GLOBAL EQUITY GROWTH FUND

The MWG Global Equity Growth Fund returned 0.4% in May, bringing its year-to-date return to 14.2%. The top performers in the Fund were Major Drilling (+52%), Cameco (+15%) and Linamar (+11%), while Twilio (-10%), Uber (-9%) and Amazon (-9%) underperformed on broad technology weakness.

We made no changes to the portfolio during the month.

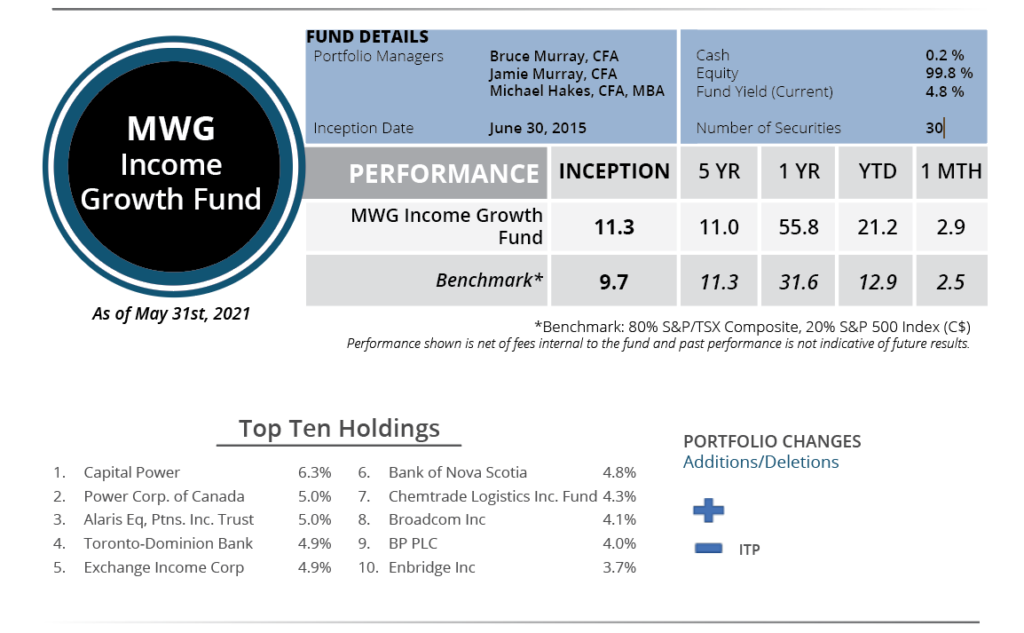

INCOME GROWTH FUND

The MWG Income Growth Fund returned 2.9% in May and has now returned 21.2% year to date. The top performers in May were Russel Metals (+18%), Canadian Natural Resources (+14%) and BSR REIT (+13%), while Doman Building Materials (previously Canwel, -11%), AT&T (-8%) and Manulife (-5%) underperformed.

The current yield on the fund is 4.8%.

During the month, we fully exited our investment in Intertape Polymer as the yield on the shares fell below our threshold due to the strong price appreciation experienced in the past year.