European Residential REIT

European Residential REIT (ERES) is a newer addition to the MWG Income Growth Fund, with a 4% weighting. We owned a prior edition of the REIT (one with a commercial focus) in 2019, exiting our investment after an acquisition/restructuring by CAP REIT, a large Canadian multi-family REIT that owns 66% of ERES units. We added the name back to the portfolio as the REIT emerged with a new strategy focused on multi-residential units in the Netherlands. We believe there are several tailwinds that should benefit the units.

The rental market in the Netherlands is bifurcated into regulated and liberalized units. Both are subject to rental growth restrictions but rent for the liberalized units can be increased at a greater rate. It is possible to convert regulated units into liberalized units by renovating the properties.

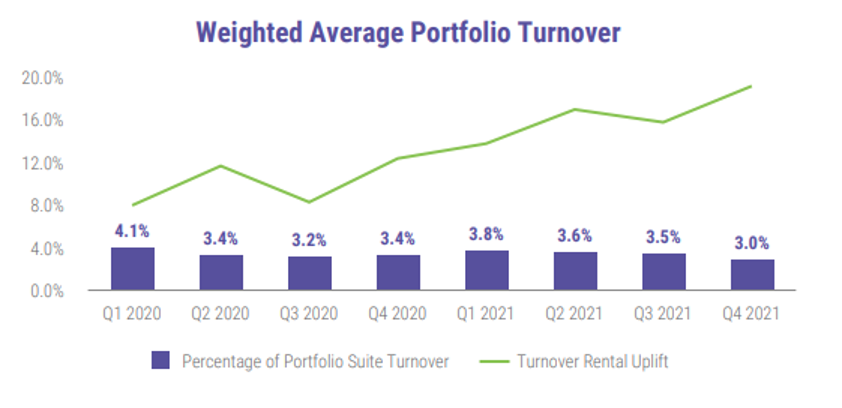

ERES currently owns 6,545 suites equally spread throughout the country. Over half the units are 3 bedrooms or more and rent for an average €930 a month. Management has proactively grown its liberalized unit count from 55% of suites at the end of 2019 to 61% currently through acquisitions and conversions, which typically provide strong rental uplift post-renovation. In 2021, converted units rented for 45% more than their pre-renovation value. These conversions are driving a strong increase in average rents across the portfolio (Figure 1). In 2021, rental uplifts helped drive a 13% increase in property net operating income.

Figure 1: The green line represents rent uplift on suite turnover

The REIT is well capitalized, with 47% Debt/Gross Book Value and a weighted average mortgage rate of 1.52%. The REIT completed several acquisitions in 2021 without the dilution caused by issuing equity and believes it has the capacity to acquire €430M of new properties. It’s noteworthy that both interest coverage and payout ratios have improved over the past two years, de-risking the investment and leading to a recent 9% dividend increase.

This Focus Stock is written by our Head of Research and Portfolio Manager, Jamie Murray, CFA.

The purpose of this is to provide insight into our portfolio construction and how our research shapes our investment decisions. As always, we welcome any feedback or questions you may have on these monthly commentaries.